Zumiez Inc (ZUMZ) Faces Net Loss in Q4 Amid Goodwill Impairment Charge

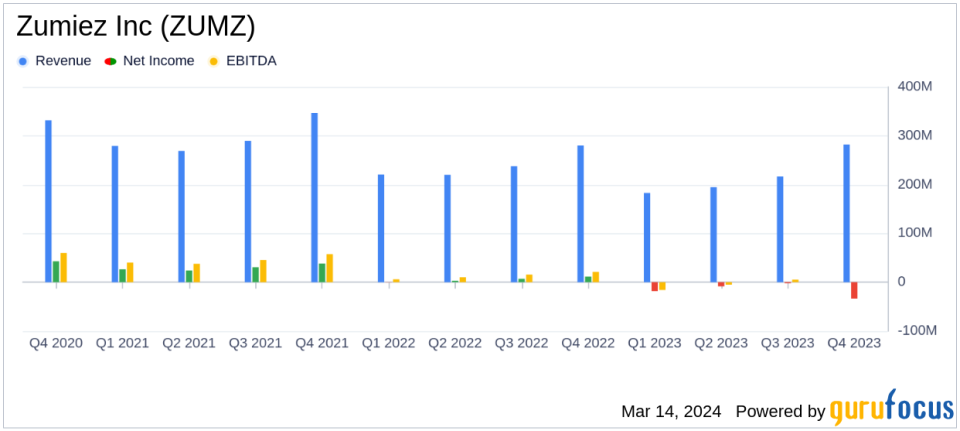

Net Sales: Slight increase in Q4 to $281.8 million, but annual sales down by 8.6%.

Net Loss: Reported a net loss of $33.5 million in Q4, influenced by a $41.1 million goodwill impairment charge.

Earnings Per Share (EPS): Q4 EPS at a loss of $1.73, with annual EPS at a loss of $3.25.

Cash Position: Cash and marketable securities slightly decreased to $171.6 million.

Store Growth: Plans to slow store growth in Europe, with approximately 10 new stores in fiscal 2024.

Comparable Sales: Decreased by 6.2% in the first quarter-to-date sales.

Zumiez Inc (NASDAQ:ZUMZ), a leading specialty retailer, released its 8-K filing on March 14, 2024, disclosing its financial results for the fourth quarter and fiscal year ended February 3, 2024. The company, known for its apparel, footwear, accessories, and hardgoods for young men and women, operates under the brands Zumiez and Blue Tomato, with a significant presence in the U.S. and additional stores in Canada, Australia, and Europe.

The fourth quarter saw a marginal increase in net sales to $281.8 million, up from $280.1 million in the prior year's quarter. However, the company faced a net loss of $33.5 million, or $1.73 per share, a stark contrast to the net income of $11.4 million, or $0.59 per diluted share, reported in the same quarter of the previous fiscal year. This loss was largely due to a goodwill impairment charge of $41.1 million related to the company's strategic decision to slow store growth and focus on profitability in Europe. For the full fiscal year, net sales declined by 8.6% to $875.5 million, with a net loss of $62.6 million, or $3.25 per share, including the goodwill impairment charge.

Zumiez's cash and current marketable securities stood at $171.6 million, a slight decrease from $173.5 million the previous year, primarily due to capital expenditures balanced by cash flow from operating activities. CEO Rick Brooks highlighted the company's stronger than anticipated fourth quarter results, with improvements led by the North American mens business. Despite these improvements, Brooks acknowledged the challenging global operating environment and outlined strategic adjustments, including slowing store growth in Europe, closing underperforming stores in the U.S., and reducing labor costs.

The company's outlook for the first quarter of fiscal 2024 anticipates net sales to be in the range of $167 to $172 million, with an expected loss per share between $1.09 and $1.19. Zumiez plans to open approximately 10 new stores during the fiscal year, with a focus on increasing productivity in existing locations.

Financial Highlights and Challenges

The financial statements reveal key details about Zumiez's performance. The balance sheet shows a total asset value of $664.2 million, with current assets including cash and equivalents of $88.9 million. The income statement reflects the impact of the goodwill impairment on the company's profitability. The cash flow statement indicates a net cash provided by operating activities of $14.8 million for the fiscal year.

The challenges faced by Zumiez, such as the goodwill impairment and the decrease in comparable sales, underscore the importance of strategic adjustments in the retail sector. The company's focus on efficiency and productivity, especially in the European market, is a response to these challenges and is crucial for maintaining financial stability and shareholder value.

Zumiez's performance and strategic decisions are significant for investors and stakeholders, as they reflect the company's adaptability in a fluctuating retail landscape. The earnings report provides valuable insights into the company's financial health and future direction, which is essential for value investors and potential GuruFocus.com members seeking reliable and objective information.

For more detailed information and analysis, investors are encouraged to access the full earnings report and financial statements provided by Zumiez Inc.

Explore the complete 8-K earnings release (here) from Zumiez Inc for further details.

This article first appeared on GuruFocus.