Top 5 Consumer Staples Picks YTD With Room to Grow in December

U.S. stock markets witnessed severe volatility once again last week. Wall Street had seen an impressive rally from mid-October. A less-than-expected inflation rate in October, courtesy of several measures along with a dovish comment from Fed Chairman Jerome Powell in November, boosted investors’ confidence in risky assets like equities.

However, hotter-than-expected job additions and a higher wage rate in November once again terminated the rally prematurely what we saw from mid-June to mid-August. A tight labor market is being perceived as a pushback from the Fed’s recent stance of trying to reassure the markets that it would slacken its stringent policy measures to avoid a hard-landing of the economy.

At this stage, it will be fruitful to invest in defensive stocks like consumer staples to stabilize your portfolio. We have selected five consumer staple stocks with a favorable Zacks Rank. These stocks have appreciated more than 20% with room for more upside in December. These companies are — Archer-Daniels-Midland Co. ADM, Campbell Soup Co. CPB, MGP Ingredients Inc. MGPI, The Hershey Co. HSY and e.l.f. Beauty Inc. ELF.

Consumer Staples Immune to the Vagaries of Economic Cycle

Market participants are now unsure whether the Fed will reduce the magnitude of the interest rate hike in the December FOMC meeting, as indicated by Powell, or will hike the rate by 75 basis points for the fifth time in a row.

Investors are not sure whether the terminal interest for this round of monetary tightening will stay within the 5% threshold or go beyond that. A section of economists and financial experts are still concerned that a higher interest rate will lead to a recession in 2023.

The consumer staples sector is mature and fundamentally strong as demand for such services is generally immune to the changes in the economic cycle. The consumer staples sector includes companies that provide necessities and products for daily use. This makes the sector defensive in nature.

Therefore, this has always been a go-to place for investors, who want to play it safe during extreme market fluctuations irrespective of internal or external disturbances. Moreover, the sector is known for the stability and visibility of its earnings and cash flows. Consequently, adding stocks from the consumer staples basket lends more stability to portfolios in an uncertain market.

Out of the 11 broad sectors of the market’s benchmark — the S&P 500 Index — the energy sector is solely trading in positive territory with a huge rally of 49% year to date. However, among the remaining 10 sectors, consumer staples has suffered marginally by 0.5% year to date while the benchmark has itself tumbled 16.3%.

Our Top Picks

We have narrowed our search to five consumer staples stocks with strong growth potential for December. These stocks have seen positive earnings estimate revisions for this year in the past 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

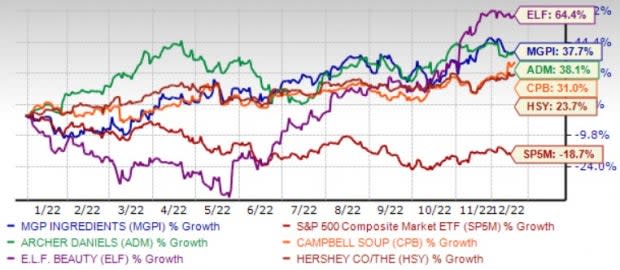

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Archer-Daniels-Midland has been gaining from solid demand, improved productivity and product innovations. Persistent growth in the Nutrition segment of ADM, aided by significant gains in the Human and Animal Nutrition units, remains the key growth driver.

Archer-Daniels-Midland expects the nutrition segment to record operating profit growth of 20% in 2022. The company has been significantly progressing on its three strategic pillars — optimize, drive and growth.

Zacks Rank #1 Archer-Daniels-Midland has an expected earnings growth rate of 44.3% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.7% over the past 60 days. The stock price of ADM has jumped 38.1% year to date.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. MGPI’s Distillery Products segment primarily offers food-grade alcohol, fuel-grade alcohol, and distiller’s feed. MGPI’s Ingredient Solutions segment primarily provides specialty wheat starches and proteins, commodity wheat starches, and commodity vital wheat gluten.

Zacks Rank #2 MGP Ingredients has an expected earnings growth rate of 12.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the past 60 days. The stock price of MGPI has climbed 37.7% year to date.

Campbell Soup manufactures and markets food and beverage products. CPB’s pricing actions, supply chain productivity improvements as well as cost-saving initiatives have been aiding amid a rising cost scenario.

Strength in the in-market brand performance and solid consumer demand remained upsides. Consumption rose 8% in the fourth quarter of fiscal 2022. Campbell Soup benefits from strength in its Snacks business as well as its focus on innovation.

Zacks Rank #2 Campbell Soup has an expected earnings growth rate of 4.9% for the current year (ending July 2023). The Zacks Consensus Estimate for current-year earnings has improved 3.1% over the past seven days. The stock price of CPB has surged 31% year to date.

The Hershey is benefiting from solid consumer demand due to sustained at-home consumption. Higher prices, improved volumes and contributions from buyouts drove HSY’s performance. The buyouts of Pretzels, Dot's and Lily's boosted net sales by 4.6 points.

Management expects pricing to remain strong in 2022. Also, Hershey is gaining from its focus on innovation and capacity expansion. HSY raised its top and bottom-line view supported by greater visibility in 2022.

Zacks Rank #2 Hershey has an expected earnings growth rate of 15.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the past seven days. The stock price of HSY has advanced 23.7% year to date.

e.l.f. Beauty operates as a cosmetic company. ELF’s cosmetic category primarily consists of face makeup, eye makeup, lip products, nail products and cosmetics sets/kits, excludes beauty tools and accessories, such as brushes and applicators.

Zacks Rank #1 e.l.f. Beauty has an expected earnings growth rate of 33.3% for the current year (ending March 2023). The Zacks Consensus Estimate for current-year earnings has improved 23.6% over the past 60 days. The stock price of ELF has soared 64.4% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report