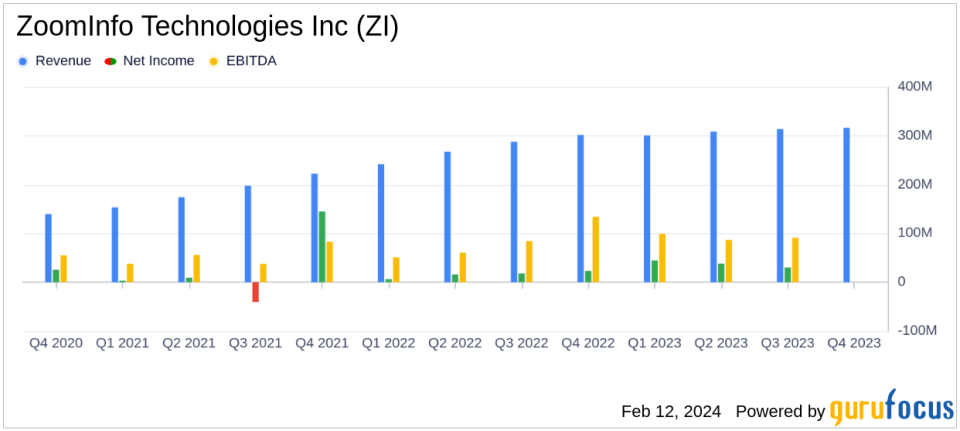

ZoomInfo Technologies Inc (ZI) Reports Steady Growth in Q4 and Full-Year 2023 Earnings

Q4 GAAP Revenue: Increased by 5% year-over-year to $316.4 million.

Full-Year GAAP Revenue: Grew by 13% year-over-year to $1,239.5 million.

Operating Income: Q4 GAAP Operating Income rose by 35% year-over-year; Full-Year GAAP Operating Income up by 48%.

Adjusted Operating Income Margin: Remained strong at 40% for both Q4 and the full year.

Unlevered Free Cash Flow: Q4 saw an increase of 3% year-over-year; Full-Year growth was 2%.

Share Repurchase: ZoomInfo repurchased and retired 22.6 million shares at an average price of $17.68, totaling $400.1 million.

Customer Growth: Ended the quarter with 1,820 customers with $100,000 or greater in annual contract value.

On February 12, 2024, ZoomInfo Technologies Inc (NASDAQ:ZI) released its 8-K filing, announcing its financial results for the fourth quarter and full-year ended December 31, 2023. The company, known for its go-to-market intelligence platform for sales and marketing teams, reported a year-over-year increase in GAAP revenue of 5% for the fourth quarter, amounting to $316.4 million, and a 13% increase for the full year, reaching $1,239.5 million.

ZoomInfo's GAAP Operating Income for Q4 was $70.5 million, a significant increase of 35% compared to the same period last year. The full-year GAAP Operating Income also saw a substantial rise, growing by 48% to $259.5 million. The Adjusted Operating Income Margin remained robust at 40% for both the quarter and the full year, reflecting the company's ability to maintain profitability amidst growth.

The company's cash flow performance was also strong, with Q4 GAAP Cash Flow from Operations at $128.8 million and Unlevered Free Cash Flow at $126.0 million. For the full year, these figures were $434.9 million and $463.5 million, respectively. ZoomInfo's commitment to shareholder returns was evident in its repurchase and retirement of 22.6 million shares of common stock, at an average price of $17.68, for a total of $400.1 million.

ZoomInfo ended the quarter with 1,820 customers with an annual contract value of $100,000 or greater, a testament to the company's growing market presence and the value it provides to its customers. The company's net revenue retention rate stood at 87%, indicating the strong loyalty and satisfaction among its existing customer base.

During the reported period, ZoomInfo introduced ZoomInfo Copilot, an AI-powered solution designed to enhance sales team performance by providing actionable insights and recommendations. The company also released its 2024 Customer Impact Report, highlighting the significant benefits customers experience using ZoomInfo's platform, including a 32% increase in revenue and a 1.5x higher win rate for sales leaders.

ZoomInfo's balance sheet remains solid, with cash and cash equivalents of $447.1 million as of December 31, 2023. The company's total assets amounted to $6,868.3 million, while total liabilities were $4,749.0 million, resulting in total stockholders' equity of $2,119.3 million.

Looking ahead, ZoomInfo provided guidance for the first quarter and full-year 2024, projecting GAAP Revenue between $307 million and $310 million for Q1, and between $1.26 billion and $1.28 billion for the full year. The company also anticipates Non-GAAP Adjusted Operating Income between $115 million and $117 million for Q1, and between $492 million and $502 million for the full year.

ZoomInfo's performance in the fourth quarter and full-year 2023 demonstrates its ability to grow revenue and maintain high levels of profitability and cash flow. The introduction of innovative solutions like ZoomInfo Copilot and the positive outcomes reported in the Customer Impact Report suggest that the company is well-positioned to continue its growth trajectory and enhance its market leadership in the go-to-market intelligence space.

Investors and potential GuruFocus.com members interested in a company with a strong track record of financial performance, commitment to innovation, and a focus on customer success will find ZoomInfo Technologies Inc (NASDAQ:ZI) to be a compelling consideration for their portfolios.

"We ended the year strong, with better-than-expected sequential revenue growth, while we delivered another year of profitability and free cash flow," said Henry Schuck, ZoomInfo Founder and CEO. "I am excited to introduce ZoomInfo Copilot, our GenAI-powered solution that turns every seller into your best seller. Copilot delivers AI powered recommendations about who to contact, when to engage them, and even what to say across channels. It gives revenue teams a substantial advantage so they can get to buyers faster."

For detailed financial tables and a full reconciliation of non-GAAP financial measures, please refer to the original 8-K filing.

Explore the complete 8-K earnings release (here) from ZoomInfo Technologies Inc for further details.

This article first appeared on GuruFocus.