Ark Invest CEO: Tesla 'is a replay of Apple'

Tesla (TSLA) and Apple (AAPL) have at least one thing in common – and it’s a big factor leading one analyst to project a price target of $4,000 for the electric vehicle manufacturer.

It comes down to the chips, ARK Invest CEO and CIO Cathie Wood said in an interview with Yahoo Finance on Friday. Tesla CEO Elon Musk confirmed in August that the company would be making its own computer chips for automated driving, pivoting away from hardware produced by chipmaker Nvidia (NVDA).

“Our conviction has increased as we understand more about its new artificial intelligent chip design,” Wood, who is one of the foremost Tesla bulls, said on Yahoo Finance’s Final Round. Two of ARK Invest fund’s have Tesla’s stock as its top holding.

“This is a replay of Apple,” she added. “Apple was moving so fast with the smartphone that it had to design its own chip to move that fast. This is what has happened to Tesla.”

‘Faster, better, cheaper, sooner’

Apple designs its own chips for use in products such as the iPhone and the Apple Watch and reportedly plans to oust Intel as its chip processor for Macs as soon as 2020.

Wood noted that Nvidia chips will be in “mostly every other” autonomous vehicle to hit the market. But Musk “has a vision for this market that needs faster, better, cheaper, sooner – and so he designed it himself,” she said.

Tesla’s aggressive move toward hardware improvement and independence is one of the key factors informing Wood’s bullish outlook on Tesla. Wood said she believes Tesla is three years ahead of any other automobile manufacturer in terms of creating an artificial intelligence chip and could be as many as five years ahead of competitors in terms of creating a cost-efficient battery. Tesla has also made strides toward collecting data from its customers through continuous software updates, which provide information about how roads are set up to help prepare the company for autonomous driving.

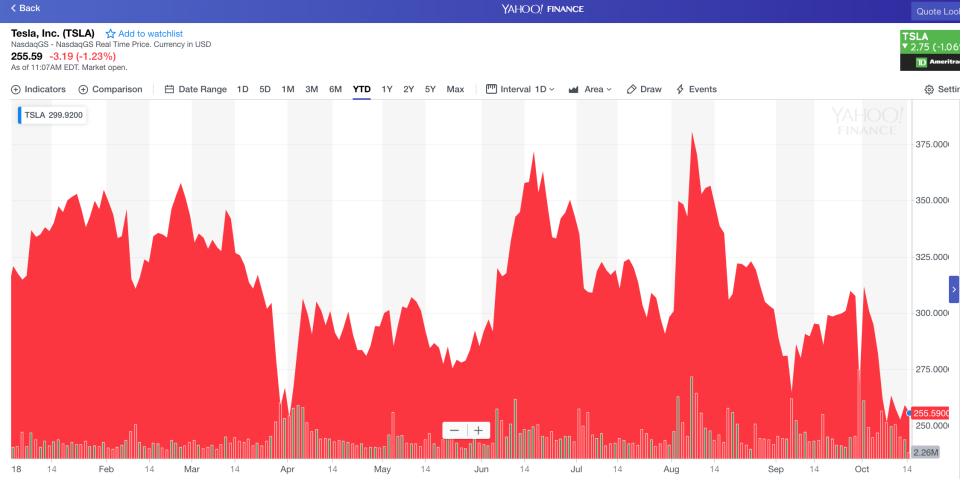

In Wood’s bull scenario, Tesla shares could be priced at $4,000 each in five years. This would represent a 1,445% premium over the price of the stock as of market close Friday. Wood’s bear case forecasts a price target of $700 over five years. Shares of Tesla are down more than 19% in 2018.

Apple or … Lehman Brothers?

Wood’s lofty price target for the electric car vehicle manufacturer has been questioned by other prominent investors, including hedge fund manager David Einhorn of Greenlight Capital.

In a letter to investors earlier in October, Einhorn said the troubles at Musk’s company were akin to Lehman Brothers before the bank failed.

“Like Lehman, we think the deception is about to catch up to TSLA,” Einhorn wrote. “Elon Musk’s erratic behavior suggests that he sees it the same way.”

In the letter, Einhorn also noted that Greenlight Capital sold the last of its Apple stock on fears of growing retaliation from China in response to U.S. tariffs.

Tesla has been mired in controversy the past several months after Musk tweeted out in August that he was prepared to bring the company private with “funding secured.” The Securities and Exchange Commission filed a lawsuit alleging Musk had defrauded investors by implying terms of the transaction had been determined. The charges were settled shortly thereafter, with Musk and Tesla each agreeing to pay $20 million. Musk later slighted the agency on Twitter, calling them the “Shortseller Enrichment Commission” after the lawsuit sparked volatility around Tesla’s stock.

Ark Invest has been a longtime Tesla bull. Wood in August sent a letter to Musk requesting that he keep Tesla a public company, given that the stock could balloon if Tesla successfully grew as planned from a hardware manufacturer to a mobility-as-a-service business provider with wider margins and robust autonomous network.

“Tesla is three years ahead of any auto manufacturer,” Wood said. “And we think they’ll have an autonomous vehicle well before most expectations.”

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Weed stock Tilray is sending investors on an incredible ride

Tilray shares jump as company says it’s exporting cannabis to sick children in Australia

A trade war won’t rattle the ‘white hot’ US economy

White House economist: Tariffs are hurting China much more than the US

Follow Yahoo Finance on Facebook, Twitter, Instagram, reddit, Flipboard, and LinkedIn.