Zuora (NYSE:ZUO) Q3 Sales Beat Estimates, Raises Full Year Guidance for Certain Key Lines

Subscription management platform Zuora (NYSE:ZUO) reported Q3 FY2024 results topping analysts' expectations , with revenue up 8.7% year on year to $109.8 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $110.8 million was less impressive, coming in 0.2% below expectations. It made a GAAP loss of $0.04 per share, down from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy Zuora? Find out by accessing our full research report, it's free.

Zuora (ZUO) Q3 FY2024 Highlights:

Revenue: $109.8 million vs analyst estimates of $108.7 million (1.1% beat)

Calculated Billings of $104.2 million (miss vs. expectations of ~$115 million)

EPS (non-GAAP): $0.09 vs analyst estimates of $0.06 ($0.03 beat)

Revenue Guidance for Q4 2024 is $110.8 million at the midpoint, roughly in line with what analysts were expecting (although non-GAAP operating profit guidance was ahead)

Full year guidance raised for revenue, non-GAAP operating profit, non-GAAP EPS, and adjusted free cash flow

Free Cash Flow of $12.67 million, up from $4.02 million in the previous quarter (beat)

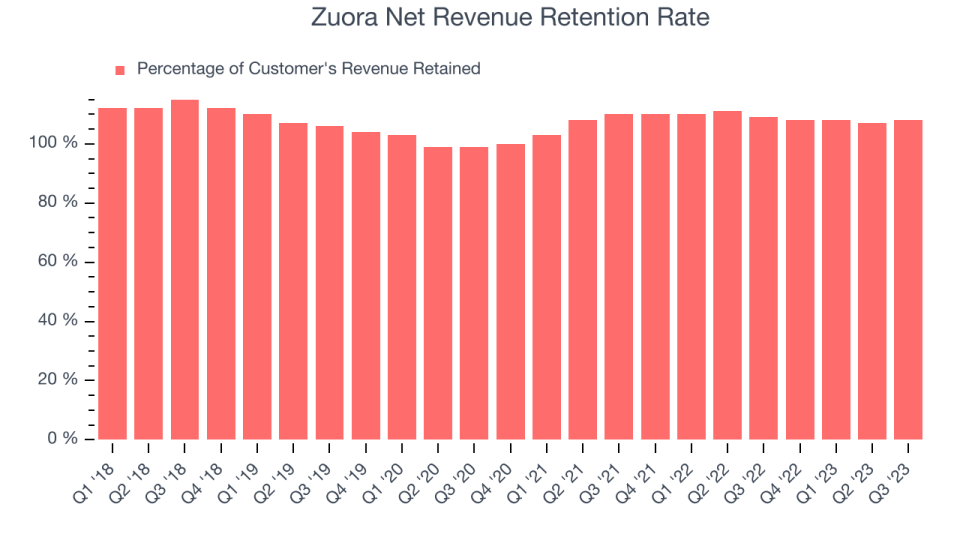

Net Revenue Retention Rate: 108%, in line with the previous quarter (beat vs. expectations of 17%)

Gross Margin (GAAP): 68.1%, up from 60.7% in the same quarter last year

“We continued to execute on our strategy in the third quarter, exceeding guidance on subscription revenue, total revenue and operating income,” said Tien Tzuo, Founder and CEO of Zuora.

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Sales Growth

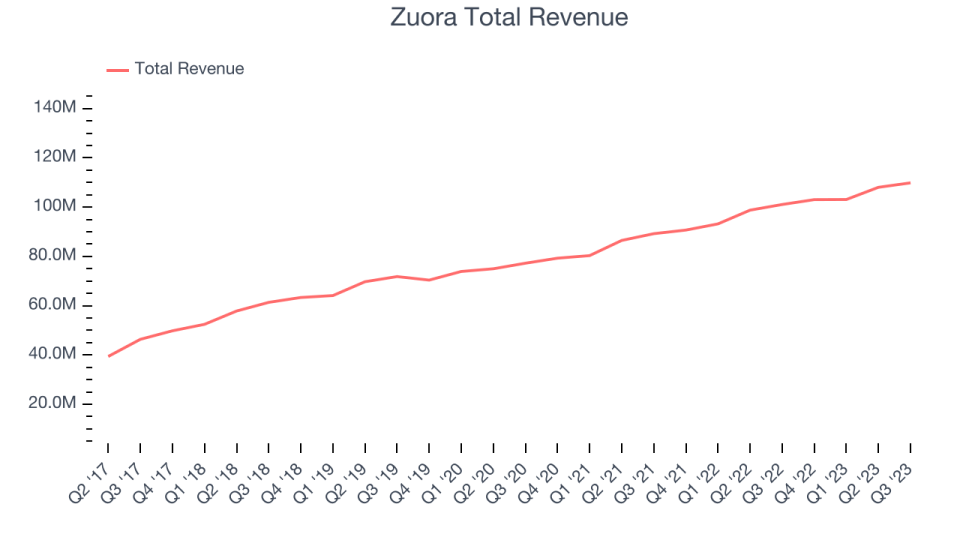

As you can see below, Zuora's revenue growth has been unremarkable over the last two years, growing from $89.23 million in Q3 FY2022 to $109.8 million this quarter.

Zuora's quarterly revenue was only up 8.7% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $1.80 million in Q3 compared to $4.95 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter, Zuora is guiding for a 7% year-on-year revenue decline to $110.8 million, a further deceleration from the 13.6% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 9.4% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Zuora's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 108% in Q3. This means that even if Zuora didn't win any new customers over the last 12 months, it would've grown its revenue by 8%.

Zuora has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from Zuora's Q3 Results

Sporting a market capitalization of $1.16 billion, Zuora is among smaller companies, but its more than $493.7 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We were glad that revenue outperformed despite a calculated billings miss. We were also impressed at how non-GAAP operating profit and free cash flow exceeded expectations. While revenue guidance for next quarter narrowly missed analysts' expectations, full year guidance was raised for key line items like revenue, non-GAAP operating profit, and free cash flow. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 4.9% after reporting and currently trades at $8.75 per share.

So should you invest in Zuora right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.