ZoomInfo (NASDAQ:ZI) Posts Better-Than-Expected Sales In Q4, Stock Jumps 10.2%

Sales intelligence platform ZoomInfo reported Q4 FY2023 results topping analysts' expectations , with revenue up 4.9% year on year to $316.4 million. The company expects next quarter's revenue to be around $308.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.26 per share, down from its profit of $0.26 per share in the same quarter last year.

Is now the time to buy ZoomInfo? Find out by accessing our full research report, it's free.

ZoomInfo (ZI) Q4 FY2023 Highlights:

Revenue: $316.4 million vs analyst estimates of $310.5 million (1.9% beat)

EPS (non-GAAP): $0.26 vs analyst estimates of $0.25 (5.6% beat)

Revenue Guidance for Q1 2024 is $308.5 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2024 is $1.27 billion at the midpoint, in line with analyst expectations and implying 2.5% growth (vs 13.5% in FY2023)

Free Cash Flow of $119.9 million, up 26.5% from the previous quarter

Gross Margin (GAAP): 88.9%, up from 87.8% in the same quarter last year

Market Capitalization: $6.00 billion

“We ended the year strong, with better-than-expected sequential revenue growth, while we delivered another year of profitability and free cash flow,” said Henry Schuck, ZoomInfo Founder and CEO.

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

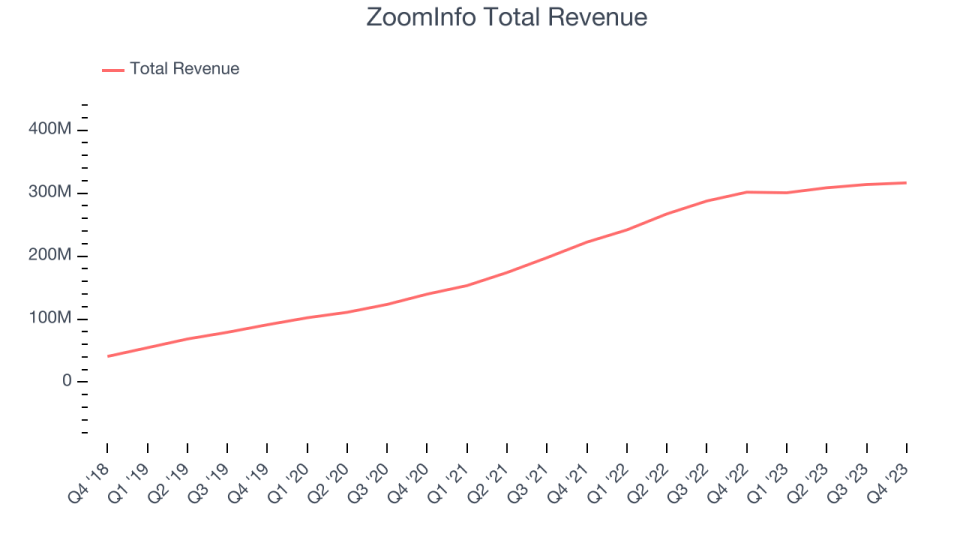

Sales Growth

As you can see below, ZoomInfo's revenue growth has been strong over the last two years, growing from $222.3 million in Q4 FY2021 to $316.4 million this quarter.

ZoomInfo's quarterly revenue was only up 4.9% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $2.6 million in Q4 compared to $5.1 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that ZoomInfo is expecting revenue to grow 2.6% year on year to $308.5 million, slowing down from the 24.4% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.27 billion at the midpoint, growing 2.5% year on year compared to the 12.9% increase in FY2023.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

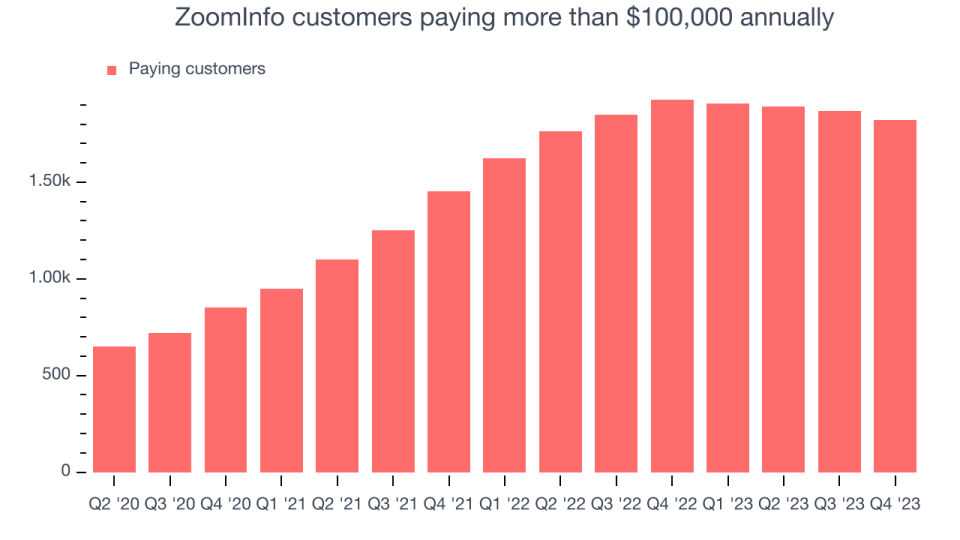

Large Customers Growth

This quarter, ZoomInfo reported 1,820 enterprise customers paying more than $100,000 annually, a decrease of 49 from the previous quarter. We've no doubt shareholders would like to see the company regain its sales momentum.

Key Takeaways from ZoomInfo's Q4 Results

It was encouraging to see ZoomInfo narrowly top analysts' revenue expectations this quarter. Non-GAAP operating profit also beat expectations. Those stood out as a positives in these results. While revenue guidance for next year suggests a slowdown in growth, guidance was roughly in line with expectations. Given some of the choppy quarters the company has had in the last year and fears about secular tailwinds to the business from AI, these results were likely better than feared. The stock is up 10.2% after reporting and currently trades at $17.68 per share.

ZoomInfo may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.