ZTO Express (ZTO) Q3 Earnings Top, Revenues Lag Estimates

ZTO Express’ ZTO third-quarter 2023 earnings of 39 cents per share beat the Zacks Consensus Estimate of 36 cents and improved year over year.

Total revenues of $1,244 million missed the Zacks Consensus Estimate of $1,452.5 million.

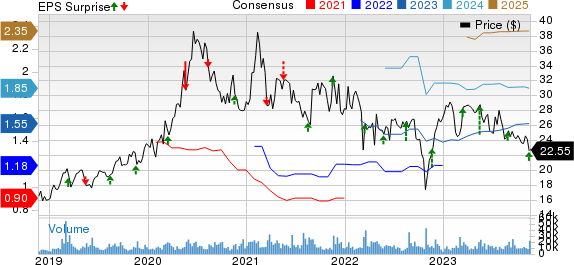

ZTO Express (Cayman) Inc. Price, Consensus and EPS Surprise

ZTO Express (Cayman) Inc. price-consensus-eps-surprise-chart | ZTO Express (Cayman) Inc. Quote

Detailed Operational Statistics

Revenues from the core express delivery business jumped 2.2% year over year, owing to an 18.1% increase in parcel volume and a 13.5% decrease in parcel unit price. Parcel volume market share increased 18.1% from the year-ago reported quarter.

Revenues from freight forwarding services fell 19.8% year over year owing to weakening cross-border e-commerce demand and declining pricing.

Moreover, revenues from sales of accessories (largely consisting of sales of thermal paper used for digital waybills' printing) climbed 32.3% year over year. Other revenues were derived mainly from financing services.

The total operating expenses of this China-based company came in at RMB282.8 million compared with RMB269.6 million in the year-ago quarter. Selling, general and administrative expenses decreased 1.8% from the year-ago reported quarter.

Gross margin rate improved to 29.8% from 27.3% in the year-ago period.

Liquidity & Buyback

ZTO Express exited the third quarter with cash and cash equivalents of RMB9.28 billion compared with RMB 7.78 billion at the end of June 2023.

As of Sep 30, 2023, ZTO Express purchased 40,258,978 ADSs at an average purchase price of $25.16, including repurchase commissions.

The company’s board of directors has further approved changes to its existing share repurchase program, increasing the value of shares to be repurchased from $1 billion to $1.5 billion and extending the effective time by one year through Jun 30, 2024. The company anticipates funding the repurchases from its existing cash balance.

2023 View Intact

ZTO Express has reaffirmed its expectation for parcel volumes in 2023 to 29.27-30.24 billion. The updated guidance represents an increase of 20-24% year over year.

Currently, ZTO Express carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT third-quarter 2023 EPS of $1.80 missed the Zacks Consensus Estimate of $1.85 and declined 30% year over year.

JBHT’s total operating revenues of $3,163.8 million also lagged the Zacks Consensus Estimate of $3,224 million and fell 18% year over year. Total operating revenues, excluding fuel surcharges, decreased 15% year over year.

Delta Air Lines, Inc. (DAL)reported third-quarter 2023 EPS (excluding 31 cents from nonrecurring items) of $2.03, which comfortably beat the Zacks Consensus Estimate of $1.92 and improved 35% on a year-over-year basis.

DAL’s revenues of $15,488 million beat the Zacks Consensus Estimate of $15,290.4 million and increased 11% on a year-over-year basis, driven by higher air travel demand.

Alaska Air Group, Inc. ALK reported third-quarter 2023 EPS of $1.83, which missed the Zacks Consensus Estimate of $1.88 and declined 28% year over year.

Operating revenues of $2,839 million missed the Zacks Consensus Estimate of $2,876.1 million. The top line jumped 0.4% year over year, with passenger revenues accounting for 92.2% of the top line and increasing 0.1% owing to continued recovery in air travel demand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

ZTO Express (Cayman) Inc. (ZTO) : Free Stock Analysis Report