Zumiez's (NASDAQ:ZUMZ) Q3 Sales Top Estimates

Clothing and footwear retailer Zumiez (NASDAQ:ZUMZ) reported results ahead of analysts' expectations in Q3 FY2023, with revenue down 8.9% year on year to $216.3 million. Guidance for next quarter's revenue was also optimistic at $278 million at the midpoint, 5.5% above analysts' estimates. It made a GAAP loss of $0.12 per share, down from its profit of $0.36 per share in the same quarter last year.

Is now the time to buy Zumiez? Find out by accessing our full research report, it's free.

Zumiez (ZUMZ) Q3 FY2023 Highlights:

Revenue: $216.3 million vs analyst estimates of $213.6 million (1.3% beat)

EPS: -$0.12 vs analyst estimates of -$0.18 (34.5% beat)

Revenue Guidance for Q4 2023 is $278 million at the midpoint, above analyst estimates of $263.4 million

EPS (non-GAAP) Guidance for Q4 2023 is $0.29 at the midpoint, below analyst estimates of $0.41

Free Cash Flow was -$2.99 million compared to -$19.72 million in the same quarter last year

Gross Margin (GAAP): 33.8%, down from 34.5% in the same quarter last year

Store Locations: 771 at quarter end, increasing by 8 over the last 12 months

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “Third quarter results came in just ahead of our guidance for sales and earnings as we saw sequential improvement in the year-over-year sales comparisons from the first two quarters of 2023. Given the challenging macroeconomic backdrop, we are encouraged by the strength of newer brand introductions and fashion trends that we look to capitalize upon in the important holiday season. While 2023 has certainly been difficult, the adjustments we’ve made to our merchandise assortment and our steadfast commitment to providing consumers with superior service and a highly differentiated shopping experience will continue to separate us from the competition and position Zumiez to recapture operating margin as our sales recover.”

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

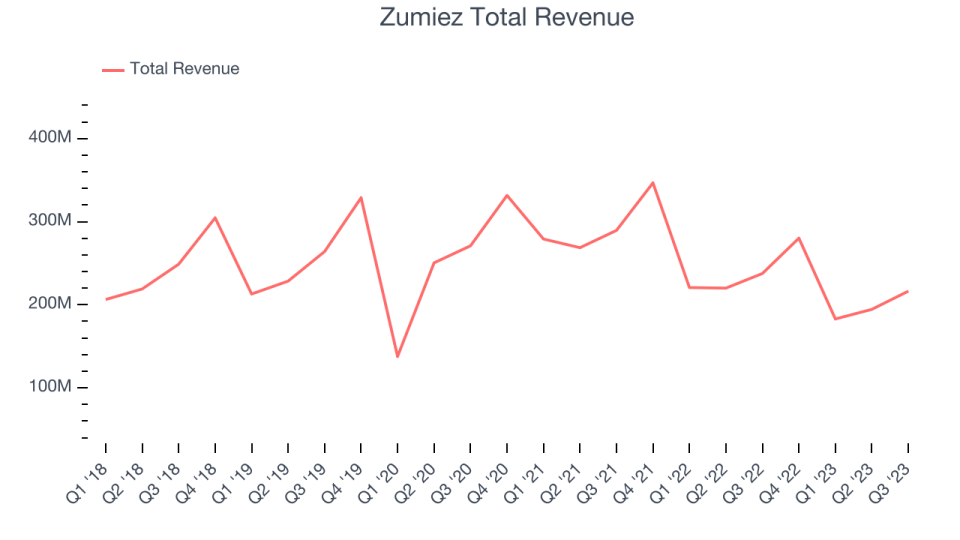

As you can see below, the company's revenue has declined over the last four years, dropping 3.6% annually despite opening new stores and expanding its reach.

This quarter, Zumiez's revenue fell 8.9% year on year to $216.3 million but beat Wall Street's estimates by 1.3%. The company is guiding for revenue to rise 0.8% year on year to $278 million next quarter, improving from the 19.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts expect revenue to decline 3.9% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

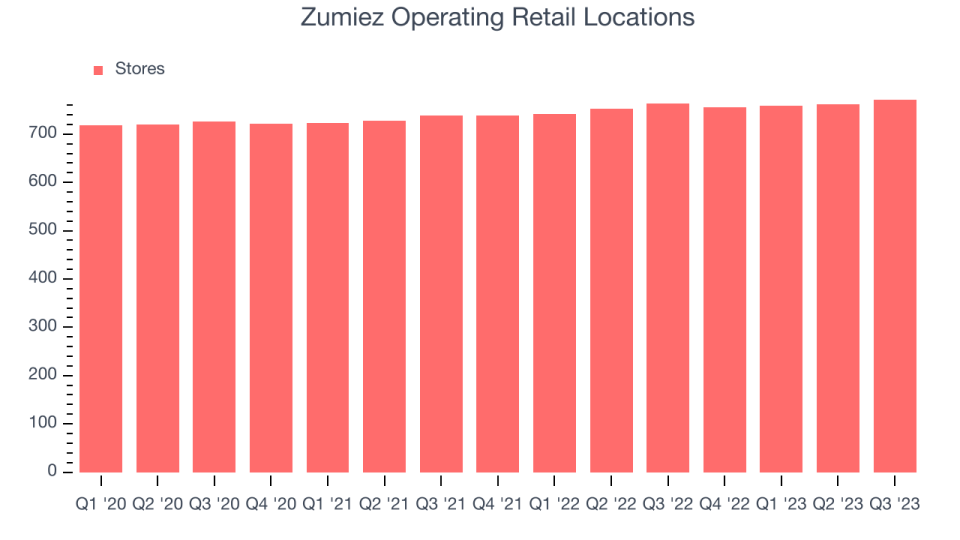

When a retailer like Zumiez keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. Since last year, Zumiez's store count increased by 8 locations, or 1%, to 771 total retail locations in the most recently reported quarter.

Over the last two years, the company has only opened a few new stores, averaging 2.3% annual growth in new locations. This sluggish pace lags the broader sector. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Key Takeaways from Zumiez's Q3 Results

With a market capitalization of $376.6 million, Zumiez is among smaller companies, but its more than $48.97 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

We were impressed by how significantly Zumiez blew past analysts' EPS expectations this quarter. We were also glad this quarter's revenue and next quarter's revenue guidance came in higher than Wall Street's estimates. The company also opened more new stores than expected, which is a tailwind to revenue growth. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 3% after reporting and currently trades at $19.5 per share.

Zumiez may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.