Booking Holdings: Can Historical Outperformance Continue?

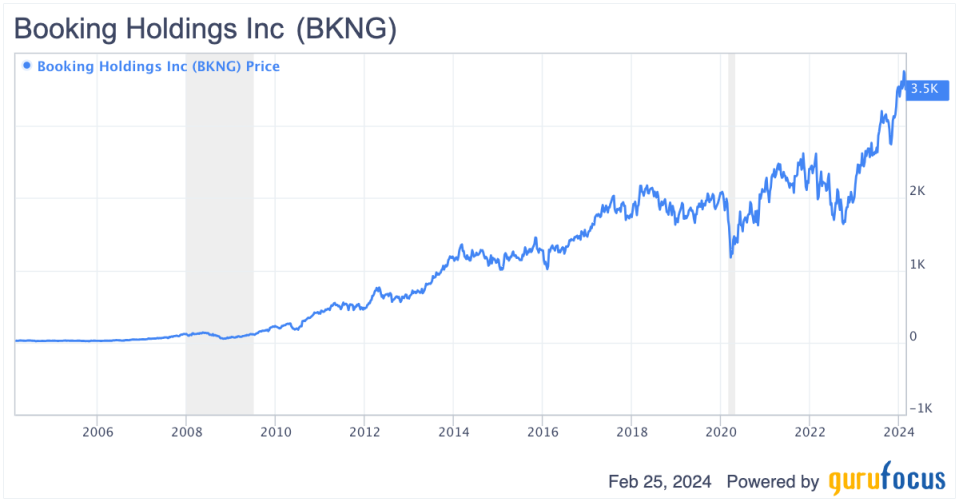

Booking Holdings (NASDAQ:BKNG) is a company with a history of delivering solid long-term results for shareholders. Over the past 20 years, the stock has delivered a total return of over 16,000%. Comparably, the S&P 500 delivered a total return of approximately 551% over the same time period.

The company enjoys competitive advantages driven in large part by its scale. Despite strong competitive advantages and above market growth prospects, Booking Holdings shares trade at an earnings multiple which is in line with the broader market.

The company faces risks due to increased competition, increased regulatory threats, and a highly cyclical business. However, I believe the company will be able to navigate these challenges.

I view the stock as undervalued at current levels and believe that Booking Holding's historical outperformance can continue.

BKNG Data by GuruFocus

Company Overview

Booking Holdings, based on Norwalk, Connecticut, is the world's leading provider of online travel reservation services. Key platforms owned by Booking Holdings include Booking.com, Priceline, Agoda, KAYAK, and OpenTable.

For FY 2023, the company generated total revenue of $21.4 billion. The company classifies revenue into three buckets: merchant revenues, agency revenues, and advertising and other revenues.

Merchant revenues, which account for roughly 51% of total revenues, are revenues derived from transactions in which Booking Holdings facilities payments from travelers at the time of booking. Agency revenues, which account for roughly 44% of total revenues, are derived from transactions in which Booking Holdings does not facilitate payments from travelers. Advertising and other revenues, which account for roughly 5% of total revenues, include revenues that KAYAK earns for sending referrals to other travel companies, revenues related to OpenTable, and other revenues.

Competitive Advantage and Strong Historical Financial Performance

The online travel services business is highly competitive. Booking Holding's competes with Expedia, Google, Trip Advisor, Lastminute.com, American Express Travel, and many other industry players. Booking Holdings derives its competitive advantage due to its scale as well as strong brand awareness and reputation.

Booking Holding's scale allows it to have better negotiating leverage with partners such as airlines and hotel operators than is the case for smaller travel service providers. This is especially true when it comes to smaller hotel operators as these companies often lack the ability to generate strong traffic to their own websites given low brand awareness.

Another key benefit to scale is that Booking Holdings is able to spend more on marketing than smaller players. It is important to note that while Booking Holdings is able to spend more on marketing than other players, it tends to represent a lower percentage of revenue compared to smaller peers which leads to superior margins. For FY 2023, Booking Holdings spent approximately $6.8 billion or 31.7% of total revenues on marketing expenses. Much of this expense consists of payments to Google for search engine optimization purchases which ensure Booking Holdings platforms receive strong placement for travel related searches. Comparably, Expedia spent $6.1 billion or roughly 47.6% of total revenue on marketing expenses for FY 2023.

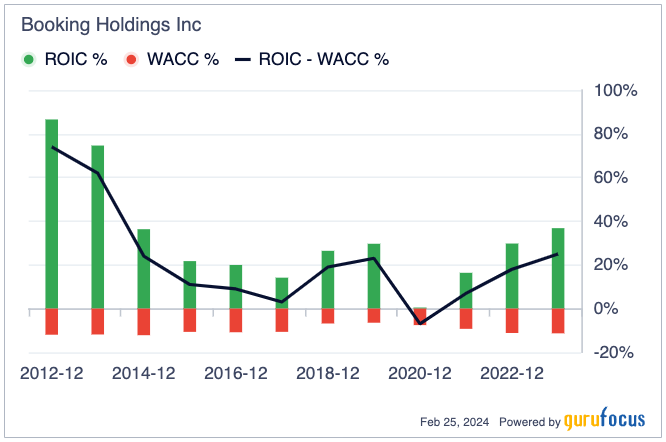

As a result of these competitive advantages, Booking Holdings has been able to deliver very strong historical financial performance. Over the past 10 years, the company has grown revenue at a 12% CAGR and EPS at a 12.5% CAGR. Additionally, as shown by the chart below, Booking Holdings has historically delivered very strong returns on invested capital well in excess of the company's cost of capital.

Attractive Valuation

Booking Holdings trades at approximately 20x FY 2024 consensus EPS. Comparably, the S&P 500 trades at approximately 23x FY 2024 earnings. Thus, on a relative basis Booking Holdings trades at a modest discount to the broader market.

In addition to trading at valuation discount to the broader market, the company also has better growth prospects. Consensus estimates currently for the company to deliver EPS growth of 14.7%, 18.8%, and 12% for FYs 2024-2026 respectively. Comparably, the S&P 500 is expected to grow FY 2024 earnings by roughly 12% and historically has grown earnings by a high single digit percentage.

The global online travel market is expected to grow at a nearly 13% CAGR through 2030. Thus, I believe the company is well positioned to continue growing earnings faster the broader market. For this reason, I find Booking Holdings current valuation attractive vs the broader market.

Aggressive Share Repurchase Program

Over the past few years, Booking Holdings has been an aggressive repurchaser of its own stock. The company's share count has decreased by more than 20% over the past 5 years. During FY 2023, the company repurchased $10.4 billion worth of shares. As of December 2023, the company had a total remaining authorization of $13.7 billion which represents roughly 11% of shares outstanding based on current market prices. The company expects to complete the repurchase program by the end of FY 2026.

I view the aggressive repurchase program as a key positive as it indicates that management views the stock's valuation as attractive relative to the company's long-term growth prospects.

Key Risks to The Bull Case

One key risk that Booking Holdings faces is potential for increased competition from Google. Given Google's significant capital resources and position as the leading search engine, it represents a unique threat to online travel agencies such as Booking Holdings. However, Google Travel currently operates primarily on the agency model in which it displays travel options but directs consumers to book directly with the airline, hotel, or travel agency.

Another key risk that Booking Holdings faces is regulatory risk. As previously discussed, Booking Holdings has strong negotiating power relative to partners including smaller hotel chains. An example of the increasing regulatory threat can be seen in recent $526 million draft decision penalty imposed on the company as part of antitrust regulators in Spain. Booking Holdings has already announced plans to appeal the penalty once it becomes final and has noted that the appeal could take years.

Finally, the company also faces macroeconomic risks as travel demand tends to be highly cyclical. A sharp economic slowdown would likely result in significantly lower EPS over the next few years. However, I believe the company is well position to navigate any potential slowdown due to its strong liquidity position, which includes $13.1 billion in cash and roughly $2 billion of availability on its revolving credit facility. Moreover, the company has a fairly low fixed cost structure and is able to maintain profitability even with large declines in revenue. As an example of this, it is interesting to note that the company remained profitable for FY 2020 despite a roughly 55% drop in revenues due to COVID.

Conclusion

Booking Holdings has delivered strong results for shareholders historically. The company enjoys competitive advantages due to its scale which have allowed the company to generate very strong returns on invested capital despite operating in a highly competitive industry.

The global travel industry remains a growth industry and the company is poised to benefit from increased levels of consumer spending on travel in the years ahead.

The stock currently trades at a market multiple despite having growth prospects which are better than the broader market. While the company faces a number of risks, I believe it can manage through these challenges.

For these reasons, I view the stock as undervalued at current levels and believe that it can continue to outperform the broader market.

This article first appeared on GuruFocus.