Zoom (ZM) Q2 Earnings Beat, Customer Growth Drives Revenues

Zoom Video Communication’s ZM second-quarter fiscal 2024 adjusted earnings of $1.34 per share beat the Zacks Consensus Estimate by 27.62% and increased 27.6% year over year.

Revenues of $1.13 billion beat the consensus mark by 2.29% and increased 3.6% year over year on strong growth from Enterprise customers.

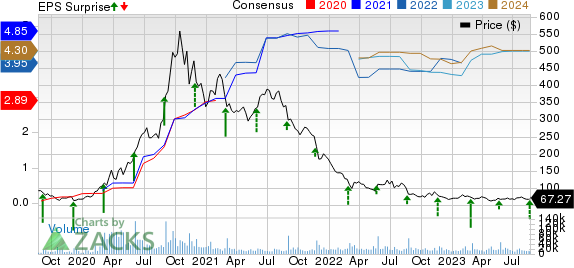

Zoom Video Communications, Inc. Price, Consensus and EPS Surprise

Zoom Video Communications, Inc. price-consensus-eps-surprise-chart | Zoom Video Communications, Inc. Quote

Quarterly Details

Revenues from Enterprise customers grew 10.2% year over year to $659.5 million and represented 58% of total revenues, up from 54% in the prior-year quarter. Customers contributing more than $100,000 in revenues in the trailing 12 months grew 17.8% to 3,672. These customers accounted for 29% of revenues, up from 26% in the year-ago quarter.

The company reported a trailing 12-month net dollar expansion rate for Enterprise customers of 109%.

The number of Enterprise customers grew 7% year over year to more than 218,100.

Zoom Contact Center product surpassed 500 customers as the company has been rolling out about 90 new features and enhancements per quarter. In early July, the company launched Workforce Management to help customers streamline customer communications, manage agent needs and transform their customer experience all from a single and unified platform.

In the second quarter, the U.S. Postal Service added Zoom Team Chat for 21,500 users to its existing Zoom for government deployment.

Revenues increased 5.9% in America, while international market revenues from APAC and EMEA decreased 2.7% and 1.1% year over year, respectively.

Non-GAAP Operating Details

Gross margin expanded 140 basis points (bps) to 80.3% in the fiscal second quarter of 2024.

Research and development expenses increased 6.5% year over year to $104.1 million. Sales and marketing expenses decreased 3.4% to $275.9 million, while general and administrative expenses decreased 19% to $73.1 million.

Operating income increased 17.3% to $461.7 million year over year. Operating margin expanded 470 bps to 40.5%.

Balance Sheet

Total cash, cash equivalents and marketable securities as of Jul 31, 2023, were $6 billion. As of Apr 30, 2023, cash, cash equivalents and marketable securities were $5.6 billion.

Free cash flow as of Jul 31, 2023, was $289.4 million. As of Apr 30, 2023, adjusted free cash flow was $396.7 million.

Guidance

Zoom expects third-quarter fiscal 2024 revenues in the range of $1.115 billion to $1.120 billion.

Non-GAAP earnings per share are expected in the range of $1.07 to $1.09.

For fiscal 2024, Zoom expects revenues in the range of $4.485-$4.495 billion.

Non-GAAP earnings per share are expected in the range of $4.63 to $4.67.

Zacks Rank & Key Picks

Currently, Zoom carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, Manhattan Associates MANH and Salesforce CRM.

NVIDIA and Manhattan Associates sport a Zacks Rank #1 (Strong Buy) each, and Salesforce carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's second-quarter fiscal 2024 earnings has been revised upward by a couple of cents to $2.06 per share in the past 60 days. For fiscal 2024, earnings estimates have increased by 4 cents to $7.83 per share in the past seven days.

NVIDIA’s earnings beat the Zacks Consensus Estimate twice in the preceding four quarters while missing the same on two occasions, the average surprise being 0.3%. Shares of NVDA have surged 196.3% YTD.

The Zacks Consensus Estimate for Manhattan Associates’ third-quarter 2023 earnings has been revised 5 cents northward to 77 cents per share in the past 30 days. For 2023, earnings estimates have moved 22 cents upward to $3.09 per share in the past 30 days.

Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 31.6%. Shares of MANH have rallied 53.2% year to date.

The Zacks Consensus Estimate for Salesforce's second-quarter fiscal 2024 earnings has remained unchanged at $1.90 per share in the past 60 days. For fiscal 2024, earnings estimates have remained unchanged at $7.44 per share in the past 60 days.

Salesforce's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 15.5%. Shares of CRM have surged 54.5% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report