Warren Buffett's Berkshire Bolsters Holdings in Liberty SiriusXM Group Acquisition

Warren Buffett (Trades, Portfolio), the esteemed investor and Chairman of Berkshire Hathaway, has made a notable addition to the firm's extensive portfolio by acquiring shares in the Liberty SiriusXM Group (NASDAQ:LSXMA). This move, executed on January 4, 2024, signifies a strategic investment by one of the world's most respected value investors. The transaction details reveal a purchase of 1,090,754 shares at a trade price of $29.76, increasing Berkshire Hathaway's total holdings in the company to 21,298,434 shares.

Guru Profile: The Oracle of Omaha

Warren Buffett (Trades, Portfolio)'s reputation as a master investor is unparalleled. Known as "The Oracle of Omaha," Buffett's investment acumen is the result of a storied career influenced by his mentor, Benjamin Graham. At the helm of Berkshire Hathaway, Buffett transformed a modest textile company into a powerhouse conglomerate, primarily focusing on insurance and other diverse investments. His value investing strategy, characterized by discipline, patience, and a keen eye for intrinsic value, has consistently outperformed the market, making his investment decisions a subject of close study by investors globally.

Details of the Trade

The recent transaction saw Buffett's Berkshire Hathaway firm add 1,090,754 shares of Liberty SiriusXM Group to its portfolio, marking a 0.01% impact. With a trade price of $29.76, the acquisition has increased the firm's position in the company to 0.2% of its portfolio, representing a 6.52% ownership stake in Liberty SiriusXM Group. This trade reflects Buffett's confidence in the company and aligns with his long-term investment philosophy.

Liberty SiriusXM Group Overview

Liberty SiriusXM Group operates as a subscription-based satellite radio service, offering a wide array of music, sports, entertainment, and other programming across the United States and Canada. Since its IPO on April 18, 2016, the company has grown to a market capitalization of $9.77 billion. Despite being labeled as modestly overvalued with a GF Value of $23.93, the stock's current price stands at $29.93, with a price-to-GF Value ratio of 1.25. The company's financial health and growth prospects are reflected in its GF Score of 62/100, indicating a moderate future performance potential.

Analysis of the Trade

Buffett's recent acquisition of Liberty SiriusXM Group shares at $29.76 each presents an interesting case when compared to the current stock price of $29.93 and the GF Value of $23.93. The stock has seen a modest gain of 0.57% since the trade date and has appreciated by 45.5% since its IPO. Year-to-date, the stock has experienced a 2.46% increase, suggesting a stable performance in the short term. The trade's impact on Berkshire Hathaway's portfolio is minimal, yet it underscores Buffett's strategy of investing in companies with favorable long-term prospects.

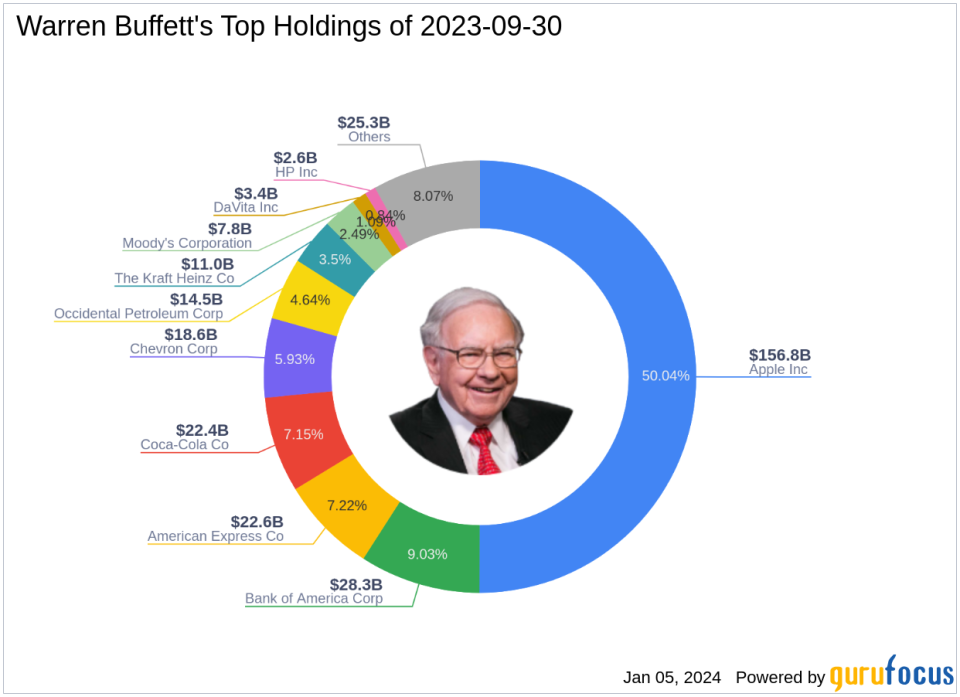

Guru's Holdings and Sector Focus

Warren Buffett (Trades, Portfolio)'s top holdings reflect a diverse range of sectors, with a significant emphasis on technology and financial services. The addition of Liberty SiriusXM Group to Berkshire Hathaway's portfolio complements its existing investments, which include major positions in Apple Inc (NASDAQ:AAPL), American Express Co (NYSE:AXP), Bank of America Corp (NYSE:BAC), Chevron Corp (NYSE:CVX), and Coca-Cola Co (NYSE:KO). The firm's equity stands at an impressive $313.26 billion, with technology and financial services being the top sectors.

Market Context and Other Gurus' Interest

Buffett is not alone in recognizing the potential of Liberty SiriusXM Group. Other notable investors such as Seth Klarman (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), and Wallace Weitz (Trades, Portfolio) have also invested in the company, indicating a broader interest in the media-diversified industry. The stock's performance must be viewed within the context of the overall market and its industry segment, which has seen varying degrees of success among its players.

Financial Health and Future Potential

Liberty SiriusXM Group's financial health is a mixed bag, with a Financial Strength rank of 4/10 and a Profitability Rank of 8/10. The company's Growth Rank is also favorable at 8/10, but its GF Value Rank stands at 3/10, suggesting that the stock may be overvalued relative to its intrinsic value. The Momentum Rank is not applicable, indicating a lack of sufficient data. However, with a Piotroski F-Score of 6 and an Altman Z-Score of 0.92, the company's financial stability and profitability are evident, albeit with some caution due to its low cash to debt ratio of 0.03. These factors will play a crucial role in determining the stock's future performance potential.

Conclusion

Warren Buffett (Trades, Portfolio)'s recent investment in Liberty SiriusXM Group is a testament to Berkshire Hathaway's strategy of identifying companies with strong long-term growth prospects. While the trade's immediate impact on the portfolio is modest, it aligns with Buffett's philosophy of acquiring great companies at attractive prices. As the market continues to evolve, investors will be watching closely to see how this investment plays out in the context of Berkshire Hathaway's storied investment history.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.