Zumiez (NASDAQ:ZUMZ) Posts Better-Than-Expected Sales In Q4 But Stock Drops

Clothing and footwear retailer Zumiez (NASDAQ:ZUMZ) announced better-than-expected results in Q4 FY2023, with revenue flat year on year at $281.8 million. On the other hand, next quarter's revenue guidance of $169.5 million was less impressive, coming in 9% below analysts' estimates. It made a GAAP loss of $1.73 per share, down from its profit of $0.59 per share in the same quarter last year.

Is now the time to buy Zumiez? Find out by accessing our full research report, it's free.

Zumiez (ZUMZ) Q4 FY2023 Highlights:

Revenue: $281.8 million vs analyst estimates of $276.7 million (1.9% beat)

EPS: -$1.73 vs analyst estimates of $0.25 (-$1.98 miss)

Revenue Guidance for Q1 2024 is $169.5 million at the midpoint, below analyst estimates of $186.3 million

Gross Margin (GAAP): 34.3%, in line with the same quarter last year

Free Cash Flow of $33.54 million, up 19.2% from the same quarter last year

Store Locations: 753 at quarter end, decreasing by 3 over the last 12 months

Market Capitalization: $305.4 million

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “We concluded a difficult year with stronger than anticipated fourth quarter results as our consolidated monthly sales trend accelerated in January. Within our recent performance, there were multiple areas that showed a marked improvement, led by our North American men’s business which grew year-over-year in the fourth quarter. While we are encouraged by our stronger than anticipated fourth quarter and sustained quarterly improvements as we moved through the year, the global operating environment remains challenging and therefore we are further adjusting our strategies to balance the interests of our shareholders and customers. For 2024, this includes slowing store growth in Europe and focusing on increasing the productivity of our current footprint in the region. We are also continuing to close underperforming stores in the U.S., reducing labor costs to align with lower revenue levels, and looking to drive even greater efficiencies throughout the organization. At the same time, we’ll invest to ensure we are winning with the consumer by launching new, highly sought-after brands, maintaining our best-in-class service levels, and strengthening our customer connections. We have successfully navigated down cycles before and I am confident in our teams’ ability to return the Company to growth and enhanced profitability both in the near-term and the years ahead.”

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

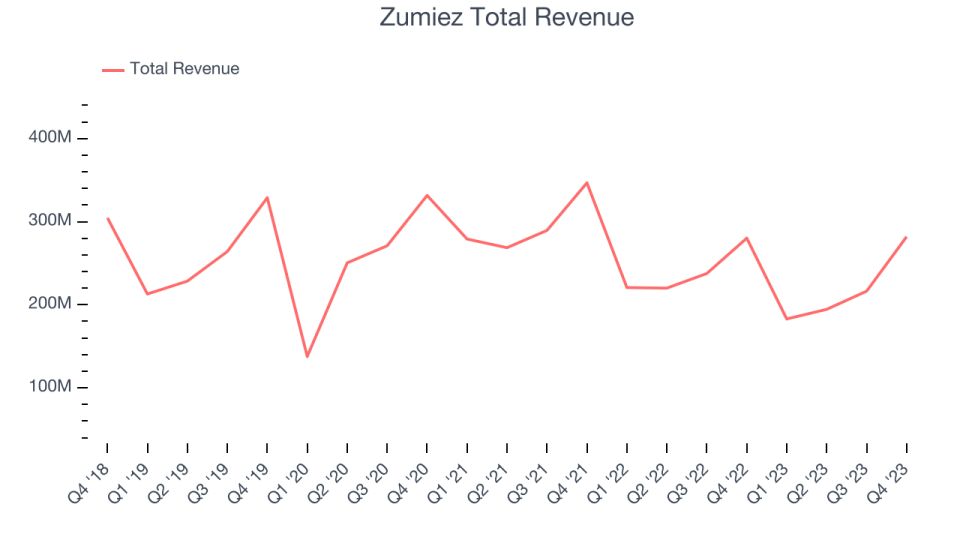

As you can see below, the company's revenue has declined over the last four years, dropping 4.1% annually despite opening new stores, indicating that its underperformance was driven by lower sales at existing, established stores.

This quarter, Zumiez reported decent year-on-year revenue growth of 0.6%, and its $281.8 million in revenue topped Wall Street's estimates by 1.9%. The company is guiding for a 7.3% year-on-year revenue decline next quarter to $169.5 million, an improvement from the 17.1% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

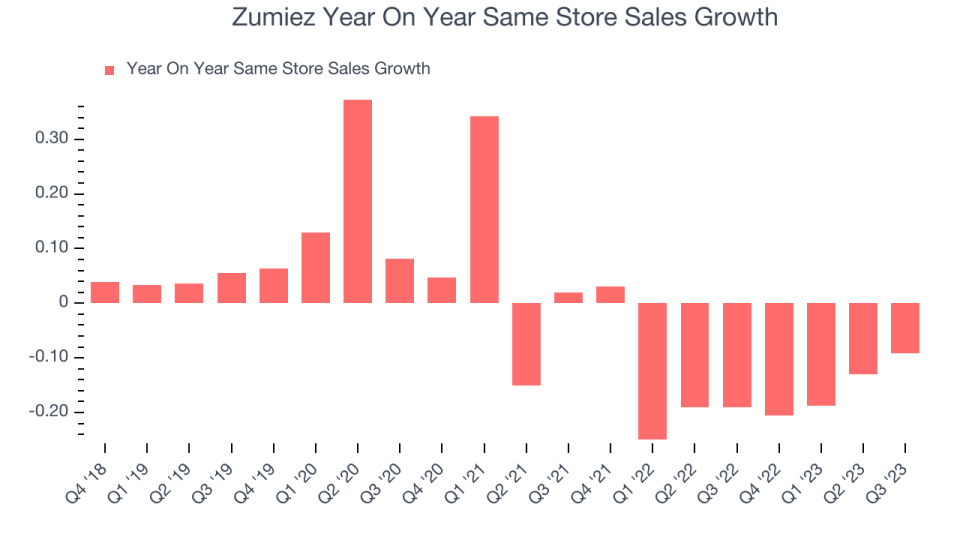

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Zumiez's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 17.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Key Takeaways from Zumiez's Q4 Results

We enjoyed seeing Zumiez exceed analysts' revenue and gross margin expectations this quarter, driven by better-than-expected performance in its North American men's business. On the other hand, its EPS and European division underperformed, and as a result, the company expects to slow its store growth in the region (it expects to open 3 new stores in Europe in 2024). Because of the weakness, Zumiez shared Q1 2024 revenue and EPS guidance that missed analysts' expectations. Overall, this was a mixed quarter for Zumiez. The company is down 5.1% on the results and currently trades at $14 per share.

Zumiez may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.