Jobs report, ISM manufacturing: What to know in the week ahead

It will be a big week for U.S. economic data with the release of the May jobs report and the Institute for Supply Management’s manufacturing index. Investors will be keeping track of how the recent state reopenings affected the U.S. economy over the past month.

Jobs report

Friday’s release of the May jobs report will likely be the focal point of the week, as the unemployment rate is expected to have skyrocketed to nearly 20% during the month, up from 14.7% in April.

The U.S. economy is estimated to have lost 8 million nonfarm payrolls, down from 20.54 million job losses in the prior month. Economists anticipate another historic decline in employment in May with the pace of layoffs significantly outpacing any rehiring.

“The April employment report showed the most severe one-month contraction in the history of labor market data. Most employment indicators have improved as nationwide shutdowns began to ease in May, but the underlying trend still points to a large contraction,” Credit Suisse economist James Sweeney said in a note May 28.

“The establishment survey is likely undercounting the extent of job losses during the current downturn. The household survey measure of employment has fallen by an additional 4 million, and is likely doing a better job of capturing the real-time cyclical impact,” Sweeney added.

Those discrepancies in the establishment and household survey won’t be fixed until the annual benchmark revision next year, and thus creates further downside risk for May payrolls and downward revisions to April’s figures, according to Sweeney.

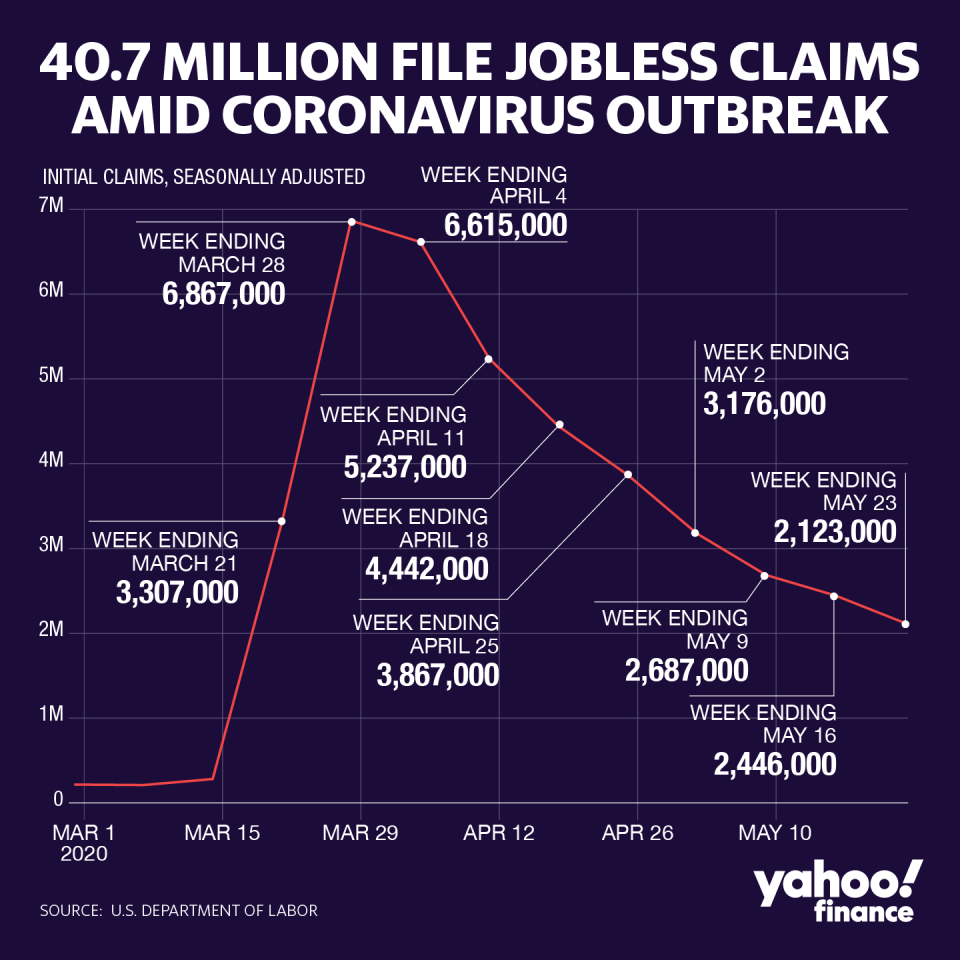

Weekly initial jobless claims have been the window into the health of the U.S. labor market amid the ongoing COVID-19 crisis. After peaking to 6.87 million jobless claims in the week ending March 28, the weekly reported figure has been steadily decreasing. However, over the past 10 weeks, more than 40 million Americans have filed for unemployment insurance.

Another 2.12 million Americans filed for unemployment benefits in the week ending May 23, but the number of continuing claims saw its first weekly decline since the end of May.

“The drop in continuing claims suggests labour market conditions are now beginning to improve again, as workers are recalled to their jobs. But that decline may have started too late in the month to make much difference to the May employment report, which is based on the week including the 12th,” Capital Economics wrote in a note to clients May 29.

“In addition, the continuing claims figures do not count the more than 6 million people separately claiming new Pandemic Unemployment Assistance (PUA) benefits. The upshot is that we expect the fall in non-farm payroll employment in May will be closer to the 10m indicated by the initial claims figure,” the firm said.

ISM manufacturing index

Economists expect the ISM manufacturing index rose to 43.5 in May from 41.5 in April, as many regional Federal Reserve manufacturing surveys showed a slower pace of contraction in May compared to April.

“Markit’s flash manufacturing PMI for May rose 3.6pp to 39.8. Altogether, most surveys indicate that while activity continued to contract in May, it likely did so at a slower rate relative to the early onset of the pandemic,” Nomura economist Lewis Alexander said in a note May 29. “In addition, many forward-looking indicators improved during the month, suggesting some firms have become more optimistic as states re-open. In May, we expect an improvement in both new orders and production, reflecting resumption of activity.”

Even despite the slight bounce expected in May, Alexander explained that it will take some time before the measures return to pre-COVID levels given the heightened uncertainty regarding the economic recovery.

The corporate earnings calendar remains light this week, but several of the big companies reporting quarterly results include Zoom Video Communications, Slack, Gap, Broadcom, Dick’s Sporting Goods and Campbell’s Soup.

Economic calendar

Monday: Markit US Manufacturing PMI, May final (39.8 prior); Construction Spending month-on-month, April (-7.0% expected, +0.9% in March); ISM Manufacturing, May (43.5 expected, 41.5 in April); ISM Prices Paid, May (40.0 expected, 35.3 in April)

Tuesday: Wards Total Vehicle Sales, May (10.8 million expected, 8.58 million in April)

Wednesday: MBA Mortgage Applications, week ending May 29 (2.7% prior); ADP Employment Change, May (-9.5 million expected, -20.24 million in April); Markit US Services PMI, May final (36.9 prior); Markit US Composite PMI, May final (36.4 prior); Factory Orders, April (-15% expected, -10.4% in March); ISM Non-Manufacturing Index, May (44.0 expected, 41.8 in April); Durable Goods Orders, April final (-17.2% prior); Durable Goods excluding Transportation, April final (-7.4% prior)

Thursday: Trade Balance, April (-$41.5 billion expected, -$44.4 billion in March); Initial Jobless Claims, week ending May 30 (2.123 million prior); Continuing Claims, week ending May 23 (21.05 million prior); Bloomberg Consumer Comfort, week ending May 31 (35.5 prior)

Friday: Change in Nonfarm Payrolls, May (-8 million expected, -20.54 million in April); Change in Manufacturing Payrolls (-400,000 expected, -1.33 million in April); Unemployment Rate (19.5% expected, 14.7% in April)

Earnings calendar

Monday: N/A

Tuesday: Dick’s Sporting Goods (DKS) before market open; Crowdstrike (CRWD), Zoom Video Communications (ZM) after market close

Wednesday: American Eagle Outfitters (AEO), Campbell’s Soup (CPB), Canada Goose (GOOS) before market open

Thursday: Broadcom (AVGO), DocuSign (DOCU), Gap (GPS), PagerDuty (PD), Slack (WORK) after market close

Friday: N/A

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.