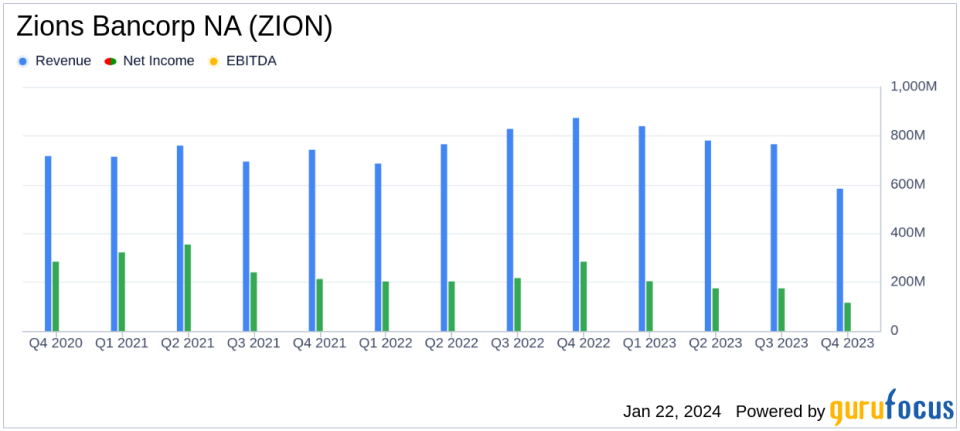

Zions Bancorp NA (ZION) Reports Decline in Q4 Earnings and Net Interest Income

Net Earnings: Reported Q4 net earnings of $116 million, a significant decrease from $277 million in Q4 of the previous year.

Diluted EPS: Earnings per share fell to $0.78, down from $1.84 year-over-year.

Net Interest Income: Dropped by 19% to $583 million, with net interest margin (NIM) relatively stable at 2.91%.

Loans and Credit Quality: Loans and leases grew by 4% to $57.8 billion, with a low net charge-off ratio of 0.06%.

Deposits and Borrowed Funds: Total deposits rose by 5% to $75.0 billion, while short-term borrowings decreased significantly.

Capital: The estimated Common Equity Tier 1 (CET1) capital ratio improved to 10.3%.

On January 22, 2024, Zions Bancorp NA (NASDAQ:ZION) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The regional U.S. bank, headquartered in Salt Lake City, reported a downturn in net earnings and diluted earnings per share (EPS) compared to both the previous quarter and the same quarter last year. Despite these challenges, Zions Bancorp NA (NASDAQ:ZION) demonstrated resilience with loan growth and a stable net interest margin.

Zions Bancorp NA (NASDAQ:ZION) operates primarily in the Western and Southwestern United States, focusing on small and midsize business banking. The bank's core services include commercial and commercial real estate lending, which saw a 4% increase in loans and leases. The bank's credit quality remained robust, with a low annualized net charge-off ratio, although nonperforming assets increased slightly to 0.39% of loans and leases.

Financial Performance Analysis

The bank's net interest income was impacted by higher funding costs and a reduction in interest-earning assets, which declined by 1% from the prior year quarter. The net interest margin, however, remained relatively stable at 2.91%, compared to 3.53% in the same period last year. This stability in NIM, alongside a 5% increase in total deposits, suggests a solid customer deposit base and prudent interest rate risk management.

Noninterest income remained stable at $150 million, but noninterest expenses rose by 23%, influenced by a one-time $90 million FDIC special assessment accrual. Excluding this one-time expense, adjusted noninterest expense increased by a modest 4%. The efficiency ratio deteriorated to 65.1%, reflecting the decline in adjusted taxable-equivalent revenue.

Harris H. Simmons, Chairman and CEO, commented on the results, stating, "Fourth quarter operating results reflect the Bank's resiliency, with strong quarter-over-quarter customer deposit growth of $1.7 billion, loan growth of $0.9 billion, a stable net interest margin and continued strengthening of the Bank's capital position." He also noted the "strong credit quality of our loan portfolio," and expressed optimism for growth in the coming year.

The bank's balance sheet analysis revealed a 4% increase in loans and leases, net of unearned income and fees, to $57.8 billion. The provision for credit losses was minimal, reflecting the strong credit quality. The estimated CET1 capital ratio improved to 10.3%, up from 9.8% in the prior year, indicating a stronger capital position.

In conclusion, Zions Bancorp NA (NASDAQ:ZION) faced headwinds in the fourth quarter of 2023, with a decline in net earnings and net interest income. However, the bank's loan growth, stable net interest margin, and improved capital ratio highlight its resilience and potential for future growth. Investors and stakeholders will be watching closely to see how the bank navigates the evolving economic landscape and capitalizes on its strengths in the coming year.

For a more detailed analysis and additional information, readers are encouraged to review the full earnings release and financial statements available on the SEC website.

Explore the complete 8-K earnings release (here) from Zions Bancorp NA for further details.

This article first appeared on GuruFocus.