A few major topics were missing from Warren Buffett's latest annual letter

Warren Buffett’s latest letter to Berkshire Hathaway (BRK-A, BRK-B) shareholders was released Saturday, and a few major themes were missing.

Not the least of which was a glaring absence of any discussion about the controversy that has engulfed Wells Fargo (WFC) over the last 18 months.

Wells Fargo

The last 18 months at Wells Fargo, Berkshire’s largest public market equity investment by market value, have been tumultuous. The bank has been embroiled in a scandal over opening millions of fake accounts for customers, which cost former CEO John Stumpf his job, and continued missteps at the firm have led some lawmakers to call for current CEO Tim Sloan to be ousted from his post.

Following repeated calls from Sen. Elizabeth Warren (D-Mass.) to use its authority to enforce changes at Wells Fargo, the Federal Reserve earlier this month required the bank to replace four members of its board by the end of 2018. The Fed also said Wells Fargo will be restricted from growing its asset base until it makes “sufficient improvements.”

At the annual meeting of the Daily Journal (DJCO) company earlier this month, Charlie Munger, chairman of Daily Journal and the vice chair of Berkshire Hathaway who has served as Buffett’s right-hand-man for decades, said it’s time for regulators to “let up” on Wells Fargo.

“Of course, Wells Fargo had incentive systems that were too strong in the wrong direction,” Munger said. “Of course, they were too slow in reacting to the bad news when it came. Everyone makes those mistakes, but we make fewer than others.”

At last year’s annual meeting of Berkshire Hathaway shareholders, Buffett said that Wells Fargo had made three key mistakes, with the failure of former CEO John Stumpf to act quickly being the primary error among them. “At some point if there’s major problem, the CEO gets wind of it,” Buffett said. “And the CEO has to act.”

In late 2016, Buffett had defended his mum stance on the wrongdoing at Wells Fargo as part of his pledge to regulators to be a passive investor in the company. This pledge was made during Berkshire’s application to the Fed to hold a larger than 10% stake in Wells Fargo without registering as a bank holding company. Last year, Berkshire pared its stake in Wells Fargo to remain below this 10% ownership threshold.

Back in 2009, Buffett said that if he had to put all his net worth in one stock it would be Wells Fargo.

In this year’s letter to shareholders, Buffett writes that, “Charlie [Munger] and I view the marketable common stocks that Berkshire owns as interests in businesses, not as ticker symbols to be bought or sold based on their ‘chart’ patterns, the ‘target’ prices of analysts or the opinions of media pundits.

“Instead, we simply believe that if the businesses of the investees are successful (as we believe most will be) our investments will be successful as well.”

It is surprising, then, if not a bit disappointing, that the $29 billion investment Berkshire has in a bank recently subjected to the toughest regulatory action since the immediate fallout from the financial crisis gets nary a mention in Buffett’s most direct communication with shareholders.

Healthcare

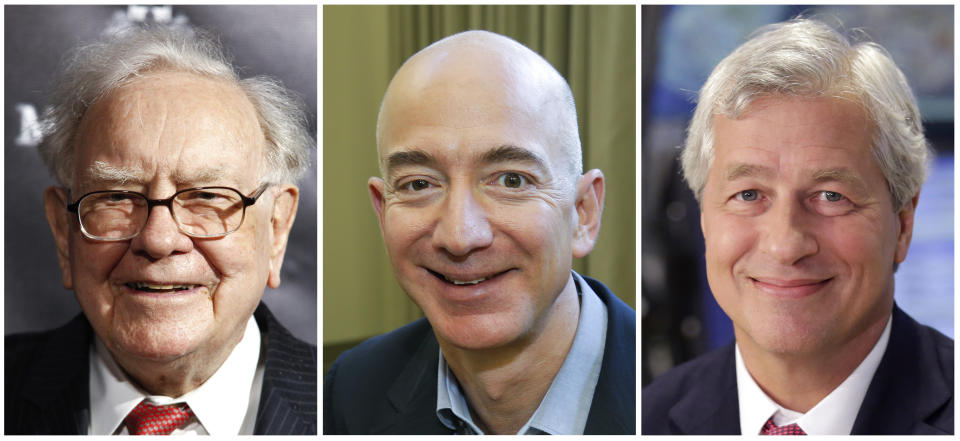

Among the other topics that some investors anticipated Buffett potentially hitting on, the recently-announced project between Buffett’s Berkshire Hathaway, Amazon (AMZN) and JP Morgan (JPM) in which the three companies would work together to find a new way to provide healthcare to their employees.

This plan brings together three of the most recognizable names in American business — Warren Buffett, JP Morgan CEO Jamie Dimon, and Amazon CEO Jeff Bezos — to try and solve one of the most recognizable problems in American society: the ballooning cost of healthcare.

The late-January announcement may not have given Buffett much lead time to have anything new to say on the matter. And most any Berkshire Hathaway shareholder reading the latest missive is aware of the announced initiative and what Buffett had to say at the time.

(“The ballooning costs of healthcare act as a hungry tapeworm on the American economy,” Buffett said in January. “Our group does not come to this problem with answers. But we also do not accept it as inevitable. Rather, we share the belief that putting our collective resources behind the country’s best talent can, in time, check the rise in health costs while concurrently enhancing patient satisfaction and outcomes.”)

Expect the topic to be addressed in May at the annual meeting of shareholders.

America

A feature of recent editions of Buffett’s letter to Berkshire Hathaway shareholders has been what can only be called a sales pitch for the merits of American capitalism.

In his 2015 letter to shareholders, for instance, Buffett wrote that, “For 240 years it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs. America’s social security promises will be honored and perhaps made more generous. And, yes, America’s kids will live far better than their parents did.”

Last year, Buffett added that, “Our efforts to materially increase the normalized earnings of Berkshire will be aided – as they have been throughout our managerial tenure – by America’s economic dynamism. One word sums up our country’s achievements: miraculous. From a standing start 240 years ago – a span of time less than triple my days on earth – Americans have combined human ingenuity, a market system, a tide of talented and ambitious immigrants, and the rule of law to deliver abundance beyond any dreams of our forefathers.”

This year, Buffett said only that, “America’s economic soil remains fertile.” Adding, “In America, equity investors have the wind at their back.”

Surely, investors know where Buffett stands when it comes to his view on the American economy — in time, he expects it will raise the fortunes of all citizens. Re-emphasizing this point may come with diminishing returns.

But coming off a year in which financial markets and the real economy both performed quite well, extended commentary from Buffett on the American business climate is a notable absence.

Bitcoin

Over the last several months, even including a sharp drop and rebound in the stock market earlier this month, bitcoin (BTC-USD) and the cryptocurrency boom have been by far the biggest topic of discussion in financial markets.

The 87-year-old Buffett has previously lamented missing out on investments in Google (GOOGL) and Amazon, but now owns about $28 billion worth of Apple (AAPL) stock. It appears, however, will not be an early adopter in bitcoin — the cryptocurrency received no mention, explicit or passing, in this year’s annual letter.

And while it would have been somewhat out of character for Buffett to launch into commentary on a digital asset that has few easily-explicable characteristics save for the fact that it has gone up in price a lot over the last year, many of his peers have been unable to help themselves. Charlie Munger, for instance, called bitcoin a “noxious poison” earlier this month.

As The Bard tells us, however, the better part of valor is discretion.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Goldman Sachs says U.S. economic data right now is ‘as good as it gets’

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Foreign investors might be the key to forecasting a U.S. recession