Amazon's NFL streaming is all about collecting ad data

Amazon paid a reported $50 million for the right to stream 11 NFL games this season, and the fun begins on Sept. 28 with the Green Bay Packers and Chicago Bears.

The streams are only accessible to Amazon Prime members, an estimated 80 million people, so many expect the cord-cutting option to help boost Prime memberships.

But the real opportunity for Amazon is to offer advertisers granular data that the company says has never before been available to brands that advertise during NFL games.

What to expect from Amazon’s ad packages

As part of its agreement, Amazon reportedly gets to sell two minutes of ads on its stream per hour. (Other reports say it’s ten 30-second ads, which would equal five minutes total, which would be fewer than two minutes of ads per hour, since the average game lasts for 3 hours 7 minutes; Amazon will not answer which is correct.) The rest of the ads that you’ll see will be the same as the national spots that appear on cable networks.

For the Amazon-only ads, Amazon has sold packages that reportedly cost $2.8 million. It’s unclear exactly how many minutes are included in each package, and Amazon will not share how many separate packages it has sold, but Amazon does say the packages include banner ads elsewhere on Amazon.com, that don’t run during the games.

The ability to sell this volume of ads against the games likely accounts for the rise in price tag compared to the $10 million Twitter paid to stream 10 TNF games last season.

And Amazon will track sales data after each ad, so that it can tell a brand exactly how many people purchased or looked up its products after seeing its ad. Saurabh Sharma, director of ad platforms at Amazon, uses Gillette as an example. Amazon will be able to tell Gillette how many people bought its razors and blades on Amazon during or immediately after a game stream. “That’s very exciting, and has never been done,” says Sharma. “We’re taking what we already do with digital ads and applying it to the NFL.”

So, what can we expect from the Amazon-only ads during the streaming TNF games? You might assume, since some Prime members will watch the game on a computer, phone, or tablet, that some of the ads might be interactive or innovative in some other way.

But the likelihood is the ads won’t look any different than the standard 30-second or 60-second spots you see on television.

“Unfortunately I don’t think we’re going to see much different… which is a big mistake,” says Brian Cristiano, CEO of ad agency Bold Worldwide. “Maybe someone surprises us, and I’m hopeful that they do, but I think that’s what’s going to happen. What should be happening is, What story can we tell that starts before, during, and after the game, that a brand can own?”

Indeed, at a promotional event at its AWS Loft in Manhattan last week, Amazon showed some of the ads that will appear during the first game. Some of the ads are for Amazon itself, and the rest are mostly from brands that are already official NFL sponsors, like Pepsi, Hyundai, and Gillette (owned by P&G). But there was also an ad from Showtime, not an NFL sponsor, for its series “Ray Donovan.”

Even if the ads don’t look unique, what matters is the data Amazon will get from them and give to the advertisers. As Cristiano acknowledges (sounding a lot like Amazon exec Sharma), the ability to figure out how many people purchased directly from Amazon after seeing an ad during the Amazon stream “has never been done before.”

Which games Amazon is streaming, and how to watch

Amazon is showing 10 Thursday Night Football games and a Christmas Day (this year, a Monday) game. On television, some of those games are on CBS, some on NBC, and some on the NFL Network.

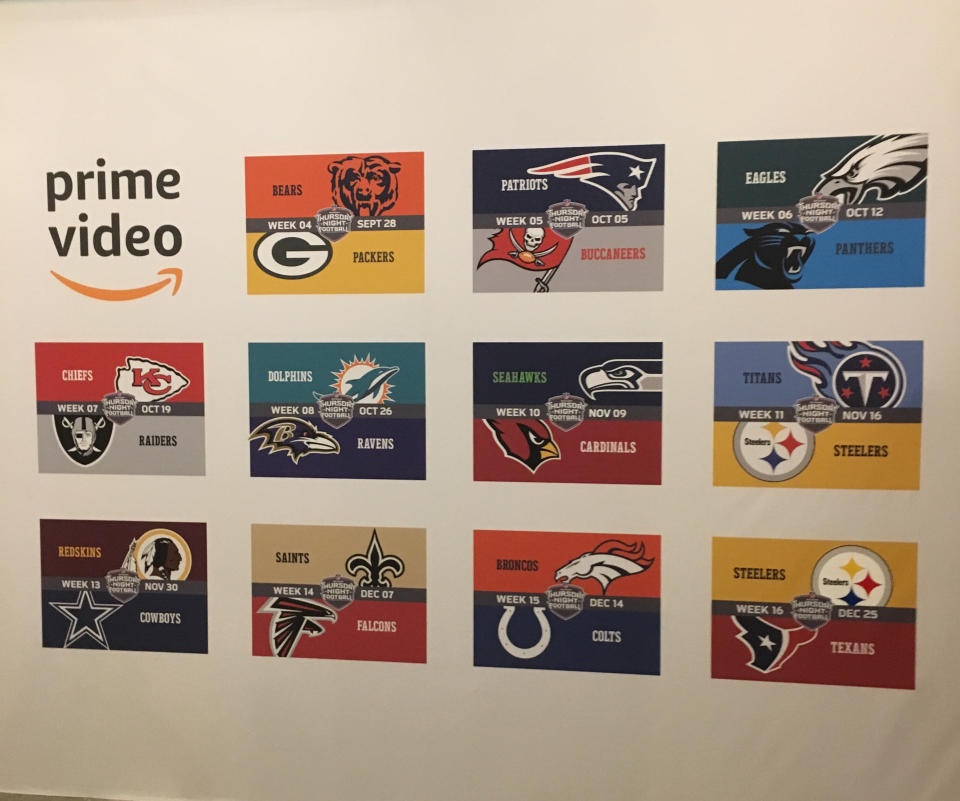

The 11 games are as follows: Bears at Packers (Sept. 28); Patriots at Buccaneers (Oct. 5); Eagles at Panthers (Oct. 12); Chiefs at Raiders (Oct. 19); Dolphins at Ravens (Oct. 26); Seahawks at Cardinals (Nov. 9); Titans at Steelers (Nov. 16); Redskins at Cowboys (Nov. 30); Saints at Falcons (Dec. 7); Broncos at Colts (Dec. 14); Steelers at Texans (Dec. 25). (A wall at Amazon’s AWS Loft in SoHo, Manhattan, shows all 11 games.)

Amazon will provide four different streams of each game, in over 200 countries: the English-language stream from CBS, with the same play-by-play you’d hear on CBS; a Spanish-language stream, with different announcers calling the game in Spanish; a Portuguese-language stream, with different announcers calling the game in Portuguese; and an “educational” stream geared toward NFL newbies, available in four different languages: Spanish, Portuguese, English, or “UK English.” The latter will have color commentary from well-known soccer broadcasters.

Amazon will offer a Thursday Night Kickoff pregame show, hosted by former NFL running back Tiki Barber and Australian chef Curtis Stone, before the NFL’s own pregame coverage begins. Of course, the Amazon pregame show will be “shoppable” on Amazon, showcasing “NFL party gear and merchandise.”

And Amazon is offering an NFL trivia game via Alexa, hosted by Marshawn Lynch, accessible on Amazon Echo or any Alexa-enabled device.

You can watch the NFL on Amazon.com; the Prime Video app for internet-connected TVs; Fire TV stick; a Fire tablet; or an Echo Show device.

Just remember to watch those ads closely — they’re aimed at inciting you to buy.

For more on the business of the NFL and the outside factors that will impact its success this season, listen to our new Yahoo Finance Sportsbook podcast.

—

Daniel Roberts is the sports business writer at Yahoo Finance. Follow him on Twitter at @readDanwrite. Sportsbook is our sports business video and podcast series.

Read more:

NFL game ratings Sunday of Week 3 fell—but pregame shows were up

NFL ratings down 13% in Week 1 of the new season

Donald Trump’s feud with the NFL dates back to 1986

‘Football is football’: Why NFL corporate sponsors don’t mind scandals

Amazon could face antitrust scrutiny as it gobbles up more companies

Inside the ugly breakup of Sports Illustrated, The Cauldron, and Chat Sports