Subprime auto loans are too small to be a big problem, says Dimon

Subprime loan delinquencies in the auto loan industry have triggered flashbacks of the financial crisis and Great Recession, and murmurs of concern have been growing louder. But at a joint town hall event put on by JPMorgan Chase (JPM) and Yahoo Finance, JPMorgan Chase’s CEO Jamie Dimon gave a calming perspective when asked by an MBA student about potential bubbles forming in the markets. The exchange occurred about an hour and ten minutes into the video above.

“There’s a problem with subprime auto, which we see,” said Dimon, whose bank offers auto lending through its consumer banking division. “But subprime auto is so small relative to the US debt market it won’t make a difference to the system.”

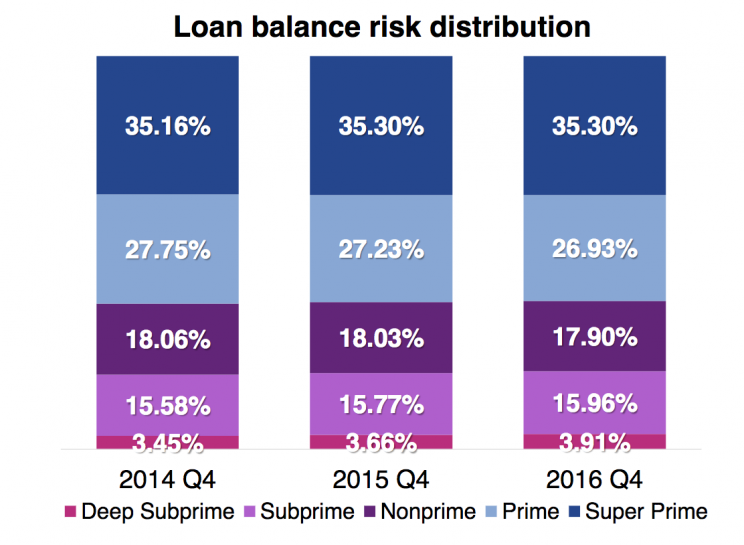

According to Q4 2016 data from Experian, the subprime and deep subprime loans make up just a hair under 20% of the automotive finance market, up slightly from the 19% at the end of 2014. Current data shows delinquencies at 2.85% on auto loans, up from 2.62% a year earlier for 30-day delinquencies. For 60-day delinquencies, the rates had risen from 0.50% to 0.69% from Q4 2015 to Q4 2016. However, the trends haven’t even always been downward throughout this period.

Whether these are meaningful increases or are relatively flat, Dimon and many other analysts are clear-headed: A problem may be coming, but not for the overall economy. Unlike mortgages, auto loans make up a small portion of the debt market.

A look at Federal Reserve data shows a remarkable difference between these two sectors. Mortgages make up around two-thirds of the market and auto loans are a slim 9%. In Dimon’s view, if the domino falls, it’s essentially going to fall against a wall. “It will cause issues somewhere but it won’t be a problem,” he said.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, tech, and personal finance. Follow him on Twitter @ewolffmann. Got a tip? Send it to tips@yahoo-inc.com.

Read more:

An interesting market sign says private jet sales may be about to take off

Democrats found a way to speak Trump’s language

What Trump’s intriguing Nafta changes say about his other promises

Facebook’s copy of Snap stories is a reminder of a Silicon Valley hard truth

The trick to getting credit card fees waived? Just ask

These two companies lobby to make your taxes way harder

Chase’s Sapphire Reserve is very worth it, even with its slashed bonus