Zynex Inc (ZYXI) Reports 17% Revenue Growth in FY 2023, Announces New $20 Million Stock ...

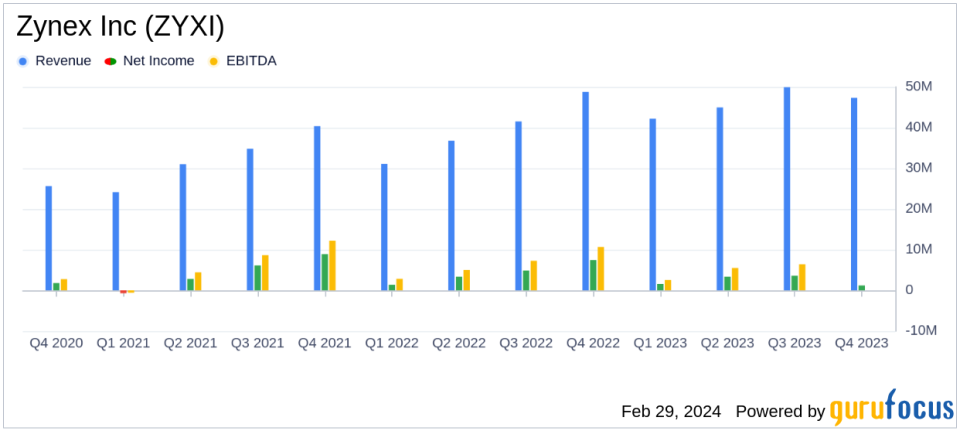

Revenue Growth: FY 2023 revenue increased by 17% to $184.3 million.

Stock Repurchase: Zynex Inc announces an additional $20 million stock repurchase plan.

Net Income: Net income for FY 2023 totaled $9.7 million, a decrease from $17.0 million in the previous year.

Adjusted EBITDA: Adjusted EBITDA for FY 2023 was $22.3 million, down from $28.1 million in FY 2022.

Future Outlook: Zynex Inc expects a 22% increase in net revenue for 2024.

On February 29, 2024, Zynex Inc (NASDAQ:ZYXI), a company specializing in non-invasive medical devices for pain management, rehabilitation, and patient monitoring, released its financial and operational results for the fourth quarter and full year ended December 31, 2023. The company's 8-K filing highlighted a revenue increase of 17% to $184.3 million for the fiscal year 2023, along with the announcement of an additional $20 million stock repurchase plan.

Zynex Inc's primary business segment, Electrotherapy and Pain Management Products, has seen a significant increase in device orders, contributing to the revenue growth. The company's commitment to innovation was evident with the submission of a 510(k) application for the M-Wave Neuromuscular Electrical Stimulation (NMES) device and the subsequent FDA clearance, positioning Zynex for further expansion in clinical and home settings.

However, the company faced challenges, including a non-recurring write-off of slow collecting receivables amounting to $6.2 million, which impacted net revenue. Gross profit for Q4 2023 was $37.0 million, or 78% of revenue, compared to 81% in the same quarter of the previous year. Sales and marketing expenses, as well as general and administrative expenses, saw an uptick in the fourth quarter and full year, contributing to a decrease in net income and Adjusted EBITDA.

Despite these challenges, Zynex Inc's financial achievements, such as the improved cash flow from operations, which increased to $17.8 million from $13.7 million in the previous year, demonstrate the company's ability to generate cash and maintain operational efficiency. This is particularly important in the Medical Distribution industry, where cash flow is critical for sustaining operations and investing in growth opportunities.

Financial Performance Analysis

Key financial metrics from Zynex Inc's earnings report include:

Financial Metric | FY 2023 | FY 2022 |

|---|---|---|

Net Revenue | $184.3 million | $158.2 million |

Net Income | $9.7 million | $17.0 million |

Adjusted EBITDA | $22.3 million | $28.1 million |

Cash and Cash Equivalents | $44.6 million | $20.1 million |

President and CEO Thomas Sandgaard commented on the company's performance, stating:

"2023 was a year of continued execution for Zynex, underscored by record revenues and order numbers, and exciting new products and technological innovation."

Looking ahead, Zynex Inc anticipates a 22% increase in net revenue for 2024, with a focus on promoting a broader range of products and maintaining a balance between revenue growth and profitability. The company's forward-looking guidance suggests confidence in its strategic direction and product offerings.

Overall, Zynex Inc's financial results reflect a company that is growing its top line while navigating operational challenges. The additional stock repurchase plan underscores the company's commitment to delivering value to shareholders. As Zynex Inc continues to innovate and expand its product portfolio, investors and stakeholders will be watching closely to see how these strategies translate into long-term financial performance.

For more detailed information and analysis on Zynex Inc's financial results, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Zynex Inc for further details.

This article first appeared on GuruFocus.