Here’s a big bitcoin problem I just discovered

I bought a fraction of a bitcoin in October, and my little investment has appreciated about 150% since then. But if I want to cash out, I might have a problem — because apparently it’s not so easy to sell.

I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin. That’s where my bitcoin resides. To my mind, it’s the same as buying a mutual fund or ETF at Vanguard or Fidelity, which would then hold the shares and maintain the account.

But the frenzied buying and selling of bitcoin during the last several weeks has caused repeat outages at Coinbase, as the firm’s servers get overloaded. I don’t really want to sell my bitcoin right now, but what if I did?

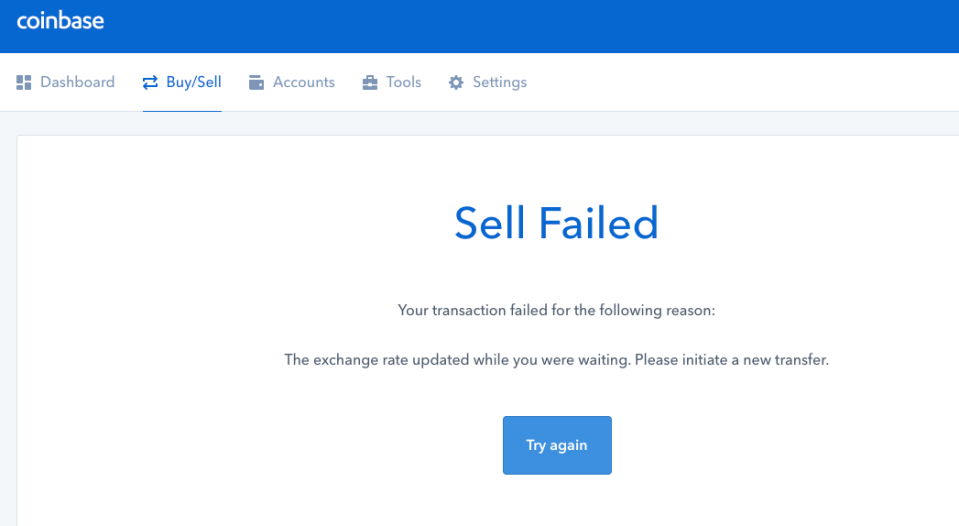

As a test, I tried to place a sell order for $10 worth of bitcoin. Here’s the message I got:

I tried again about an hour later, and this time Coinbase let my order go through: I sold off $10 worth of bitcoin. But there have been other times during the past few weeks when I wasn’t even able to access my account, since the whole website appeared to be offline. Such Coinbase crashes have occurred sporadically during heavy trading days since 2015, at least.

Coinbase has characterized its technical problems as “minor service outages” caused by “high traffic.” And its website says the company has insurance to protect all customer deposits, in full. Another popular exchange, Kraken, has had similar outages.

This comes amid a dizzying week for bitcoin, with the price soaring 82% during the past seven days and more than 2,200% during the last year. The action has been so volatile lately that by the time you read this story, any price changes I note as I’m writing it will assuredly be obsolete.

Those giant price gains are luring rabid investors hoping for a cut of the action, with soaring demand, in turn, pushing prices even higher. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Most financial markets have “circuit breakers” and other mechanisms to slow runaway trading, but only for a while. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes.

[Meet some people getting rich from bitcoin.]

That’s not the case with bitcoin, which was launched in 2009 and has gained a following gradually until this year, with dramatic surges in value drawing mainstream attention. Yet the immature infrastructure supporting bitcoin is one reason it remains risky, with volatile price swings.

At one point on Dec. 7, for instance, various exchanges quoted bitcoin prices that varied by more than $2,000, from a low of $15,592 to a high of $18,259 — all at the same time. On established financial markets, there can be very minor discrepancies in prices quoted simultaneously on various exchanges— but never in the range of 15% of a security’s entire value.

Bitcoin is not liquid

On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. Computers might even do it automatically. But the limited liquidity on bitcoin markets doesn’t completely allow for that—for now. And one reason is the difficulty some bitcoin holders have selling when market action is hot.

If you can’t sell when the price is rising, it might not be that big a deal. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher.

But if you can’t sell when the price is falling, that could be a major problem that compounds losses, intensifies selling pressure and wrecks confidence in the cryptocurrency. If you want to sell at $10,000 but can’t get an order in until the price drops to $8,000, the delay costs you $2,000, or 20%, on top of whatever the loss would have been at $10,000. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can.

This can create the equivalent of a bank run, with more customers trying to get their cash out than Coinbase or any other exchange might be able to handle. Bank runs begin as psychological panics, which means that even if Coinbase had the assets on hand to fulfill all requests, technical problems preventing those transactions could freak consumers out just as much as if their money were actually gone. Once confidence crumbles, everybody wants their assets in hand, rather than in the system. That wrecks the market. For everybody wondering if bitcoin is a bubble about to burst, well, that’s one way it could burst.

The risky nature of bitcoin

Bitcoin is not an ordinary financial product, but a new and highly risky one. Anybody investing in it should be prepared for disruptions and other risks. Nobody should have to sell bitcoin urgently because they need the cash, for one thing. If you don’t have an emergency cash fund, then you should build one before you risk your money buying bitcoin, which could still plunge in value, at any time.

But many bitcoin backers also believe (or hope) that bitcoin will become a mainstream financial instrument, similar to gold or other commodities. For that to happen, liquidity needs to improve and trading disruptions need to become rare, no matter how hot the trading action is.

For now, there are ways to trade bitcoin without being dependent upon an exchange such as Coinbase. For instance, you can download your bitcoin —w hich is essentially a string of unique software code — onto a device that’s similar to a hard drive, and physically trade it with local brokers. But that’s cumbersome and there are risks — if your gizmo is lost or stolen, your bitcoin is gone. It’s probably not necessary for people with small holdings, unless you profoundly distrust exchanges to safeguard your investment.

I bought my little bitcoin stash fully aware that its value could plunge to nothing and I should write the money off. I was also willing to risk a little bit of money because I knew I’d learn more about bitcoin if I had a stake in the action. So there shouldn’t come a time when I need to sell on a moment’s notice. But I’d also like to know the exchange holding my coin is a professional operation getting closer to financial-market standards. Everybody in bitcoinland is learning, it seems.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Read more:

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman