Zoom Video Communications Inc (ZM) Posts Modest Revenue Growth and Strong Cash Flow in FY 2024

Total Revenue: $4,527.2 million in FY 2024, a 3.1% increase year over year.

Enterprise Revenue: $2,619.3 million, marking an 8.7% rise from the previous year.

Operating Cash Flow: $1,598.8 million for FY 2024, up 23.9% year over year.

Net Income: GAAP net income of $637.5 million, a significant improvement from $103.7 million in FY 2023.

Stock Repurchase: Authorization to repurchase up to $1.5 billion of Zooms Class A common stock.

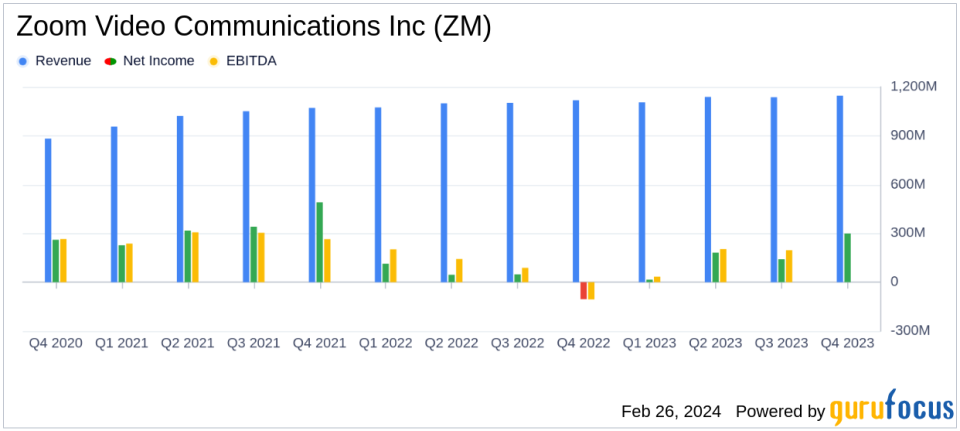

On February 26, 2024, Zoom Video Communications Inc (NASDAQ:ZM) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year ended January 31, 2024. The company, known for its video-first unified communications platform that revolutionized personal and professional connectivity, reported a modest year-over-year revenue growth and a significant increase in operating cash flow, reflecting its operational efficiency and the strength of its enterprise customer base.

Financial Performance Overview

Zoom's total revenue for the fourth quarter was $1,146.5 million, a 2.6% increase year over year, while the full fiscal year revenue rose by 3.1% to $4,527.2 million. The Enterprise segment was particularly strong, with an 8.7% year-over-year increase, signaling robust demand for Zoom's offerings among larger organizations. The company's operating cash flow for the fiscal year stood at $1,598.8 million, up 23.9% compared to the previous fiscal year, showcasing a healthy cash-generating capability.

GAAP net income attributable to common stockholders for the fourth quarter was $298.8 million, or $0.95 per share, a notable rebound from a net loss of $104.1 million, or $(0.36) per share, in the same period last year. For the full fiscal year, GAAP net income was $637.5 million, or $2.07 per share, compared to $103.7 million, or $0.34 per share, for the previous fiscal year.

Strategic Developments and Customer Growth

Zoom's founder and CEO, Eric S. Yuan, highlighted the launch of Zoom AI Companion and the continued innovation across the platform, including enhancements to Zoom Contact Center. The company's focus on democratizing AI accessibility and driving platform-wide innovation has been instrumental in maintaining a competitive edge in the market.

"In FY24, we unveiled Zoom AI Companion, our generative AI digital assistant, aimed at boosting productivity, enhancing team effectiveness, and fostering skill development across the Zoom platform. We're committed to democratizing AI accessibility, offering it to all our customers regardless of business size, included at no extra charge with a paid license," stated Eric S. Yuan.

At the end of the fourth quarter, Zoom had approximately 220,400 Enterprise customers, a 3.5% increase year over year, and a trailing 12-month net dollar expansion rate for Enterprise customers of 101%. The company also reported 3,810 customers contributing more than $100,000 in trailing 12 months revenue, up approximately 9.8% from the same quarter last fiscal year.

Financial Outlook and Share Repurchase Program

For the first quarter of fiscal year 2025, Zoom expects total revenue to be approximately $1.125 billion and non-GAAP income from operations to be between $410.0 million and $415.0 million. The full fiscal year 2025 revenue is projected to be approximately $4.600 billion, with non-GAAP income from operations expected to be between $1.720 billion and $1.730 billion.

Additionally, Zoom's Board of Directors has authorized a stock repurchase program of up to $1.5 billion of Zooms outstanding Class A common stock, demonstrating confidence in the company's financial strength and commitment to delivering shareholder value.

Conclusion

Zoom Video Communications Inc (NASDAQ:ZM) has shown resilience in a challenging market, delivering modest revenue growth and a strong increase in operating cash flow. The company's strategic focus on innovation and customer expansion, particularly within the Enterprise segment, positions it well for sustained growth. The authorization of a significant stock repurchase program further underscores Zoom's financial health and optimistic outlook.

Investors and potential GuruFocus.com members interested in a deeper analysis of Zoom's financials and future prospects are encouraged to visit GuruFocus.com for comprehensive research tools and expert commentary.

Explore the complete 8-K earnings release (here) from Zoom Video Communications Inc for further details.

This article first appeared on GuruFocus.