The shifting American retail landscape summarized in 3 charts

At this point, it’s a pretty well-known story: American consumers are doing more shopping online than at brick-and-mortar retailers. For many goods and services, it’s cheaper and it saves time.

However, this continues to be a rapidly developing story with profits and investment returns surging for those in the right parts of the industry. We see this illustrated in three charts.

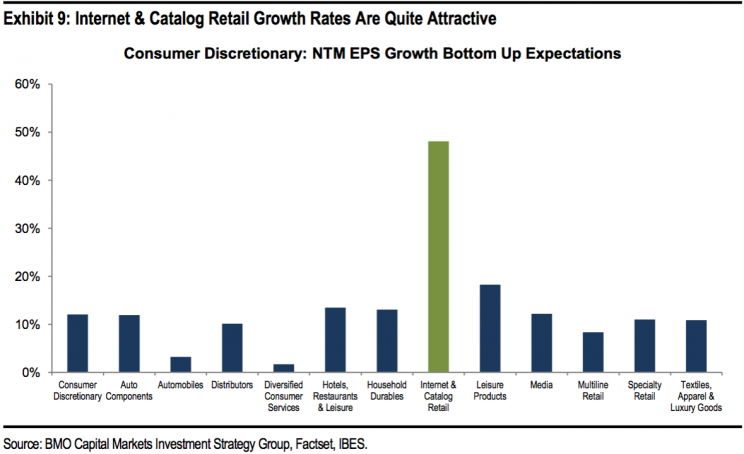

The first chart comes from BMO chief investment strategist Brian Belski, who has been recommending clients to increase their bets on the consumer discretionary sector. In a note to clients on Friday, he highlighted the operating line of retailers, which are expected to see next-12-month profits surge 48.1% year-over-year.

“We believe the Internet & Catalog Retail industry provides an excellent opportunity for growth,” Belski said. “Although the group is maturing, its earnings outlook remains one of the strongest not only within Consumer Discretionary, but also within the S&P 500.”

Even the likes of Wal-Mart (WMT) fully appreciate this shift in consumer behavior. Earlier this month, it agreed to acquire online retailer Jet.com for $3 billion in its effort to bolster its online presence.

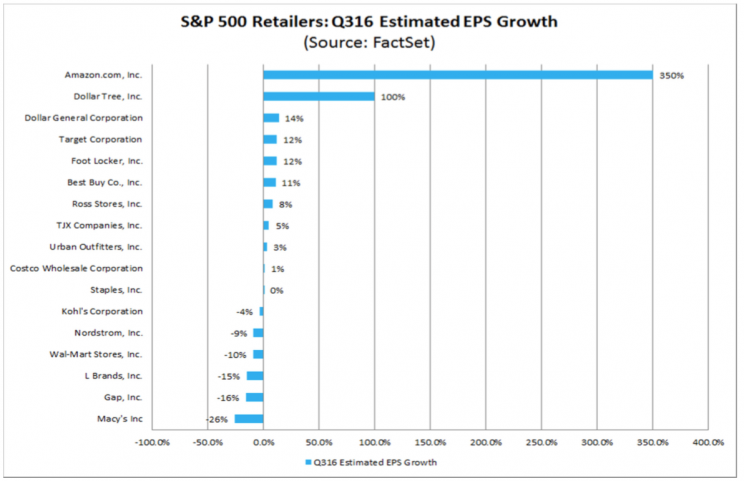

The 800-lb gorilla in the category: Amazon.com (AMZN). Thanks to the company’s ability to exceed expectations, shares of Amazon are up nearly 43% in the past year.

Of the 17 big retailers in the S&P 500 (^GSPC), Amazon is by far expected to see the biggest growth in the bottom line with earnings per share forecast to increase by 350%. This next chart from FactSet illustrates how the retailers stack up.

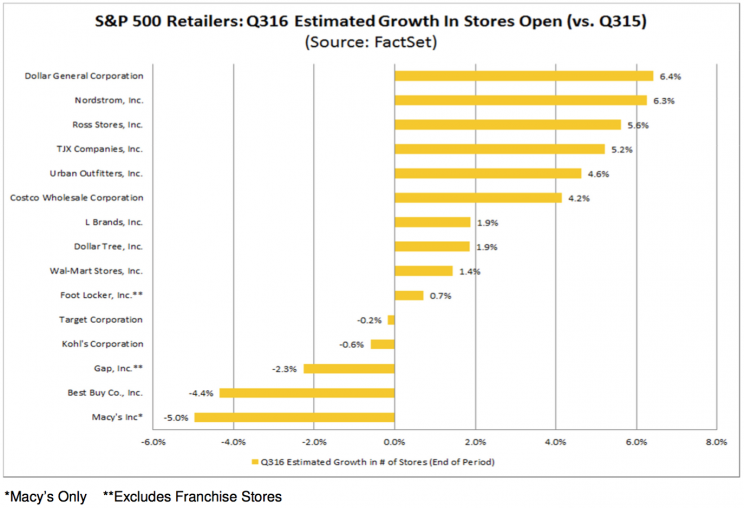

Within the brick-and-mortar sector, there are some changes going on. As expected, many big names are closing stores like electronics retailer Best Buy (BBY), which continues to be challenged by cheaper online offerings. Macy’s (M), which used to boast owning the “World’s Largest Store” in New York City, just last week announced it would be closing more than 100 stores.

Who’s still expanding? It’s mostly the retailers known explicitly for competing on price. These include deep discounters like Dollar General (DG) and Dollar Tree (DLTR); big-box discounters like Costco (COST) and Wal-Mart; and off-price retailers like Ross Stores (ROST) and TJ Maxx (TJX).

Target (TGT) and Wal-Mart are among retailers announcing earnings this week.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

What Wall St. is saying about the all-time-high stock market

David Rosenberg nails the stock market in a perfect sentence

The gloomy profits narrative underlying the stock market just got worse