Zoom (NASDAQ:ZM) Beats Q4 Sales Targets, Stock Jumps 13.2%

Video conferencing platform Zoom (NASDAQ:ZM) reported results ahead of analysts' expectations in Q4 FY2024, with revenue up 2.6% year on year to $1.15 billion. The company expects next quarter's revenue to be around $1.13 billion, in line with analysts' estimates. It made a non-GAAP profit of $1.42 per share, improving from its profit of $1.22 per share in the same quarter last year.

Is now the time to buy Zoom? Find out by accessing our full research report, it's free.

Zoom (ZM) Q4 FY2024 Highlights:

Revenue: $1.15 billion vs analyst estimates of $1.13 billion (1.4% beat)

EPS (non-GAAP): $1.42 vs analyst estimates of $1.15 (23% beat)

Revenue Guidance for Q1 2025 is $1.13 billion at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2025 is $4.6 billion at the midpoint, missing analyst estimates by 1.3% and implying 1.6% growth (vs 3.1% in FY2024)

Free Cash Flow of $332.7 million, down 26.6% from the previous quarter

Net Revenue Retention Rate: 101%, down from 105% in the previous quarter

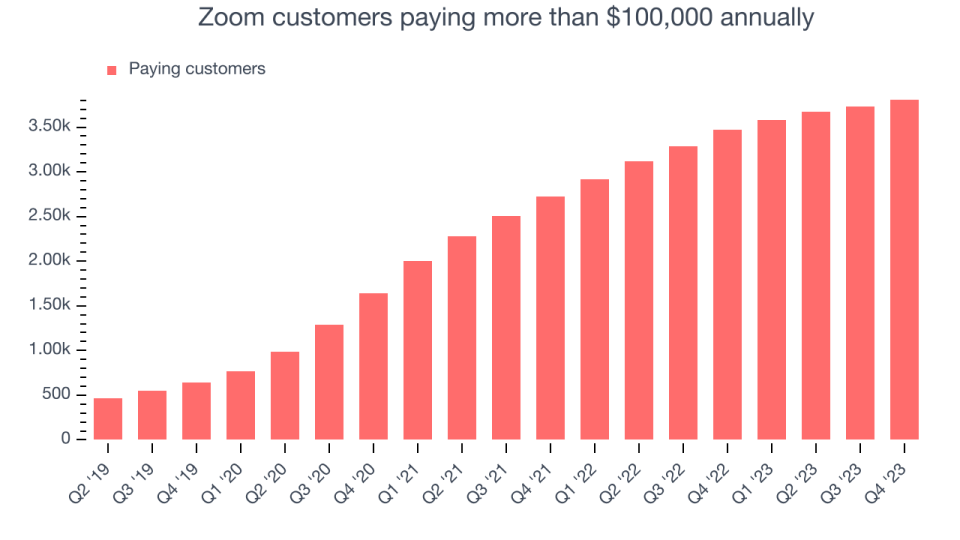

Customers: 3,810 customers paying more than $100,000 annually

Gross Margin (GAAP): 75.9%, up from 73.7% in the same quarter last year

Market Capitalization: $19.3 billion

Zoom’s Board of Directors has authorized a stock repurchase program of up to $1.5 billion of Zoom’s outstanding Class A common stock.

"In FY24, we unveiled Zoom AI Companion, our generative AI digital assistant, aimed at boosting productivity, enhancing team effectiveness, and fostering skill development across the Zoom platform. We're committed to democratizing AI accessibility, offering it to all our customers regardless of business size, included at no extra charge with a paid license,” stated Eric S. Yuan, Zoom's founder and CEO.

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Sales Growth

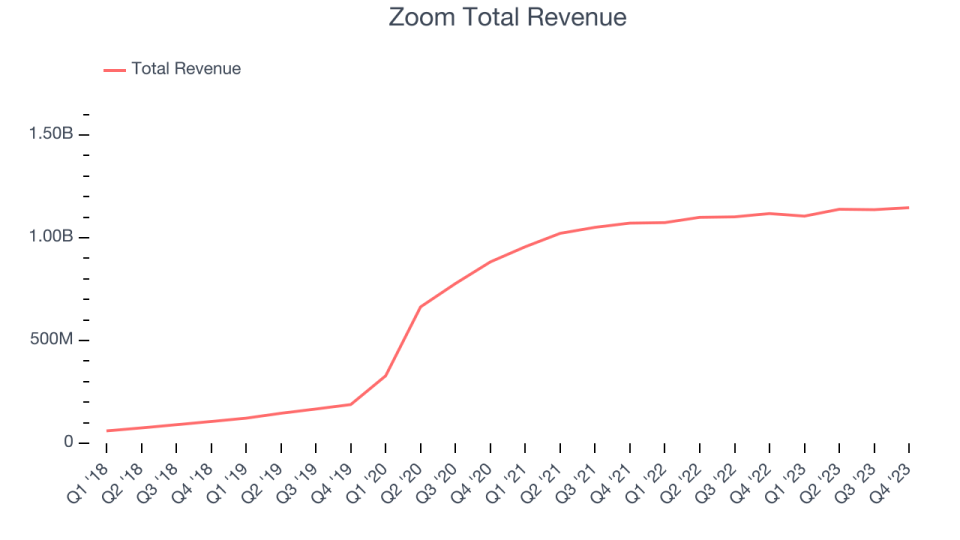

As you can see below, Zoom's revenue growth has been unimpressive over the last two years, growing from $1.07 billion in Q4 FY2022 to $1.15 billion this quarter.

Zoom's quarterly revenue was only up 2.6% year on year, which might disappoint some shareholders. However, its revenue increased $9.73 million quarter on quarter, a strong improvement from the $1.95 million decrease in Q3 2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Zoom is expecting revenue to grow 1.8% year on year to $1.13 billion, slowing down from the 2.9% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $4.6 billion at the midpoint, growing 1.6% year on year compared to the 3.1% increase in FY2024.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Large Customers Growth

This quarter, Zoom reported 3,810 enterprise customers paying more than $100,000 annually, an increase of 79 from the previous quarter. That's quite a bit more contract wins than last quarter and about the same as what we've seen in past quarters, demonstrating that the business has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is running smoothly.

Key Takeaways from Zoom's Q4 Results

We enjoyed seeing Zoom accelerate its new large contract wins this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand. Overall, this was a mixed quarter for Zoom. But the market reacted very positive to the news of share buyback and the stock is up 13.2% after reporting and currently trades at $71.47 per share.

So should you invest in Zoom right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.