Chuck Royce Adds Noodles & Co to Portfolio in Recent Trade

Overview of Chuck Royce (Trades, Portfolio)'s Portfolio Addition

The investment firm managed by Charles M. Royce, known for its focus on small-cap companies, has recently expanded its portfolio with the addition of Noodles & Co (NASDAQ:NDLS). On December 31, 2023, the firm acquired 355,800 shares of the fast-casual restaurant chain, increasing its total holdings to 2,381,489 shares. This transaction, executed at a trade price of $3.15 per share, represents a 0.08% impact on the portfolio and increases the firm's stake in Noodles & Co to 5.30%.

Profile of Investment Firm: Chuck Royce (Trades, Portfolio)

Charles M. Royce, a prominent figure in small-cap investing, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's firm is renowned for its value investing approach, targeting companies with strong balance sheets, successful business records, and promising futures. The firm's portfolio is diverse, with top holdings in various sectors, including FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL). With an equity portfolio valued at $9.82 billion, the firm's top sectors are Industrials and Technology.

Noodles & Co Company Overview

Noodles & Co, operating within the fast-casual segment of the restaurant industry, offers a variety of cooked-to-order dishes, including noodles, pasta, soups, and salads. The company, which also provides dining, pick-up, and delivery services, has a market capitalization of $119.061 million. Despite a challenging market, Noodles & Co's stock is currently priced at $2.65, reflecting a decrease of 15.87% since the trade date. The company's stock has significantly underperformed since its IPO in 2013, with a price change of -91.72%.

Analysis of the Trade

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm has modestly bolstered its position in Noodles & Co, now accounting for 0.08% of the portfolio. The trade was conducted at a price that is currently 15.87% higher than the stock's latest trading price, indicating a potential undervaluation at the time of purchase. However, with the stock's GF Value at $6.99 and the current price to GF Value ratio at 0.38, the investment may be considered a possible value trap, warranting caution.

Financial Health and Performance Metrics

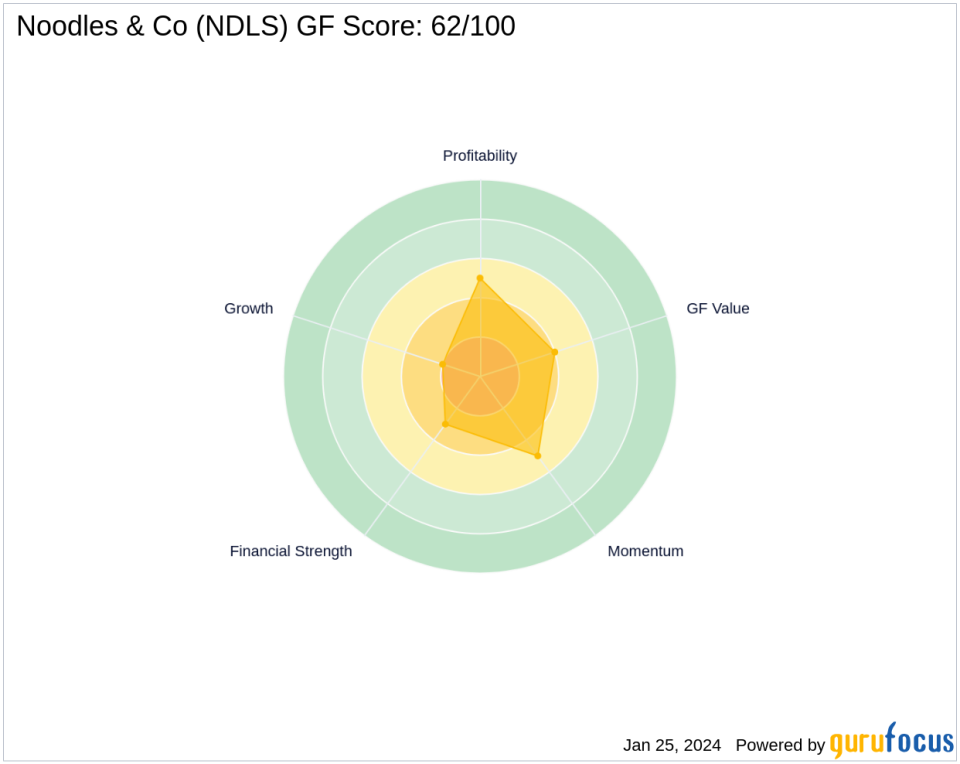

Noodles & Co's financial health and performance metrics present a mixed picture. The company's Financial Strength is ranked 3/10, with a concerning Cash to Debt ratio of 0.01. Its Profitability Rank stands at 5/10, while the Growth Rank is a low 2/10. The GF Value Rank and Momentum Rank are both at 4/10 and 5/10, respectively. The Piotroski F-Score of 6 indicates a somewhat stable financial situation, but the Altman Z-Score of 0.91 suggests potential distress. The company's Operating Margin has not shown growth, and its EBITDA has declined by 6.30% over the past three years.

Market Sentiment and Valuation

The current market sentiment towards Noodles & Co is cautious, as indicated by the GF Valuation status of "Possible Value Trap, Think Twice." The stock's GF Score of 62/100 suggests poor future performance potential, and the year-to-date price change of -14.79% reflects a negative trend. The company's financial ratios and growth metrics, coupled with its market performance, underscore the need for careful evaluation by investors.

Sector and Industry Context

Within the restaurant industry, Noodles & Co's performance has been lackluster when compared to industry benchmarks. The company's stock has struggled to gain momentum, as evidenced by its negative price changes since IPO and year-to-date. The industry as a whole faces challenges, but Noodles & Co's specific financial and growth metrics indicate that it may be underperforming relative to its peers.

Conclusion

The investment decision by Chuck Royce (Trades, Portfolio)'s firm to increase its stake in Noodles & Co reflects a strategic move that aligns with the firm's value investing philosophy. However, given the company's current financial health, market valuation, and industry position, investors should approach this stock with caution. The potential outlook for Noodles & Co will depend on its ability to improve its financial strength, profitability, and growth metrics in the competitive restaurant industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.