ZTO Express (ZTO) Benefits From Parcel Volumes, Expenses Ail

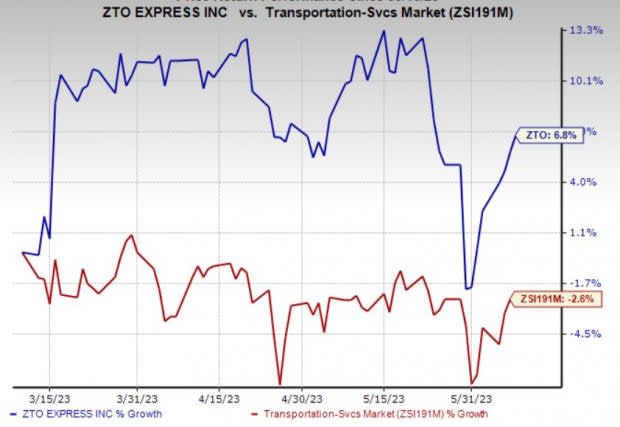

ZTO Express’ (ZTO) top line continues to benefit from the upbeat performance of its core express delivery services segment. Shares of ZTO have gained 6.8% over the past six months against the 2.6% loss of the industry it belongs to.

Image Source: Zacks Investment Research

Recently, the company reported first-quarter 2023 earnings of 34 cents per share, beating the Zacks Consensus Estimate of 24 cents and improving year over year. Total revenues of $1,308.1 million missed the Zacks Consensus Estimate of $1,379.3 million. However, the top line improved year over year, owing to a rise in revenues at the core express delivery services unit (contributing 93.4% to the top line).

How is ZTO Express Doing?

Strength across the core express delivery services unit is encouraging. Notably, revenues from the unit increased 16.1% year over year in first-quarter 2023. The uptick was driven by a 20.5% increase in parcel volumes on the back of rapid growth in the e-commerce business in recent times. Market share of parcel volume grew by 1.8 points to 23.4% in the reported quarter. ZTO Express now expects 2023 parcel volumes in the range of 29.27-30.24 billion (prior view: 28.78-29.75 billion). The updated guidance indicates an increase of 20-24% year over year.

ZTO Express’ consistent initiatives to reward its shareholders look encouraging. As of Mar 31, 2023, ZTO Express purchased 38,250,449 ADSs at an average purchase price of $25.18, including repurchase commissions. The company’s board of directors has further approved changes to its existing share repurchase program, increasing the value of shares to be repurchased from $1 billion to $1.5 billion and extending the effective time by one year through Jun 30, 2024. ZTO anticipates funding the repurchases from its existing cash balance.

However, higher selling, general & administrative (SG&A) expenses might increase operating expenses and affect the bottom line. Apart from other factors, increases in compensation, benefits and office expenditures are leading to higher SG&A expenses. In first-quarter 2023, SG&A expenses increased 27.2% due to a rise in compensation and benefits.

Zacks Rank and Stocks to Consider

Currently, ZTO Express carries a Zacks Rank #3 (Hold).

Some better-ranked stocks for investors interested in the Zacks Transportation sector are Copa Holdings, S.A. CPA and Allegiant Travel Company ALGT. Each of these companies presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Copa Holdings has an expected earnings growth rate of 75.42% for the current year. CPA delivered a trailing four-quarter earnings surprise of 14.60%, on average.

The Zacks Consensus Estimate for CPA’s current-year earnings has improved 25.5% over the past 90 days. Shares of CPA have soared 19.3% over the past three months.

Allegiant has an expected earnings growth rate of more than 100% for the current year. ALGT delivered a trailing four-quarter earnings surprise of 79.78%, on average.

The Zacks Consensus Estimate for ALGT’s current-year earnings has improved 46.5% over the past 90 days. Shares of ALGT have soared 13.6% over the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Allegiant Travel Company (ALGT) : Free Stock Analysis Report

ZTO Express (Cayman) Inc. (ZTO) : Free Stock Analysis Report