BOOM: U.S. adds whopping 312,000 jobs in December

The U.S. labor market is charging forward.

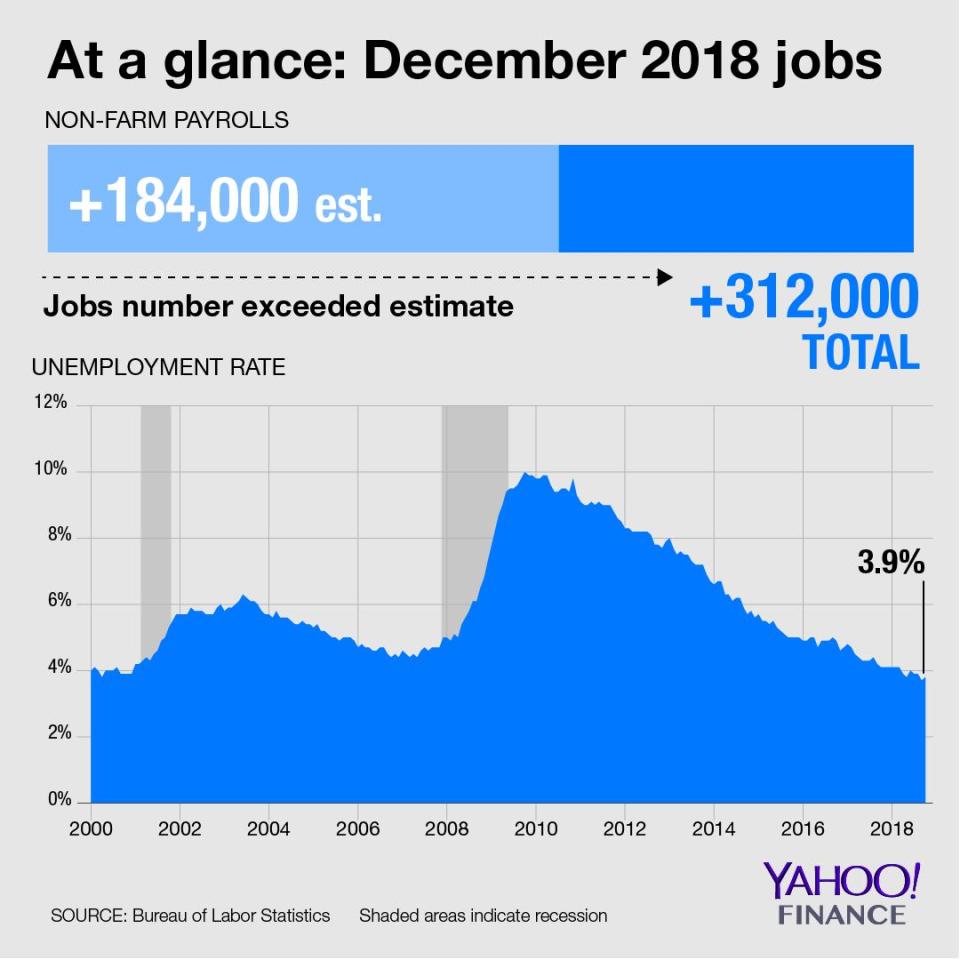

The Bureau of Labor Statistics reported Friday that non-farm payrolls grew by 312,000 in December, surging past expectations of 184,000. The BLS also upwardly revised its figure for non-farm payroll additions in November to 176,000, from 155,000 previously reported.

The unemployment rate rose to 3.9% in December. The unemployment rate was 3.7% in November, the lowest overall unemployment level since 1969. The uptick was due to the labor force participation rate increasing to 63.1% in December from 62.9% in November.

Average hourly earnings – a closely watched metric of inflation pressures in the economy – increased 0.4% over last month and 3.2% over the previous year. This exceeded expectations of wage growth of 0.3% over last month and 3% over last year. Wages rose 3.1% over the prior year in both November and October.

The results of Friday’s job report do not capture any impact from the ongoing partial government shutdown, which began after the Labor Department conducted the survey. An extended shutdown, however, could go on to affect January’s figures.

Friday’s jobs report comes as other key indicators of economic strength in the U.S. have begun to deteriorate. The past month’s manufacturing surveys from the New York, Philadelphia, Richmond and Dallas Federal Reserve banks each disappointed, and The Conference Board’s latest reading on consumer confidence sagged to a six-month low. Growth in the housing has been crimped by heightened mortgage rates, with the average rate on a 30-year fixed rate mortgage climbing to the highest level since February 2011 at the beginning of November before retreating slightly over the past several weeks.

Earlier this week, both the Institute of Supply Management and IHS Markit reported a slower pace of expansion in U.S. manufacturing sector activity. ISM’s manufacturing index experienced the worst monthly drop since October 2008. However, job gains occurred in the manufacturing sector in December, with 32,000 new positions added for the month, according to the BLS.

The labor market has so far been a bright spot even against a backdrop of a swooning stock market, ongoing trade tensions and tightening monetary policy, each of which has contributed to weakness in other areas of the economy. In the first 11 months of 2018, employers added more positions than they did during the same period in 2017.

And that upward trend for the labor market has continued through December. Paul Ashworth, chief U.S. economist for Capital Economics, said the strength reflected in Friday’s report makes “a mockery of market fears of an impending recession.”

A tight labor market, however, may not come without consequence. Many investors are concerned that a combination of a low unemployment rate and strong wage growth will spur policymakers to push for additional rate increases to stave off inflation. However, Federal Reserve Chairman Jerome Powell said during a press conference after the Federal Open Market Committee’s December meeting that wage increases would be “a welcomed development” and “need not be inflationary.”

“From a jobs perspective, I can't imagine a much better report. From the market's perspective, this could be really tricky,” Peter Tchir, head of macro strategy at Academy Securities, said. “A series of weak data has had the market convinced we get Powell the dove – but if he wants to play hardball with the Powell Put he may feel justified to remain more hawkish than the market would like.”

On Thursday, the ADP Research Institute released its own national employment figures and reported that the U.S. added 271,000 private sector jobs in December. This represented the strongest monthly gain since February 2017, and far exceeded consensus estimates of 180,000 new positions added for the month. The results of ADP’s report, however, tends to diverge from the “official” BLS survey results since the former counts all employees listed as active on an employer’s payroll, while the latter tallies only employees actually paid during the survey period.

This post has been updated.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read more from Emily:

What Wall Street strategists forecast for the S&P 500 in 2019

Dow plunges more than 650 points as Apple flashes warning signs

Why the Huawei arrest is a huge problem for U.S.-China trade relations

Why race to an IPO? Staying private may be more viable, study suggests

Now is a ‘once-in-a-lifetime chance’ to invest in US pot companies, investor says