$1.5 trillion student debt crisis: Many borrowers still don't understand the costs

President Trump and leading Democratic presidential candidates seem to agree on the need to alleviate the nation’s $1.5 trillion student loan crisis: Trump’s proposed 2020 budget released last month would forgive undergraduates’ student loans after 15 years when they’re enrolled in an income-based repayment program, and Senator Elizabeth Warren proposed taxing those who make more than $50 million in income to eliminate student debt and tuition at public colleges.

Nevertheless, given the level of animosity in Washington, student loan relief from Washington seems unlikely anytime soon.

That’s unfortunate because a new study from Lendkey Technologies, a digital lending partner to hundreds of credit unions and banks, found that borrowers are still taking on massive amounts of debt without fully understanding the financial burden that awaits them after graduation. The online survey, conducted in March 2019, polled 2,390 Americans over age 18 who took out student loans from public and/or private lenders.

Nearly half of borrowers surveyed had no idea what their debt obligations will be once they graduate: 49% of borrowers did not know what their monthly minimum payment would be, with as few as 10% of 18-34 year-olds knowing what the exact payment amount would be.

“For millions of U.S. students, higher education begins with a significant decision that can impact their financial health for the rest of their lives,” LendKey Technologies CEO Vince Passione said in a statement. “A quality education should begin with sound advice, not only about the best course of study, but also the best means of how to finance it.”

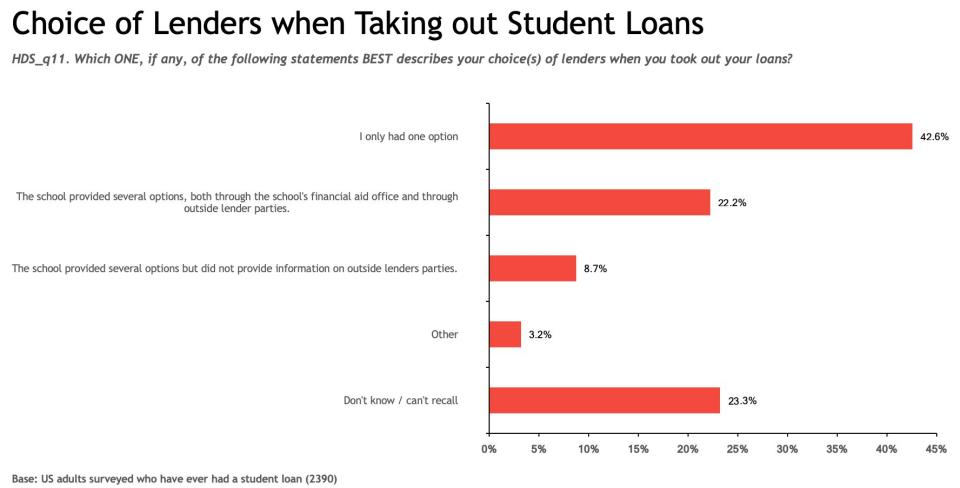

Student borrowers need better financial advice, according to the survey. Just 22% of them say their academic institutions offered them a range of lender options through the school or outside lenders. And over half of students blamed their college or university for failing to provide them with “sufficient” information about the debt they were taking on. Furthermore, more than 40% of students say they were only given a single option.

‘Think with your head, not your heart’

Alternatives can be key to helping students avoid crippling debt once they start a new job after graduation.

“Unlike any other asset that you might buy like a home or a car, where you would payment shop, most consumers don’t payment shop when they’re shopping for education,” Passione told Yahoo Finance. “Consumers are still struggling with this concept.”

Passione noted that he encourages students to seriously consider what job they would like to pursue after graduation and if that potential salary would enable them to afford the debt obligations they decide to take on.

“It’s all about a payment when you come out,” he added. “I tell people: ‘Think with your head, not your heart.’ If what’s going to make you happy is the [college] experience, then remember you’re paying for that experience for the rest of your life.”

The survey found that 75% of student loan borrowers said that financing made it possible for them to attend a school they otherwise would not have been able to afford.

And while some may be earning a higher salary after graduation, only half of those surveyed were satisfied with their school choice once they factor in their ability to repay the cost.

Follow Sibile Marcellus on Twitter: @SibileTV

More from Sibile:

Single women are more confident about managing money than married women: UBS

Closing the southern border could cost $2.5 billion a week: Wells Fargo

Gen Y and Z will drive up demand for rentals over the next 10 years

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.