It's been 17 years since consumers felt this good about the U.S. economy

U.S. consumer confidence is at a 17-year high.

On Tuesday, the latest data from The Conference Board showed consumer confidence in October hit a reading of 125.9, up from 120.6 the prior month and the best reading since December 2000. That month’s reading hit 128.6.

“Consumers’ assessment of current conditions improved, boosted by the job market which had not received such favorable ratings since the summer of 2001,” said Lynn Franco, director of economic indicators at The Conference Board.

“Consumers were also considerably more upbeat about the short-term outlook, with the prospect of improving business conditions as the primary driver. Confidence remains high among consumers, and their expectations suggest the economy will continue expanding at a solid pace for the remainder of the year.”

Tuesday’s reading follows the University of Michigan’s final assessment of sentiment in October released last Friday. That report showed sentiment hitting a 13-year high in October and a notable feeling of contentment among U.S. consumers.

“Lingering doubts about the near term strength of the national economy were dispelled as more than half of all respondents expected good times during the year ahead and anticipated the expansion to continue uninterrupted over the next five years,” said Richard Curtin, chief economist for the University of Michigan survey.

Curtin added that, “Consumers do not anticipate accelerating growth rates but rather a continuation of the slower pace of growth that has characterized this recovery.” The economic recovery, which to many has been disappointing since the financial crisis, has, it seems, become acceptable to many consumers.

Daniel Silver, an economist at J.P. Morgan, said in a note following these two reports that, “We do not think there is a tight link between consumer sentiment and the monthly changes in consumer spending, but the strong sentiment data is still a favorable sign regarding momentum in the economy.”

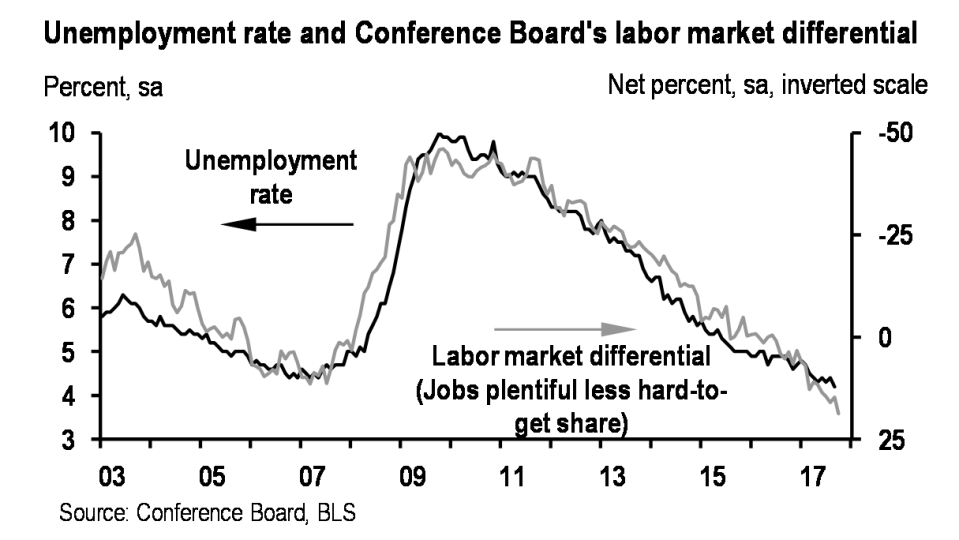

Silver also notes that labor market confidence was a particularly bright spot in The Conference Board’s report, with the survey’s labor market differential — which measures the difference between those saying jobs are plentiful and those who jobs are hard to find — hitting 18.8 in October, the highest level since July 2001.

The rise in confidence also comes amid stock prices hitting record highs, economic growth hitting its strongest two-quarter stretch since 2014, and the unemployment rate sitting at its lowest level since 2001.

Savings rate at 7-year low

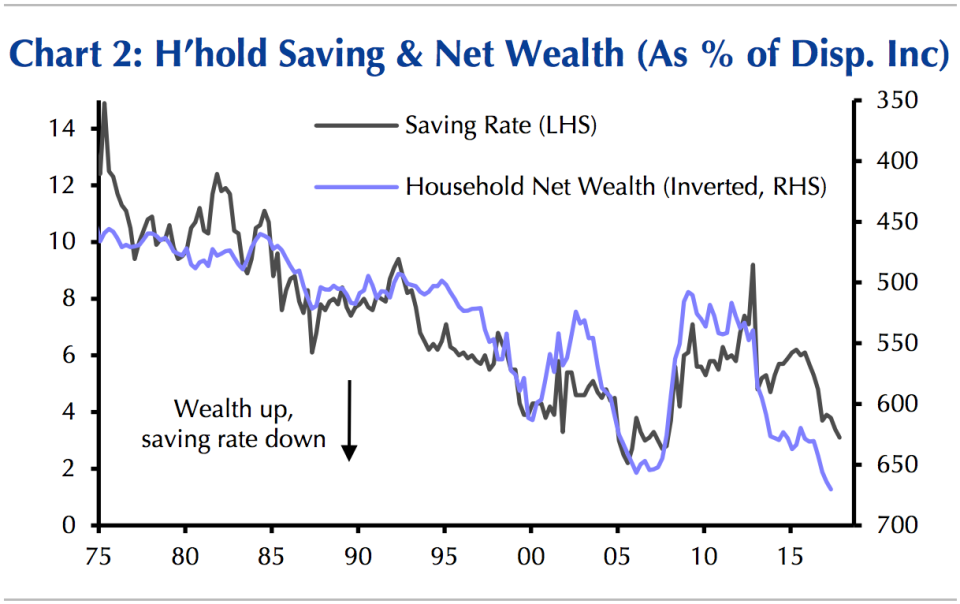

Away from direct surveys of consumer confidence, the latest update on the household savings rate — released on Monday — gives another look at the relative confidence of American consumers right now. In September, the savings rate hit 3.1% of disposable income, the lowest since 2007.

Paul Ashworth at Capital Economics said in a note published Tuesday that this drop is “largely explained by the accompanying surge in household net wealth to a record high.”

Rising asset prices means that capital gains income can allow households to save less from current income — think dividends from stocks or other investments — and Ashworth says prospects for lower taxes next year could be influencing consumer decisions to run down savings now.

Yet falling household savings amid an environment of rising asset prices and home values also potentially sets up the economy for a disappointment in the case of a financial markets reversal.

Ashworth notes that “lower saving rate can be sustained as long as the value of households’ financial and housing assets don’t take a dive.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: