America's job growth is slowing because we're 'running out of workers': Economist

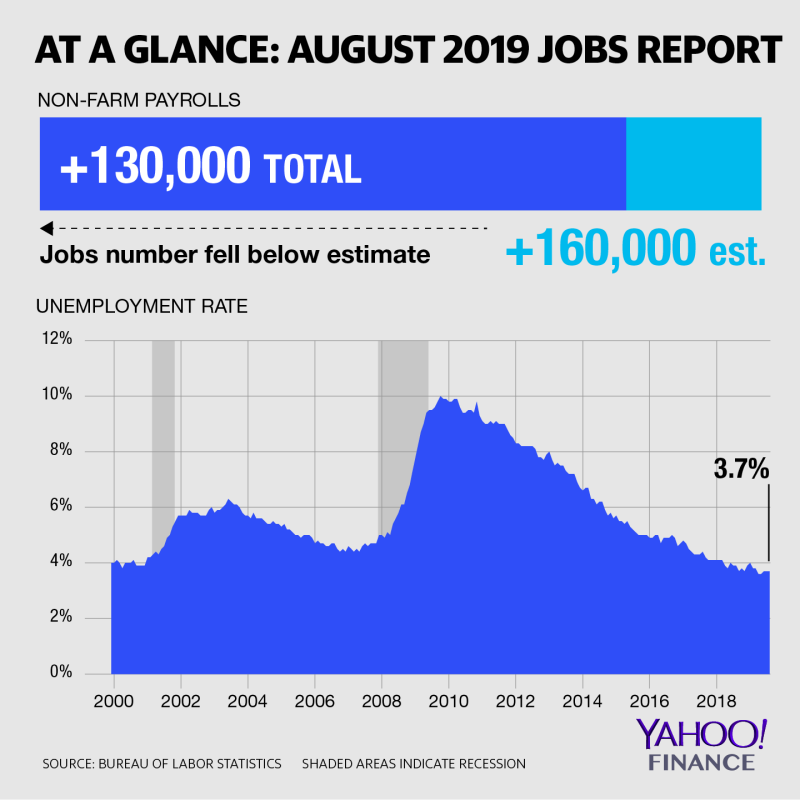

The August jobs report brought 30,000 fewer jobs than expected, with 130,000 nonfarm payrolls added versus the 160,000 expected.

According to one analyst, the reason for the slowing job growth is simple: “We are running out of workers,” Markus Schomer, chief economist at PineBridge Investments, told YFi AM.

“It’s a supply-side issue just as much as it’s a demand-side issue,” he said.

But, Schomer suggested that this isn’t a reason for concern. Rather, “it’s a sign of how strong this market is.”

In order to get a peek into “what companies are doing,” Schomer recommended looking at core durable goods orders.

“For the last 13 months now, the average of orders growth of core durable goods has been zero. Not minus five ... Nobody’s cutting back,” he said.

This lack of movement shows that businesses are sitting and waiting for progress in the U.S.’s trade negotiations with China and to see what changes the Federal Reserve might make, rather than preempting what could happen.

“What they need is a little confidence that we’re not going into a recession,” Schomer said, while also calling the trade talks “noise.”

“If we get that second Fed cut, and, maybe — hopefully — some bullish language around it, that will demonstrate to CEOs: ‘The Fed’s got our back,’” which he said will then release the pent-up demand over the past year.

—

Follow Katie on Twitter: @hashtagkatie.

Read More:

Read the latest stocks and stock market news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.