Zoom Video Forecasts High FCF Margins, Which Could Make the Stock a Takeover Candidate

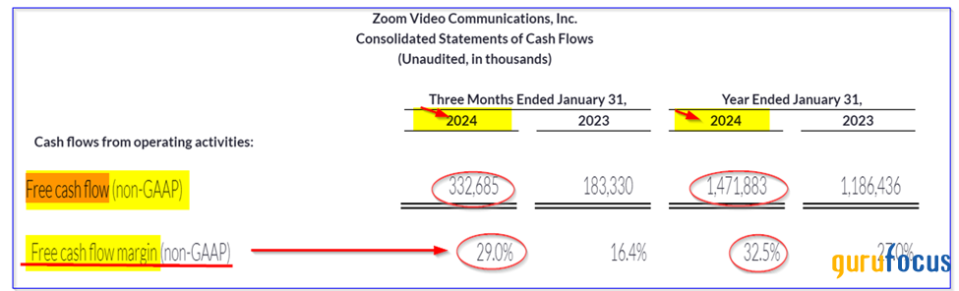

Zoom Video Communications reported after hours on February 26 that its free cash flow (FCF) skyrocketed for the fiscal quarter ending Jan. 31, 2024. Although Zoom's sales were up 2.6% for the year, FCF rose 24.1% to $1,471.9 million.

That is almost $1.5 billion. It's up from $1,186.4 million in 2023. Zoom also said reported that Q4 FCF rose from $183.33 million to $332.685 million. That represents a huge gain of 81.5% in Q4 FCF over the prior year quarter.

As a result, Zoom has been stockpiling cash with as it is now a cash cow. That could make it a potential takeover candidate. This article will discuss these points.

Free Cash Flow Margins Rise

Zoom's results were also impressive due to its huge free cash flow (FCF) margins. This measures how much of its sales is converted into FCF. That is not only a measure of its profitability but also measures its efficiency in usage of cash.

For example, based on full year 2023 sales of $4.527 billion. Based on $1.472 billion in FCF, Zoom generated converted almost one-third of sales into free cash flow.

That was up from a 27% margin a year ago. Moreover, even during Q4 its FCF margin was high at 29%, up from 16.4% a year ago.

As a result, analysts can now confidently estimate its FCF and potentially derive an upside target price.

Guidance Shows It Could Continue

Zoom is one of the few tech companies that forecasts its own free cash flow for the year. That shows it has a good deal of confidence in its capabilities to be a cash cow.

For example, management said in the press release that it expects this year's FCF to be between $1.440 billion and $1.480 billion. But everyone knows that companies like to downplay expectations. So, the reality is that FCF could end up much higher.

For example, based on analysts' forecasts of $4.66 billion in revenue this year, FCF could hit $1.538 billion.,

This assumes that the company produces a steady 33% FCF margin throughout the year. Moreover, if margins rise just slightly to 34.5%, FCF could rise to over $1.6 billion, up from $1.5 billion in 2023.

What This Means for Investors

Free cash flow is what is left over after the company spends incoming cash flow on all its cash expenses. This includes not only operating cash costs, or burn, but also its R&D, capex spending and even inventory needs from net working capital flows.

As a result, this cash flow is free to be spent on shareholder value creation activities such as buybacks, dividends, net debt reduction and even acquisitions. Or it can just pile up on in the company's checking account and balance sheet.

The latter can make it attractive to a potential takeover target. For example, cash and marketable securities are now $6.95 billion or almost $7 billion, as of Jan. 31, 2024. That is up 58% from $4.4 billion last year.

This net cash works out to 36% or so of its $19.1 billion market capitalization prior to the release of the earnings. That, along with Zoom's huge FCF margins could end making this stock very attractive to a potential takeover bidder.

On top of this Zoom has been buying back its shares. That increases value for all remaining non-selling shareholders. For example, Zoom said its board had authorized a $1.5 billion stock buyback. That is about 7.8% of its present market value.

This is significant since it's the first since the quarter ending Oct. 2022 that Zoom has repurchased its own shares. It's also another indicator that the company has a high level of confidence in its ability to generate free cash flow

Target Price

Based on its huge FCF margin, we can derive a price target. For example, using a very conservative 6.0% FCF yield metric, ZM stock could be worth $25 billion.

This is seen by dividing our forecast of $1.538 billion in FCF this year by 6.0%. Dividing by 6.0% is also the same as multiplying by 16.667, since the inverse of 6% is 16.667 (i.e., 1/0.06 = 16.667). Therefore 1.528b x 16.667 equals $25.633 billion.

That is 34% over today's market cap of $19.12 billion. Just to be conservative, let's use $25 billion. That is a 30% potential increase in the stock price to $82.00 per share.

Moreover, using a 5.0% FCF yield (i.e., 20x FCF), sets a price target of over $30 billion (i.e., $1.538 billion x 20 = $30.766 billion. That leads to a price target of $101 per share as this is 61% over today's $19.12 billion market cap.

Analysts Agree

Some analysts have correctly seen Zoom's upside in the past. For example, AnaChart, is a new sell-side analyst tracking service that measures analysts' past performance.

The site shows that the average price target of 29 analysts covering ZM stock is $98.51 per share. That represents a potential upside of over 56% from the stock price today (before the earnings release).

One analyst in particular has been very good in predicting the moves in ZM stock. James Fish of Piper Sandler has met his price targets on the stock over 52% of time according to AnaChart.

The market will be anticipating his updated analysis of the stock after today's results.

The bottom line is that ZM stock looks very attractive here to value investors. This is based on its huge FCF margins, its cash buildup, the share buybacks, and the company's own forecasts of its free cash flow generation. That could also make it attractive to a potential takeover bidder who might want to gain control of this cash cow.

This article first appeared on GuruFocus.