The 3 Most Undervalued Travel Stocks to Buy in March 2024

For the last 18 months, finding undervalued travel stocks has been difficult. Despite concerns about a recession, consumers have been remarkably resilient and continue to prioritize spending on travel over accumulating things.

The February 2024 Jobs report did nothing to dampen the travel surge narrative. The report showed that the travel and leisure sector created 57,000 jobs. That was second only to the healthcare sector. At a time when companies large and small are making layoff announcements, this is significant.

On the other hand, the recent read on inflation shows that the economy may not be as strong as it seems. Analysts broadly expect the Federal Reserve to cut interest rates in June. But what if they don’t? And if they do, would it be because the economy worsens over the next few months?

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Those are questions for another day. However, if the data is correct, many companies are expecting more of the boom and none of the bust. That means there’s still an opportunity to get into travel stocks. Here are three undervalued travel stocks to consider. One is an industry leader, and the other two are contrarian picks based on recent headlines.

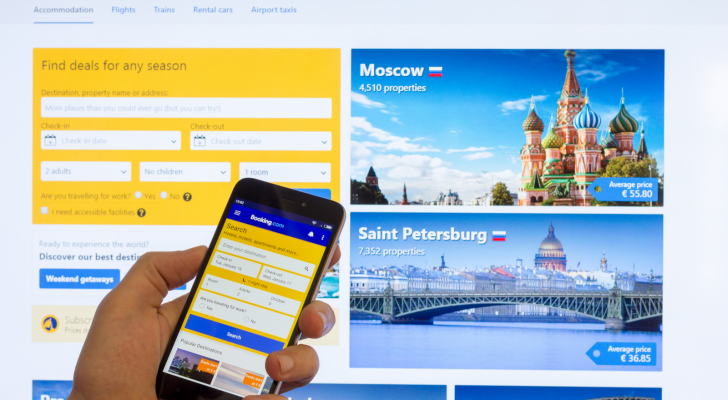

Booking Holdings (BKNG)

Source: Andrey Solovev / Shutterstock

At first glance, Booking Holdings (NASDAQ:BKNG) hardly appears to belong on a list of undervalued travel stocks. But even at $3,500 per share, Booking shows that there’s a difference between price and value. Analysts have a consensus price target of $3,943.40 for BKNG stock. And out of 36 analysts that have issued ratings, 21 give the stock a Strong Buy.

The question is, why? For starters, BKNG stock trades at just 20.2x forward earnings, which is right around the sector average. And in the company’s last earnings report, the company posted a 16% year-over-year increase in quarterly gross travel bookings. That will help ensure the company continues to generate strong free cash flow. The stock also has an average five-year return on invested capital (ROIC) of approximately 18%.

The company continues innovating in a commodity that could easily become commoditized. Booking launched an AI trip planner in 2023, and the feature was launched for its Priceline brand in February 2024.

Avis Budget Group (CAR)

Source: Brookgardener / Shutterstock.com

March 12, Southwest Airlines (NYSE:LUV) stock dropped 14% over news of Boeing’s (NYSE:BA) anticipated delivery delays. The company also said it would revisit its 2024 forecast—and not in a way analysts and investors would like.

This may only become a flesh wound for the airline industry, but as anyone who’s had a paper cut knows, they can linger awhile. Consumers may find themselves priced out of flights. They may also be anxious about flying in a Boeing aircraft.

That’s why you might consider parking some capital in Avis Budget Group (NYSE:CAR). This is definitely a contrarian play. CAR stock has been down 40% in the last 12 months, and it has been the most since the company reported earnings in mid-February. Avis has been beset by higher prices for its fleet of cars due to higher-for-longer interest rates.

However, it’s not unreasonable to believe travel plans may shift from flying to driving. With a short interest of over 9%, it wouldn’t take much forward movement for CAR stock to make an outsized move.

Marriott (MAR)

Source: DELBO ANDREA / Shutterstock

Marriott (NYSE:MAR) only fits into the undervalued travel stocks category if earnings come in on the high side of its guidance. MAR stock has a 26x forward P/E, which is a premium to the sector average of the hotel, resorts and cruise line sector. So, how could they beat those expectations? Once again, a recent news item may provide the answer.

Airbnb (NASDAQ:ABNB) is banning property owners from installing on-premise security cameras. At face value, this makes sense as the company tries to address its customers’ legitimate privacy concerns. Airbnb says this will only affect a small subset of its properties. Still, if only a few dozen owners pull their homes from the market, it could cause travelers to go the old-fashioned route for lodging, particularly during the peak summer travel season.

This is another contrarian play, but Marriott has aggressively added rooms to meet midscale travelers’ needs. The company also has a global portfolio of all-inclusive resorts and branded residences.

On the date of publication, Chris Markoch did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Chris Markoch is a freelance financial copywriter who has been covering the market for over five years. He has been writing for InvestorPlace since 2019.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

“America’s Top Trader” Issues A.I. Code Red: Act Now or Miss Out

It doesn’t matter if you have $500 or $5 million. Do this now.

The post The 3 Most Undervalued Travel Stocks to Buy in March 2024 appeared first on InvestorPlace.