Zimmer Biomet (ZBH) Rides on ROSA Uptake, Favorable Trend

Zimmer Biomet's ZBH strategic focus on ROSA Robotic Platform and stabilizing market trends bolster investors’ confidence in this stock. The stock carries a Zacks Rank #2 (Buy) at present.

ZBH implemented four meaningful pillars inside its Knee business to drive pricing stability, mix benefit and competitive conversions. Under the first pillar, the company fouses on ROSA Robotic Platform, combined with its Persona cementless Knee. According to the company, this is a powerhouse combination that will continue to accelerate its growth. Zimmer Biomet expects ROSA and Persona cementless to enhance its robotics and cementless penetration from the current 20% to 50-60% at a rapid pace.

The second pillar is focused on Persona revision. This provides a meaningful conversion and mix opportunities inside the revision category. Under the third pillar, Zimmer Biomet plans to work on the overall shift of the company’s legacy knee systems to a fully rounded-out Persona portfolio.

The fourth pillar focuses on the development of the world's first and only Smart Knee- Persona iQ, which is still in limited launch, per its current status. Zimmer Biomet is optimistic about the full launch of Persona IQ in 2024.

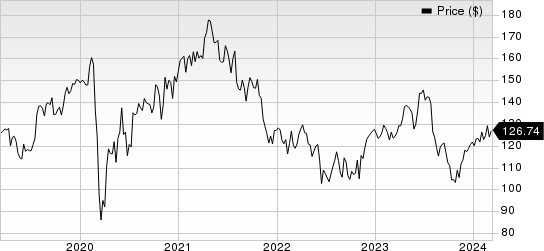

Zimmer Biomet Holdings, Inc. Price

Zimmer Biomet Holdings, Inc. price | Zimmer Biomet Holdings, Inc. Quote

Meanwhile, despite challenging market conditions in the form of pricing pressure, the last few quarters witnessed gradual stability in the global musculoskeletal market with better-than-expected sales growth in certain geographies, banking on improved procedural volume. This was driven by favorable demographics and growing utilization of musculoskeletal healthcare in emerging markets and under-penetrated developed markets. The focused execution of the company's global sales teams amid a stable global musculoskeletal market also helped accelerate global sales for Persona, the personalized knee system.

In the fourth quarter of 2023, the company witnessed strong growth, driven by continued procedure recovery, strong execution, and a solid momentum with the new innovation. The company saw another positive quarter of year-over-year momentum in large joints, with the overall global Knees, Hips and S.E.T. business growing 9.4%, 3.6% and 3.3%, respectively.

However, the ongoing industry-wide trend of staffing shortages and supply chain-related hazards is denting Zimmer Biomet’s growth. Deteriorating international trade and geopolitical complications lead to a tough situation related to raw materials and labor costs as well as freight charges. Added to this, the rise in central bank policy rates to fight inflation, along with the gradual withdrawal of fiscal policies amid high debt, continues to dent economic growth, adversely impacting the overall market situation for Zimmer Biomet. Rising interest rates have put the dental treatment space (which is highly elective) in a tight spot.

In the Hip category, headwinds in Russia are disproportionately impacting the outside U.S. business. Further, Zimmer Biomet is facing challenges in the form of reimbursement headwinds, particularly in the Restorative Therapies business, in its S.E.T. category. In addition, the company experienced acute supply challenges within Sports and Trauma. All these are creating significant pressure on ZBH’s revenues and operating profit.

Other Key Picks

Some other top-ranked stocks from the broader medical space are Cardinal Health CAH, Stryker Corporation SYK and Cencora, Inc. COR.

Cardinal Health, carrying a Zacks Rank #1 (Strong Buy) at present, reported second-quarter fiscal 2024 adjusted earnings of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion improved 11.6% on a year-over-year basis and also topped the Zacks Consensus Estimate by 1.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

CAH has a long-term earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 15.6%.

Stryker, carrying a Zacks Rank #2 at present, reported a fourth-quarter 2023 adjusted EPS of $3.46, which beat the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s increase of 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 5.1%.

Cencora, carrying a Zacks Rank #2 at present, reported first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s growth of 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 6.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report