Analysts unveil new Nvidia price targets ahead of 'AI Woodstock' conference

Nvidia (NVDA) shares jumped higher in early Monday trading as the AI-chip maker, the market's hottest tech company, kicks off its annual global developers' conference amid a surge in new technology spending and unprecedented hype from Wall Street investors.

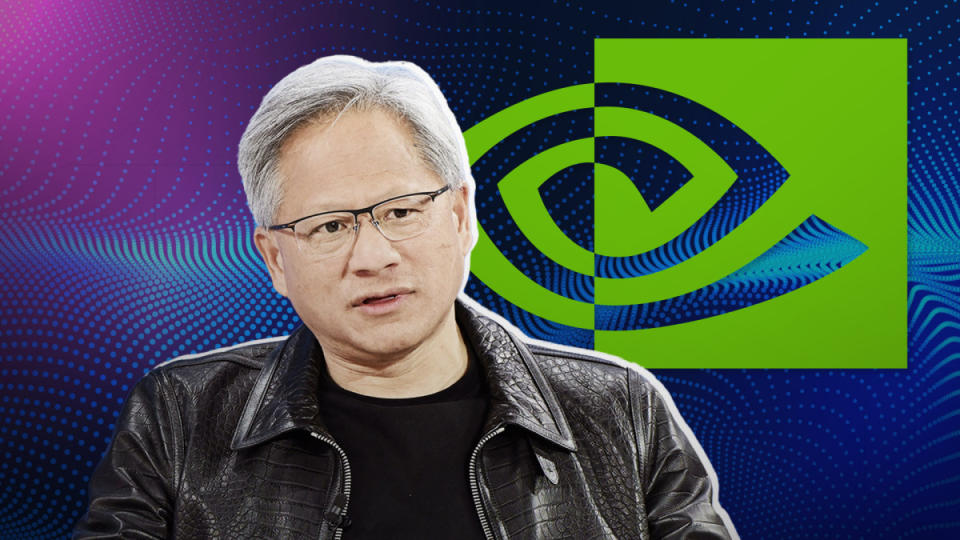

Dubbed "AI Woodstock" by Bank of America analyst Vivek Arya, Nvidia's flagship GTC event is expected to attract more than 300,000 participants, in person and online, and include a host of new product launches and AI market forecasts through a keynote address from founder and CEO Jensen Huang.

"With the AI Revolution now here, it all starts with the Godfather of AI Jensen and Nvidia as this highly anticipated conference will be a launching pad for a number of products, use cases, partnerships to launch the next phase of the AI Revolution," said Wedbush analyst Dan Ives.

Nvidia shares have added more than $1 trillion of market value over the past year, carrying the stock to record levels and putting it within touching distance of Apple (AAPL) as the world's second biggest tech stock behind Microsoft (MSFT) .

TheStreet/Shutterstock/Slaven Vlasic/Stringer/Getty Images

The vast majority of the move has been powered by Nvidia's position in the global AI-chip market, where its A100 processors form the benchmark for large language model projects.

Sales from Nvidia's data-center division, which houses its AI chips, rose 410% from a year earlier to $18.4 billion, reflecting the surge in demand from cloud-service providers like Microsoft and the broader AI ambitions tied to Magnificent 7 rival Meta Platforms (META) .

Our CEO Jensen Huang's groundbreaking keynote is happening on Monday, March 18 at 1p.m. PDT. https://t.co/20m0rYvesh

Register to attend #GTC24 in person to secure a spot for an immersive experience at the SAP Center, or tune in to the livestream virtually.

Don’t miss your…— NVIDIA (@nvidia) March 15, 2024

$1 trillion AI spending wave

"Our quick math suggests that the overall cost of a two-chip solution supporting 192GB could be over $6k (vs $3.3k for H100)," said Raymond James analyst Srini Pajjuri. "To maintain a similar gross margin, the ASP for the two-chip solution will need to be at a 50-60% premium."

Wedbush's Ives sees the new chips, as well as Nvidia's existing lineup, fetching the lion's share of a $1 trillion AI spending wave expected over the next decade.

"The ripple impact that starts with the golden Nvidia chips is now a tidal wave of spending hitting the rest of the tech world for the coming years," Ives said. "We estimate a $1 trillion+ of AI spending will take place over the next decade as the enterprise and consumer use cases proliferate globally in this 4th Industrial Revolution."

Related: Nvidia stock flashes warning ahead of key AI conference

HSBC analyst Frank Lee, who lifted his price target on Nvidia by $170, to $1,050 per share, also sees the group capturing a larger share of the AI value chain through its new GB200 AI effort.

The new platform combines Nvidia's Grace Hopper graphics processing unit with a new B200 AI chip, helping it boost average selling prices while adding heft to its current revenue outlook.

Truist Securities analyst William Stein also boosted his Nvidia price target ahead of the GTC event, which will run until Thursday, taking it to $1,177 from $911.

Nvidia: Big market, limited capacity

Commentary from Huang on both the Blackwell chip launch and Chip-on-wafer-on-substrate, or CoWoS, will also be crucial for investors in determining Nvidia's ability to grow data-center revenue at the currently projected pace.

CoWoS, is a crucial component of AI-chip making and has been weighing on Nvidia deliveries for much of the past year.

Taiwan Semiconductor (TSM) , the world's biggest chip contractor, has struggled to meet the surge for its high-end so-called stacking and packing technology, warning investors "that condition will continue probably to next year."

More AI Stocks:

"The key question for investors is how quickly the new products will ramp given the shorter product cadence," said Pajjuri of Raymond James.

"Management already indicated that they expect next-generation products to be supply-constrained," he added. "Outside of chip supply, the other potential impediment for a quick ramp is the availability of power supply/physical infrastructure."

Nvidia shares were marked 2.8% higher in premarket trading to indicate an opening bell price of $903.20 each, a move that would extend the stock's year-to-date gain to around 82.3%.

Related: Veteran fund manager picks favorite stocks for 2024