Aethlon Medical, Inc. (NASDAQ:AEMD) Q4 2023 Earnings Call Transcript

Aethlon Medical, Inc. (NASDAQ:AEMD) Q4 2023 Earnings Call Transcript June 28, 2023

Aethlon Medical, Inc. beats earnings expectations. Reported EPS is $-0.1, expectations were $-0.13.

Operator: Good day, and welcome to the Aethlon Medical Fiscal Year End 2023 Earnings and Corporate Update Conference Call. [Operator Instructions] Please note, this event is being recorded. I would now like to turn the conference over to Jim Frakes, Chief Financial Officer. Please go ahead.

Jim Frakes: Thank you, operator, and good afternoon, everyone. Welcome to Aethlon Medical's fiscal year end earnings conference call. My name is Jim Frakes, and I am Aethlon's Chief Financial Officer. At 04:15 PM Eastern Time today, Aethlon Medical released financial results for its fiscal year ended March 31, 2023. If you have not seen or received Aethlon Medical's earnings release, please visit the Investors page at www.aethlonmedical.com. Following this introduction and the reading of our forward-looking statement, Aethlon's Chief Medical Officer, Dr. Steven LaRosa will provide an overview of Aethlon's strategy and recent developments. I will then make some brief remarks on Aethlon's financials. We will then open up the call for the Q&A session.

Now before I hand the call over to Dr. LaRosa, please note that the news release today and this call contain forward-looking statements within the meaning of the Securities Act of 1933 as amended, and the Securities Exchange Act of 1934 as amended. The Company cautions you that any statement that is not a statement of historical fact is a forward-looking statement. These statements are based on expectations and assumptions as of the date of this conference call. Such forward-looking statements are subject to significant risks and uncertainties, and actual results may differ materially from the results anticipated in the forward-looking statements. Factors that could cause results to differ materially from those anticipated in forward-looking statements can be found under the caption Risk Factors in the company's annual report on Form 10-K for the fiscal year ended March 31, 2023, our most recent report on Form 10-Q and in the company's other filings with the Securities and Exchange Commission.

Except as may be required by law, the company does not intend nor does it undertake any duty to update this information to reflect future events or circumstances. With that, I will now turn the call over to Dr. Steven LaRosa, Aethlon's Chief Medical Officer.

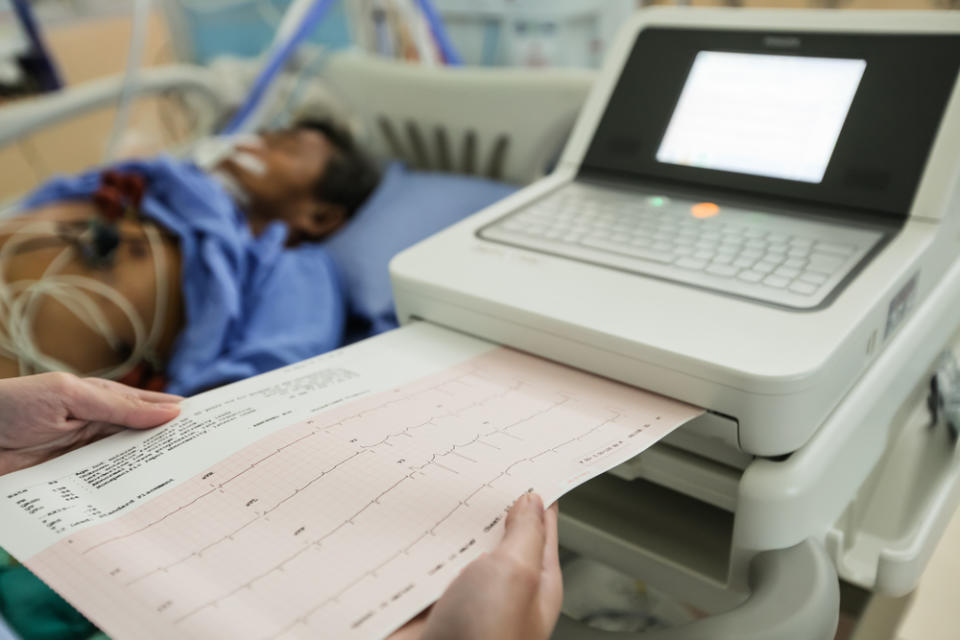

Chaikom/Shutterstock.com

Steven LaRosa: Thank you, Jim, and thank all of you for dialing in. This is Steven LaRosa, the Chief Medical Officer at Aethlon Medical. Aethlon Medical is continuing the research in clinical development of its Hemopurifier, a therapeutic blood filtration system that can bind and remove harmful exosomes and life threatening viruses from the blood. This action has potential applications in cancer where cancer associated exosomes may promote immune suppression and metastasis and in life threatening infectious diseases. The company's ongoing COVID-19 trial in India for patients in the intensive care unit at Medanta Medicity Hospital remains open for enrollment with one patient treated to-date. In May 2023, a second clinical site, Maulana Azad Medical College, MAMC, received Ethics Board Approval to participate in the trial and site activation activities are currently underway.

Cases of COVID-19 infection that require hospitalization continue to occur in India. The addition of MAMC as a second, high quality clinical site may improve the enrollment of patients who go on to require ICU care for severe COVID infection. In the oncology indication, Aethlon Medical continues to work with its contract research organization, NAMSA to initiate a clinical trial in Australia. This new clinical trial in oncology is planned to be a safety, feasibility and dose finding trial in solid tumors failing anti-PD-1 antibodies. Management of Aethlon Medical believes that the data from this trial will help inform the design of future efficacy trials of the company's Hemopurifier in oncology. Current activities underway for this trail would include site identification and qualification, finalization of the necessary documents for Ethics Board submission at the clinical sites, case report form development and selection of a Data Safety Monitoring Board.

On June 21, 2023, Aethlon announced that it is investigating the use of its Hemopurifier in the organ transplant market. Specifically, the company is conducting translational studies with the objective of determining if the Hemopurifier, when incorporated into a machine perfusion organ preservation circuit, can remove harmful viruses and exosomes from harvested organs. The company has previously demonstrated the removal of multiple viruses and exosomes from buffer solutions, in vitro, utilizing a scaled-down version of the Hemopurifier. This process may potentially reduce complications following transplantation of the harvested organ, including viral infection, delayed graft function and rejection. The company believes that this new approach could be additive to existing therapies that are currently in place to increase the number of viable organs for transplant.

According to Precedence Research, the size of the global organ transplantation market is projected to hit approximately $33.7 billion by 2032, compared to $15.1 billion in 2022. Further, Precedence Research estimates that the global organ transplantation market is poised to expand at a compounded average growth rate of 8.36% during the forecast period of 2023 through 2032. Additionally, according to Precedence Research, rising demand for organ transplantation to treat organ failure and novel tissue transplantation products is the prime factor that is driving market growth. In the United States, all organ transplant programs must be located in hospitals that have a Medicare provider agreement. The ultimate goal of Aethlon Medical's research in the organ transplantation area is to position the Hemopurifier as a beneficial and potentially transformative accessory element to existing or future organ perfusion systems that keep harvested organs in transplantable condition.

Now with that, I will turn the call back over to Jim for the financial discussion and then open up for questions.

Jim Frakes: Thanks, Steve, and good afternoon again everyone. As of March 31, 2023, Aethlon Medical had a cash balance of approximately $14.5 million. Our consolidated operating expenses for the fiscal year ended March 31, 2023 were approximately $12.47 million, compared to $10.71 million for the fiscal year ended March 31, 2022. This was an increase of approximately $1.76 million. And that $1.76 million increase was due to increases in administrative expense of $1.03 million and in professional fees of approximately $910,000, which were partially offset by a decrease in payroll and related expenses of approximately $180,000. Our G&A or general and administrative expense for the fiscal year ended March 31, 2023 was $4.48 million, compared to $3.45 million for the fiscal year ended March 31, 2022.

The $1.03 million increase was due to an increase in manufacturing and research and development supplies of approximately $400,000 related to the manufacture of the Hemopurifier devices and various research and development activities. Other increases included approximately $147,000 in subcontract expense related to revenue recognized from contracts and grants with the NIH; approximately $155,000 associated with the close out of the U.S. COVID-19 clinical trial; approximately $104,000 associated with the launch of our Australian subsidiary and the oncology clinical trial in Australia as Steve mentioned; and approximately $118,000 in rent expense related to the addition of the our new manufacturing suite in this past fiscal year and a full year of rent for our office and laboratory space.

Approximately $117,000 in depreciation and amortization expense associated with leasehold improvements to the manufacturing space and; approximately $94,000 in D&O and medical insurance. We also had an increase in utility expense of approximately $32,000, largely as the result of the increased space under lease. These increases were offset by decreases in outside services of approximately $65,000, laboratory fees of approximately $61,000 and decreases in office supplies and equipment of approximately $32,000. Our professional fees for the fiscal year ended March 31, 2023 were $3.54 million compared to $2.63 million in the prior fiscal year. This approximate $910,000 increase was primarily due to increases of approximately $291,000 in legal expenses, approximately $335,000 in contract labor associated with product development and scientific analytical services, approximately $176,000 in regulatory consulting, approximately $40,000 in investor relations, approximately $73,000 in recruiting expense and approximately $16,000 in director fees, which were partially offset by a decrease in accounting fees of approximately $17,000.

Aethlon Medical's National Cancer Institute or NCI award contract ended on September 15, 2022 and we subsequently presented the required final report to the NCI. As the NCI completed its close out review of the contract, we recorded total government contract revenue of approximately $574,000 in the fiscal year ended March 31, 2023 compared to approximately $294,000 in the fiscal year ended March 31, 2022. As a result of the above mentioned factors, the company's net loss before noncontrolling interests increased to $12 million for the fiscal year ended March 31, 2023, from $10.4 million for the fiscal year ended March 31, 2022. During the fiscal year ended March 31, 2023, we raised approximately $8.9 million in net proceeds under our At The Market Offering Agreement pursuant to sales of its common stock.

And subsequent to March 31, we raised net proceeds of approximately $1.1 million under the At The Market Offering agreement. We included these earnings results and related commentary in a press release issued earlier this afternoon. That release included the balance sheet from March 31, 2023 and the statements of operations for the fiscal years ended March 31, 2023 and 2022. We will file our annual report on Form 10-K following this call. Our next earnings call for the fiscal first quarter ending June 30, 2023 will coincide with the filing of our quarterly report on Form 10-Q in August of 2023. And now, Steve and I would be happy to take any questions that you may have. Operator, please open the call for questions.

See also 35 Safest Countries In the World and 25 Poorest Cities In The US That Are Getting Poorer.

To continue reading the Q&A session, please click here.