PROG Holdings Inc (PRG) Announces Q4 2023 Results and Initiates Dividend

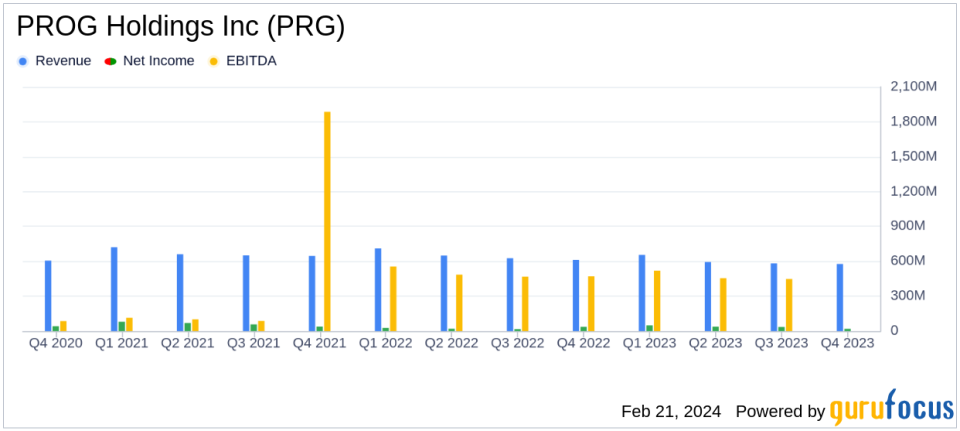

Consolidated Revenues: $577.4 million, a decrease of 5.7% year-over-year.

Earnings Before Taxes: $28.5 million for the quarter.

Adjusted EBITDA: $61.0 million, down 18.1% from the same period in 2022.

Diluted EPS: Reported at $0.41, with Non-GAAP Diluted EPS at $0.72.

Progressive Leasing GMV: Increased by 1.2% year-over-year to $547.6 million.

Capital Returns: Initiation of a quarterly cash dividend and a $500 million share repurchase authorization.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 21, 2024, PROG Holdings Inc (NYSE:PRG) released its 8-K filing, announcing its financial results for the fourth quarter ended December 31, 2023. The fintech holding company, which operates Progressive Leasing, Vive Financial, Four Technologies, and Build, reported consolidated revenues of $577.4 million, marking a 5.7% decrease from the same period in the previous year.

Despite the revenue decline, the company's President and CEO, Steve Michaels, expressed satisfaction with the quarter's performance, highlighting strong customer behavior and conversion rates during the holiday season. However, the company faced challenges, including a lower gross leased asset balance entering the quarter and deleveraging of SG&A expenses, which contributed to an 18.1% decrease in adjusted EBITDA to $61.0 million.

PROG Holdings Inc's financial achievements, such as the initiation of a quarterly cash dividend of $0.12 per share and a new $500 million share repurchase authorization, underscore the company's commitment to returning value to shareholders. These strategic moves are particularly significant for a company in the Business Services industry, where maintaining a balance between reinvestment in the business and capital returns is crucial for sustaining growth and shareholder confidence.

Financial Performance Analysis

PROG Holdings Inc's diluted earnings per share (EPS) for the fourth quarter stood at $0.41, down from $0.73 in the prior year. The non-GAAP diluted EPS was $0.72, compared to $0.84 for the same period in 2022. The company's Progressive Leasing segment reported a modest increase in Gross Merchandise Volume (GMV) of 1.2% to $547.6 million, attributed to strong customer demand during the holiday season.

The company ended the quarter with $155.4 million in cash and $600 million in gross debt. Stock repurchases in the quarter amounted to $31.3 million at an average price of $28.35 per share. The Board's authorization for share repurchases and the initiation of a quarterly dividend reflect a cash-efficient model that aims to balance reinvestment with shareholder returns.

PROG Holdings Inc's outlook for 2024 anticipates continued soft demand for consumer durable goods but remains committed to its three-pillared strategy to grow, enhance, and expand. The company's forward-looking statements suggest a focus on managing portfolio performance and SG&A spending while investing in key growth initiatives.

Value investors may find PROG Holdings Inc's approach to capital returns and cost discipline appealing, especially in the context of the challenging retail conditions that the company navigates.

"We believe our cash-efficient model will allow us to reinvest in the business while pursuing a balanced capital return strategy for our shareholders," said Steve Michaels, President and CEO of PROG Holdings Inc.

For a more detailed breakdown of PROG Holdings Inc's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from PROG Holdings Inc for further details.

This article first appeared on GuruFocus.