Baillie Gifford Trims Stake in Sprout Social Inc

Investment management firm Baillie Gifford (Trades, Portfolio) has recently adjusted its holdings in Sprout Social Inc (NASDAQ:SPT), a notable player in the cloud software industry. On December 1, 2023, the firm reduced its position in Sprout Social by 290,362 shares, resulting in a 6.59% decrease in their holdings. This transaction had a minor impact of 0.02% on Baillie Gifford (Trades, Portfolio)'s portfolio, with the trade executed at a price of $59.78 per share. Following the trade, Baillie Gifford (Trades, Portfolio)'s total share count in Sprout Social stands at 4,114,040, which represents 0.22% of their portfolio and 8.43% of the company's holdings.

Investment Firm Baillie Gifford (Trades, Portfolio)

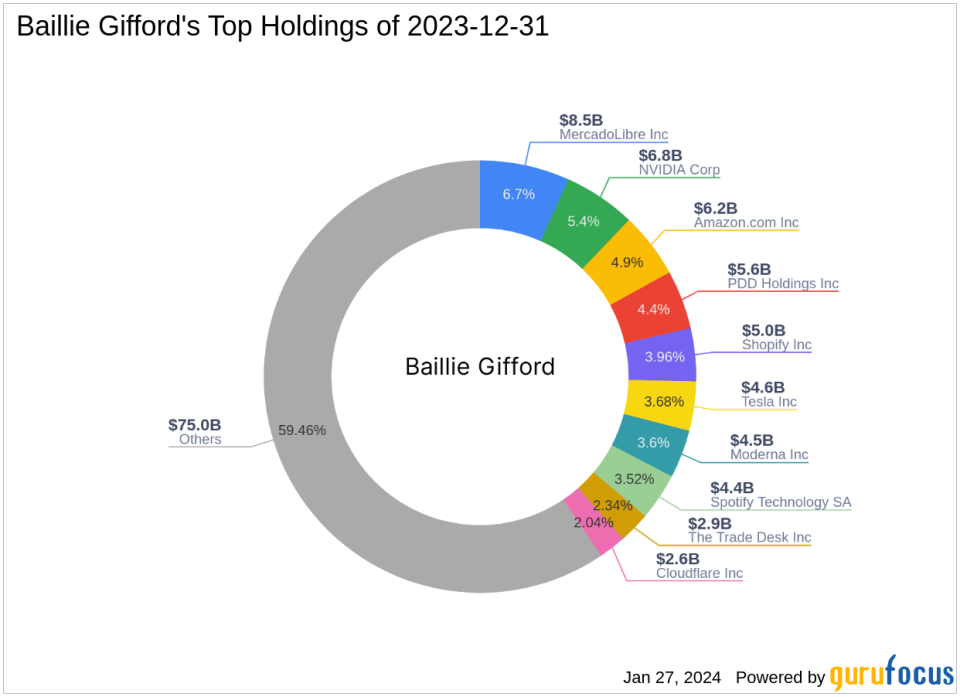

With a history spanning over a century, Baillie Gifford (Trades, Portfolio) has established itself as a prominent investment management partnership. The firm prioritizes the interests of existing clients, often closing products to new business to maintain the quality of service and strategy integrity. Baillie Gifford (Trades, Portfolio) manages funds for some of the world's largest professional investors, including pension funds and financial institutions across various continents. The firm's investment philosophy is rooted in fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth over a five-year period or longer. Baillie Gifford (Trades, Portfolio)'s portfolio includes 288 stocks, with top holdings in technology giants such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA), and a total equity of $126.19 billion.

About Sprout Social Inc

Sprout Social Inc, headquartered in the USA, offers a cloud-based software solution that integrates social messaging, data, and workflows. The company, which went public on December 13, 2019, primarily generates revenue through software subscriptions and professional services. With a market capitalization of $3.57 billion, Sprout Social has established itself as a key player in the software industry. Despite not having a positive PE percentage, indicating current losses, the company is considered significantly undervalued with a GF Value of $102.46 and a Price to GF Value ratio of 0.62.

Trade Impact and Position Analysis

The recent sale by Baillie Gifford (Trades, Portfolio) has slightly altered the firm's investment landscape, with Sprout Social now accounting for 0.22% of its portfolio. The firm's remaining stake of 8.43% in Sprout Social suggests a continued, albeit reduced, confidence in the company's prospects. This move aligns with Baillie Gifford (Trades, Portfolio)'s strategy of long-term growth potential and may reflect a strategic rebalancing rather than a shift in conviction.

Market Performance of Sprout Social Inc

Since its IPO, Sprout Social's stock price has seen a substantial increase of 253.07%, with a year-to-date change of 8.37%. The current stock price stands at $63.73, which is 6.61% higher than the price at which Baillie Gifford (Trades, Portfolio) reduced its stake. This performance indicates a positive market trajectory for Sprout Social, despite the firm's recent sell-off.

Financial Health and Valuation Metrics

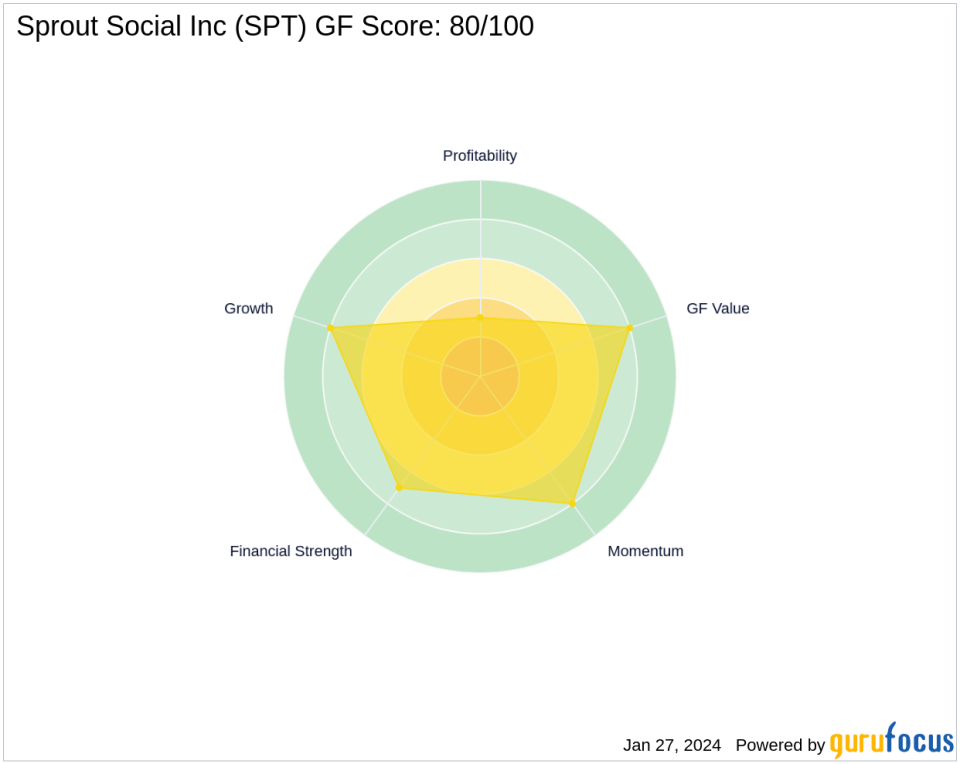

Sprout Social's financial health and valuation metrics present a mixed picture. The company's GF Score of 80/100 suggests a strong potential for outperformance. However, its Profitability Rank is low at 3/10, while the Growth Rank and GF Value Rank are more favorable at 8/10. The company's Piotroski F-Score of 4 indicates average financial health, and its Altman Z score of 8.00 suggests low bankruptcy risk.

Sector and Industry Investment Context

Baillie Gifford (Trades, Portfolio)'s top sectors include Technology and Consumer Cyclical, with Sprout Social fitting well within the firm's preference for technology investments. The software industry plays a significant role in Baillie Gifford (Trades, Portfolio)'s investment strategy, as evidenced by its other top holdings in the sector.

Comparative Analysis with Largest Guru Holder

Baron Funds stands as the largest guru holder of Sprout Social Inc, although specific data on the share percentage held is not available. The lack of comparative data on Baron Funds' stake in Sprout Social makes it challenging to assess the relative confidence between the two investment entities.

Conclusion

In conclusion, Baillie Gifford (Trades, Portfolio)'s reduction in Sprout Social shares appears to be a strategic decision rather than a reflection of the company's performance or potential. With Sprout Social's stock price currently above the trade price and the company's strong GF Score, the firm's remaining stake could still offer significant value. Investors will be watching closely to see how this trade impacts Baillie Gifford (Trades, Portfolio)'s portfolio performance in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.