Zimmer Biomet (ZBH) Gains From ROSA Sales Growth Amid FX Woes

Zimmer Biomet’s ZBH focus on emerging markets and stabilizing market trends have bolstered our confidence in this stock. Yet, factors like macroeconomic uncertainties, pricing pressure and unfavorable currency fluctuations continue to adversely impact Zimmer Biomet's sales. The company carries a Zacks Rank #3 (Hold) currently.

Zimmer Biomet has implemented four meaningful pillars inside its Knee business to drive pricing stability, mix benefit and competitive conversions. As part of the first pillar, the company is focusing on ROSA Robotic Platform combined with its Persona cementless Knee. According to the company, this is a powerhouse combination that will continue to accelerate growth. Zimmer Biomet expects ROSA and Persona together to enhance its robotics and cementless penetration from the current mid-teen level to 50% or better.

The second pillar is focused on Persona revision. It provides meaningful conversion and mix opportunities inside the revision category. The third pillar involves Zimmer Biomet’s plans to work on the overall shift of the company’s legacy knee systems to a fully rounded-out Persona portfolio. The fourth pillar focuses on the development of the world's first and only Smart Knee- Persona iQ. which is in limited launch per its current status.

Zimmer Biomet is witnessing a rebound in its business since the past few quarters despite macroeconomic challenges. According to the company, procedure recovery continues to be successfully aided by no meaningful impact from COVID or staffing challenges. Accordingly, the company is enjoying a tailwind from increased provider capacity, resulting in backlog pull-through in the recent quarters.

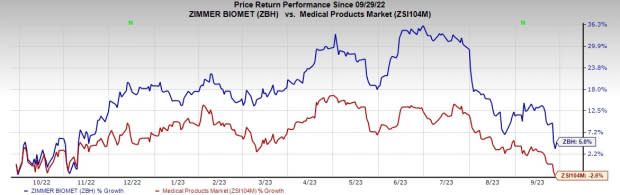

Image Source: Zacks Investment Research

In the second quarter, U.S. sales rose 5%, well ahead of the company’s expectations, with elective procedure volumes recovering and procedure cancellation rates returning to pre-pandemic levels. International sales grew 7.2%, driven by strong performance in both EMEA as well as Asia Pacific. All regions benefited from continued recovery of elective procedures, backlog recapture as well as strong commercial execution and new product uptake.

In terms of business category, Global Knees grew 10.5%, driven by the strong execution of the company’s four-pillar strategy, centering on a strong Persona portfolio, combined with the benefits of the ROSA robotics platform. Global Hips grew 4.9% on the back of new product flow, execution and market recovery.

Over the past year, shares of Zimmer Biomet have risen 5% against the industry’s 2.6% decline.

On the flip side, although Zimmer Biomet is gradually coming out of the impact of the two-and-a-half-year-long healthcare crisis, the ongoing industry-wide trend of staffing shortages and supply chain-related hazards is denting growth. Deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor cost as well as freight charges and rising interest rate, put the dental treatment space (which is highly-elective) in a tight spot.

Further, within the S.E.T. category, Zimmer Biomet is facing challenges in the form of reimbursement headwinds, particularly in the Restorative Therapies business. In addition, the company also noted acute supply challenges within Sports and Trauma. All these are creating significant pressure on the company’s operating profit. During the second quarter, Zimmer Biomet witnessed a 4.4% increase in SG&A expenses and a 18.8% rise in R&D expenses.

Also, a substantial portion of Zimmer Biomet’s foreign revenues is generated in Europe and Japan. In recent times, significant increases in the value of the U.S. dollar relative to the euro, the Japanese yen, the Swiss franc and other currencies are having an adverse effect on the company’s results of operations. During 2022, Zimmer Biomet’s net sales were affected by 5% from changes in foreign exchange rates.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Intuitive Surgical ISRG and Quanterix QTRX.

Haemonetics has an estimated earnings growth rate of 26.1% for fiscal 2024 compared with the industry’s 18.7%. HAE’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.39%. Its shares have rallied 18.3% against the industry’s 0.5% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical, carrying a Zacks Rank #2 at present, has a long-term estimated earnings growth rate of 15.7% compared with the industry’s 15.5%. Shares of the company have rallied 51.1% compared with the industry’s 1.8% growth over the past year.

ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 4.19%.

Quanterix, carrying a Zacks Rank #2 at present, has an estimated earnings growth rate of 62.8% for the current year compared with the industry’s 15.2%. Shares of QTRX have surged 145.6% against the industry’s 0.8% decline over the past year.

Quanterix’s earnings surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report