Zions' (ZION) Q4 Earnings Beat Estimates, Costs Rise Y/Y

Zions Bancorporation’s ZION fourth-quarter 2023 adjusted net earnings per share of $1.29 handily surpassed the Zacks Consensus Estimate of $1.00. However, the bottom line decreased 29.9% from the year-ago quarter.

Results were primarily aided by nil provisions and improvement in loan balance. However, elevated adjusted non-interest expenses and a decline in net interest income (NII) and non-interest income were the major headwinds.

Results excluded the FDIC special assessment charge and negative impact from Credit Valuation Adjustment. After considering these, net income attributable to common shareholders was $116 million, plunging 58.1% year over year.

Revenues Decline, Expenses Rise

Net revenues (tax equivalent) were $741 million, which decreased 16.1% year over year. The top line missed the Zacks Consensus Estimate of $754.8 million.

NII was $583 million, declining 19% year over year. The fall was mainly due to higher funding costs. It was also affected by a decline in interest-earning assets and a rise in interest-bearing liabilities. Likewise, net interest margin (NIM) shrunk 62 basis points (bps) to 2.91%. Our estimates for NII and NIM were $562.1 million and 2.81%, respectively.

Non-interest income came in at $148 million, decreasing 3.3%. We had projected non-interest income to be $166.5 million.

Adjusted non-interest expenses were $489 million, up 3.6% year over year. We had expected this metric to be $480.7 million.

Adjusted efficiency ratio was 65.1%, up from 52.9% in the prior-year period. A rise in the efficiency ratio indicates a decrease in profitability.

As of Dec 31, 2023, net loans and leases held for investment were $57.1 billion, rising 1.6% from the prior quarter. Total deposits were $75 billion, down marginally.

Credit Quality: Mixed Bag

The ratio of non-performing assets to loans and leases, as well as other real estate owned, expanded 12 bps year over year to 0.39%.

In the reported quarter, the company recorded net loan and lease charge-offs of $9 million against net loan and lease recoveries of $3 million in the prior-year quarter. Provision for credit losses was nil in the reported quarter against $43 million in the year-ago quarter.

Capital Ratios Improve, Profitability Ratios Deteriorate

Tier 1 leverage ratio was 8.3% as of Dec 31, 2023, compared with 7.7% at the end of the prior-year quarter. Tier 1 risk-based capital ratio of 10.9% increased from 10.5%.

Further, as of Dec 31, 2023, common equity tier 1 capital ratio was 10.3%, which increased from 9.8% in the prior-year period.

At the end of the fourth quarter, the return on average assets was 0.57%, down from 1.27% as of Dec 31, 2022. Return on average tangible common equity was 11.8%, down from 33.4% in the year-ago quarter.

Our Take

Zions’ decent balance-sheet position, business-simplifying efforts and higher interest rates bode well for the future. However, persistently increasing operating expenses and uncertain macroeconomic outlook are near-term concerns.

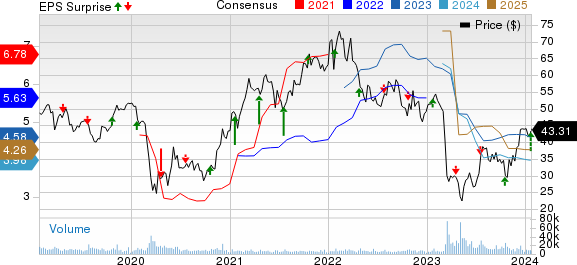

Zions Bancorporation, N.A. Price, Consensus and EPS Surprise

Zions Bancorporation, N.A. price-consensus-eps-surprise-chart | Zions Bancorporation, N.A. Quote

Currently, Zions carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Huntington Bancshares HBAN reported fourth-quarter 2023 earnings per share of 27 cents (excluding non-recurring items), surpassing the Zacks Consensus Estimate of 26 cents. However, the bottom line declined from the prior-year figure of 42 cents.

Results reflected improvements in average loans and deposits. However, a fall in NII and elevated expenses were headwinds for HBAN.

Fifth Third Bancorp FITB reported fourth-quarter 2023 adjusted earnings per share of 99 cents, surpassing the Zacks Consensus Estimate of 90 cents. In the prior-year quarter, the company reported earnings of $1.01.

FITB’s results were aided by increases in non-interest income and the deposit balance. However, a fall in NII limited its revenue growth. Higher expenses posed another undermining factor.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report