Zoetis (ZTS) to Report Q3 Earnings: What's in the Cards?

Zoetis Inc. ZTS is scheduled to report third-quarter 2023 results on Nov 2, before market open.

Zoetis has a mixed earnings surprise history. The bottom line surpassed estimates in two of the trailing four quarters, missed in one and met in the other. The company delivered an average earnings surprise of 1.89% in the same time frame.

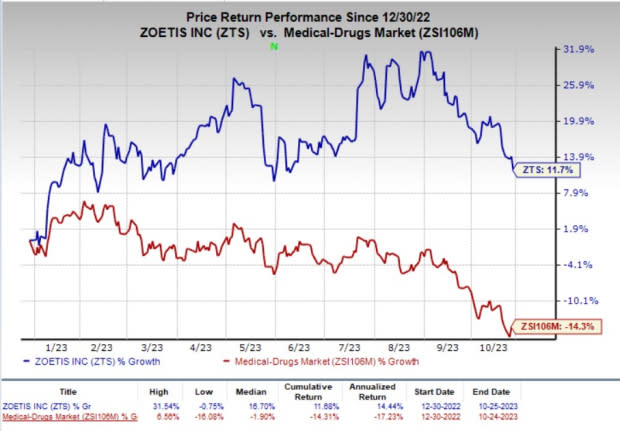

Shares of ZTS have gained 11.7% in the year-to-date period against the industry’s 14.3% fall.

Image Source: Zacks Investment Research

Let's see how things might have shaped up in the to-be-reported quarter.

Factors to Consider

The veterinary drugmaker derives most of its revenues from a diversified product portfolio of medicines and vaccines used to treat and protect livestock and companion animals. Zoetis’ remaining revenues are derived from its non-pharmaceutical product categories, such as nutritional and agribusiness, and products and services in biodevices, genetic tests and precision animal health.

The company reports business results under two geographical operating segments — the United States and International.

Third-quarter revenues in the United States segment are likely to have increased from the year-ago quarter, based on the rising sales of livestock products and new approvals. The Zacks Consensus estimate for this segment is pegged at $1.17 billion.

Revenues from the International segment are likely to have increased in the third quarter. The Zacks Consensus estimate for this segment is pinned at $974 million.

In the previous quarter, the increased sales of Zoetis’ key dermatology products, Apoquel and Cytopoint, boosted the sales of its companion animal products in the U.S. region, along with growth in the sales of vaccine portfolio and Solensia, a monoclonal antibody product for osteoarthritis pain in cats. This trend is likely to have continued in the third quarter as well.

In June 2023, the FDA approved Apoquel Chewable tablets in the United States for controlling pruritus related to allergic dermatitis and control of atopic dermatitis in dogs at least 12 months of age. Apoquel chewable marks the first and only chewable treatment for the control of allergic itch and inflammation in dogs in the United States. This is expected to have increased sales of the product in the to-be-reported quarter.

In the second quarter, the increased sales of livestock products (Draxxin and implant product Synovex) and poultry products (vaccine sales and medicated feed additives) also contributed to Zoetis’ U.S. revenues. Sales of these products are expected to have contributed to the company’s revenues in the United States in the upcoming earnings release.

Revenues in the International segment are likely to have been primarily driven by the company’s key companion animal products. These include monoclonal antibody products for osteoarthritis pain like Librela for dogs and Solensia for cats, dermatology products, such as Apoquel and Cytopoint, as well as Zoetis’ new parasiticide products like Revolution/Stronghold and the Simparica Trio.

Growth in ZTS’ livestock product sales and fish portfolio is also expected to have contributed to its International revenues, partially offset by declining swine product sales owing to supply constraints in certain regions.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Zoetis this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Zoetis has an Earnings ESP of 0.00% as both the Zacks Consensus Estimate and the Most Accurate Estimate are currently pegged at $1.35.

Zacks Rank: ZTS currently has a Zacks Rank #3.

Zoetis Inc. Price and Consensus

Zoetis Inc. price-consensus-chart | Zoetis Inc. Quote

Stocks to Consider

Here are some stocks in the same industry that have the right combination of elements to beat on earnings this time around:

bluebird bio BLUE has an Earnings ESP of +2.37% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of bluebird have declined 57.9% year to date. It beat earnings estimates in each of the last four quarters. BLUE has an earnings surprise of 89.60%, on average.

ACADIA Pharmaceuticals ACAD has an Earnings ESP of +6.76% and a Zacks Rank #2 at present.

ACADIA’s stock has increased 41.9% year to date. It beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions. ACAD has an earnings surprise of 20.33%, on average.

Ascendis Pharma ASND has an Earnings ESP of +13.03% and a Zacks Rank #2 at present.

Ascendis’ stock has decreased 29.3% year to date. It beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions. ASND has a negative earnings surprise of 8.64%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zoetis Inc. (ZTS) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Ascendis Pharma A/S (ASND) : Free Stock Analysis Report