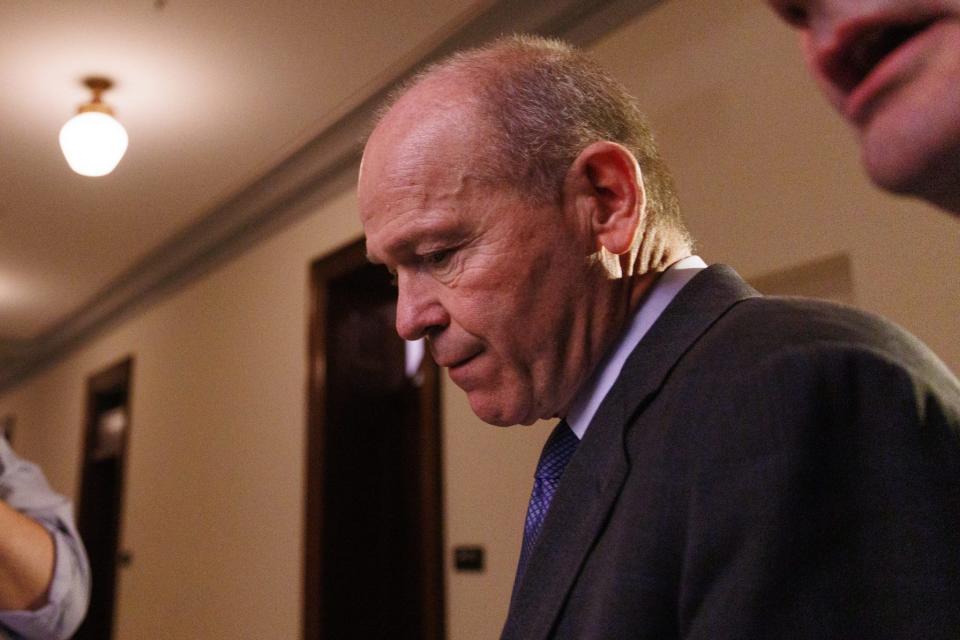

Boeing’s 20-year ‘capital light’ manufacturing drive led to CEO David Calhoun’s downfall

Good morning, CEO Daily readers. I’m Matt Heimer, Fortune’s executive editor for features, writing from Chicago.

At the end of 2019, Boeing was in utter disarray. Two crashes involving Boeing’s 737 Max passenger jet had killed 346 people. The catastrophes were eventually linked to a faulty flight software system, and lengthy investigations found quality-control problems up and down Boeing’s supply chain. Amid demands for new leadership, the board ousted CEO Dennis Muilenburg and turned to an outsider—David Calhoun, an accountant by training and a 26-year veteran of General Electric.

There have been no further fatal failures on Calhoun’s watch, thankfully, but Boeing’s flight path seems no less choppy. The infamous Alaska Airlines door-plug incident this January—in which a chunk of a 737 Max fuselage popped off mid-air—has triggered a hailstorm of new revelations about safety flaws and construction problems. Federal regulators have ordered a slowdown in plane production; the Department of Justice is investigating.

And yesterday, Boeing announced that Calhoun will step down as CEO at the end of the year. (The head of Boeing’s commercial aircraft business is stepping down immediately; the 737 production chief got sacked in February.)

Calhoun could probably feel the sands draining out of his Boeing hourglass well before yesterday: The stock is down 24% this year, and airline CEOs—Boeing’s most important private-sector customers—have voiced growing exasperation. But as Fortune’s Shawn Tully has chronicled in his terrific recent reporting on Boeing, the aircraft-maker’s problems arguably run deeper than anything Calhoun could have fixed—and their roots predate his arrival by decades.

Tully’s thesis—articulated in this deep dive, featured in the next issue of Fortune magazine—is that over the years, Boeing has evolved from an engineering-first company to one that emphasized “capital light” manufacturing. That meant a greater reliance on outside suppliers, and a more intense focus on efficiency and cost-cutting—all of which created incentives to speed up or cut corners on crucial quality checks.

“Managerial decisions, made over a period that spanned more than 20 years and four CEOs, gradually weakened a once vaunted system of quality control and troubleshooting on the factory floor,” Tully writes, “leaving gaps that have allowed sundry defects to slip through.”

The capital-light strategy looked great for a while: From the close of 2010 through 2018, Boeing’s share price vaulted from $70 to $425, outperforming laggards like Microsoft, Apple, and Alphabet. But the October 2018 737 Max crash was the first indication of systemic problems. The cascade of safety and production issues since then has made it hard for investors, customers, or passengers to regain their trust in Boeing.

As for who will lead Boeing next, for now all eyes are on the company’s new chairman: Steven Mollenkopf, CEO of chipmaker Qualcomm from 2014 to 2021, who will lead the search for Calhoun’s replacement. Mollenkopf has a background as an engineer and a product manager. He also comes from a competitive industry where breakdowns in quality and performance lead to instant irrelevance. Will he put an engineer in the corner office? Given recent events, Boeing and its customers should be rooting for just that.

Matt Heimer

matt.heimer@fortune.com

This story was originally featured on Fortune.com