Zynga (ZNGA) Q4 Loss Wider Than Expected, Revenues Up Y/Y

Zynga ZNGA reported a loss of 6 cents per share in fourth-quarter 2021. The company had reported a loss of 5 cents per share in the year-ago quarter.

Quarterly revenues increased 12.9% year over year to $695.4 million on broad-based strength in live services.

The Zacks Consensus Estimate for earnings and revenues was pegged at 8 cents per share and $720 million, respectively.

Total bookings came in at $727 million, up 4% year on year on strong mobile bookings. The consensus mark for bookings was pegged at $720 million.

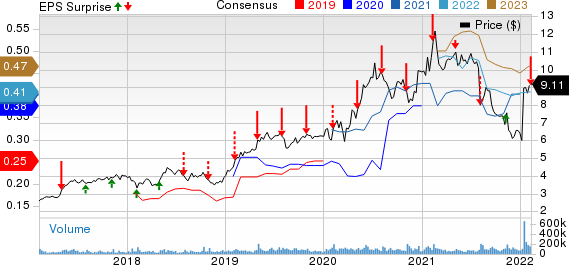

Zynga Inc. Price, Consensus and EPS Surprise

Zynga Inc. price-consensus-eps-surprise-chart | Zynga Inc. Quote

Quarter Details

Zynga’s online game or user-pay revenues (76.8% of total revenues) increased 7.1% year over year to $534 million.

Advertising and other revenues (23.2% of total revenues) increased 37.5% year over year to $161.4 million. Advertisement bookings (24.7% of total bookings) rose 46.3% year over year to $171.5 million.

Mobile revenues (96.9% of total revenues) and mobile bookings increased 13.5% and 2.3% year over year to $673.9 million and $695 million, respectively. The upside was driven by robust live services performance.

The company’s revenues have benefitted from live services. Growth in advertising, particularly from Rollic’s hyper-casual portfolio, and contributions from Chartboost as well as FarmVille 3 and Golf Rival have driven the top line. Rollic now includes16 game titles that have reached the #1 or #2 top free downloaded game positions in the U.S. App Store.

User Base Details

In the fourth quarter, user-pay bookings were $555 million, down 5% year over year. The downside was caused by tougher year-over-year comparisons.

Zynga’s average mobile daily active users (DAUs) moved up 3% year over year to 37 million. Average mobile monthly active users (MAUs) soared 38% year over year to 184 million in the reported quarter.

The solid uptick in user count was driven by contributions from Rollic’s hyper-casual game portfolio.

Average mobile daily bookings per average mobile DAU (ABPU) declined 1% year over year to $0.204.

Operating Details

Non-GAAP operating expenses (49.1% of total bookings) rose 7.8% year over year to $357.1 million in the reported quarter due to higher marketing investments.

Non-GAAP research & development (R&D) and sales & marketing (S&M) expenses shot up 27.4% and 2.6% year over year to $93.9 million and $234.7 million, respectively. General & administrative (G&A) expenses declined 1.3% year over year to $22.5 million.

Adjusted EBITDA came in at $146.6 million compared with the year-ago quarter’s figure of $89.9 million.

Balance Sheet

As of Dec 31, 2021, Zynga had cash, cash equivalents & short-term investments of $1.15 billion compared with $1.34 billion as of Sep 30, 2021.

Cash flow used by operating activities in fourth-quarter 2021 was $158.1 million compared with the previous quarter’s $98.6 million and the year-ago quarter’s level of $205.9 million. Free cash flow was $152.40 million in the fourth quarter compared with the previous quarter’s free cash flow of $96.1 million and the year-ago quarter’s $203.2 million.

Zacks Rank & Other Stocks to Consider

Currently, Zynga carries a Zacks Rank #2 (Buy).

ZNGA shares have declined 23.4% in the past year against the Zacks Gaming industry’s plunge of 22.3% and the Consumer Discretionary sector’s fall of 22.3%.

Some other top-ranked stocks from the Zacks Consumer Discretionary sector are Cedar Fair FUN and Crocs CROX, both sporting a Zacks Rank #1 (Strong Buy), and Gildan Activewear GIL, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cedar Fair is set to announce fourth-quarter 2021 results on Feb 16.

FUN is up 39.8% in the past year against the Zacks Leisure and Recreation Services industry’s decline of 0.7% and the Consumer Discretionary sector’s fall of 22%.

Crocs is set to announce fourth-quarter fiscal 2021 results on Feb 16.

CROX is up 36.4% in the past year against the Zacks Textile – Apparel industry’s decline of 6.2% and the Consumer Discretionary sector’s fall of 22% in the past year.

Gildan Activewear is set to announce fourth-quarter 2021 results on Feb 23.

GIL is up 49.9% in the past year against the Zacks Textile – Apparel industry’s decline of 6.2% and the Consumer Discretionary sector’s fall of 22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Zynga Inc. (ZNGA) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Cedar Fair, L.P. (FUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.