Warren Buffett's Roller-Coaster Ride With Retail

Retail is an easy business to like. One of Warren Buffett (Trades, Portfolio)'s business tenets is investing in businesses that we can understand, and retail is easy to comprehend for individual investors. We are close to the action, and we can easily gain insight into how well Starbucks (NASDAQ:SBUX) is doing by how long the line is in the airport, in our local grocery store or in a retail store location.

Warning! GuruFocus has detected 6 Warning Signs with BRK.A.

I was a bit shocked to hear about Buffett's aversion to retail while listening to the October Acquired Podcast interview with the late Charlie Munger (Trades, Portfolio). Some of the most notable Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) success stories are about retail like the 1972 purchase of See's Candy, or the 1983 purchase of Nebraska Furniture Mart. However, Munger indicated Buffett's distaste for retail was because the industry has evolved, matured and become too competitive. It is no longer the great industry it once was. This story looks at retail industry characteristics and some of Berkshire Hathaway's major retail acquisitions.

Industry Overview

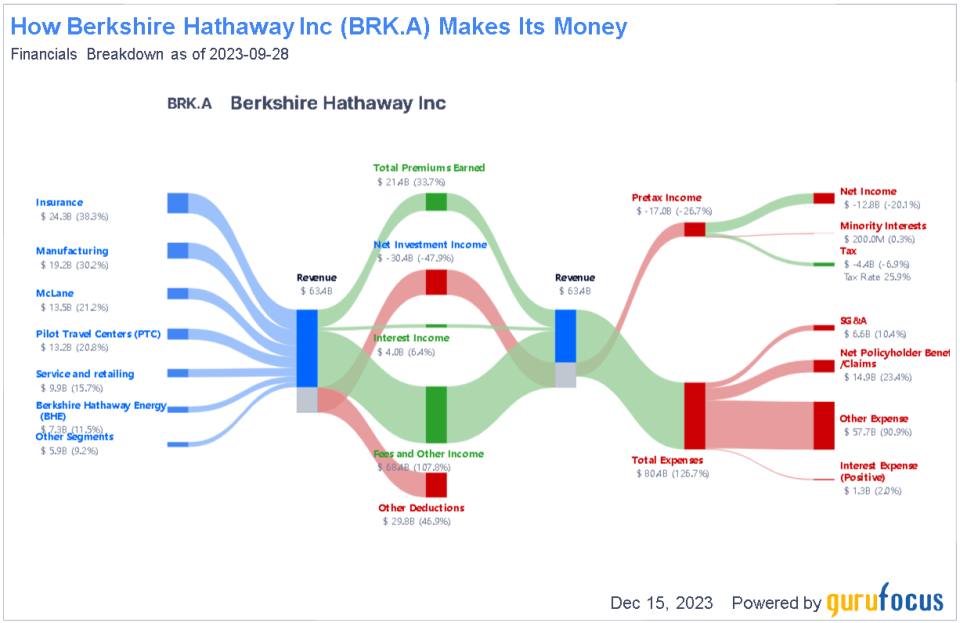

Retail is broadly defined as commerce between a business and the end consumer. This encompasses a wide range of Berkshire Hathaway products and services businesses such as vehicles, financial and insurance products, service products and energy in addition to brick-and-mortar or online store fronts. Berkshire combines its retail operations with its service operations businesses, an appropriate choice as the line defining these two businesses is often blurred. Not all Berkshire businesses and investments are neatly defined. For example, Geico offers retail insurance as part of the insurance group; PacifiCorp that offers retail energy services and Berkshire's real estate brokerage services belong to the Berkshire Hathaway Energy group. Cort Business Services markets to both business customers and consumers. For simplification, I am narrowing my focus to a discussion of the following GuruFocus industries:

Retail defensive Includes grocery, convenience stores and discount stores.

Retail cyclical-Includes hardline, softline and specialty stores.

Consumer cyclical Restaurants

Retail is a long-standing industry that has been around since ancient times. In the last 100 years, the industry has evolved from department stores in the early 20th century, to shopping malls in the 1950s, to online commerce in 1990s and social media platforms like Meta Platforms' (NASDAQ:META) Facebook and Instagram beginning in the mid-2000s. The evolution of payment system changes and omni-channel experiences like the advent of cash registers, credit cards and now reverse logistics and curbside pickup have facilitated transactions between buyers and sellers. New technologies like augmented reality and other forms of V-commerce are enhancing the retail experience for consumers.

The move from physical store retailing to online and other types of electronic shopping has allowed businesses to lower capital expenditures compared to cash flow generation. On the flipside, it has allowed easy entrance, which has intensified competition to the point where the profitability of retail has waned as Munger indicated during his interview with Acquired.

Berkshire's current retail operations

Berkshire Hathaway still holds many wholly-owned retail operations and investments. Retail, excluding the Pilot Travel Center segment, accounted for 8.5% pre-tax earnings of as a percentage of sales for the first nine months of 2023. The following is a list of his prominent retail holdings, including both wholly-owned and partial investments.

1972 | See's Candy | Candy Sales | Wholly Owned |

1983 | Nebraska Furniture Mart | Home Furnishings | Wholly Owned |

1989 | Borsheims | Jewelery | Wholly Owned |

1995 | Helzberg Diamonds | Jewelery | Wholly Owned |

1995 | R.C. Willey | Jewelry | Wholly Owned |

1997 | Star Furniture | Home Furnishings | Wholly Owned |

1998 | Dairy Queen | Restaurant | Wholly Owned |

1999 | Jordan's Furniture | Home Furnishings | Wholly Owned |

2000 | Ben Bridge Jewelers | Jewelery | Wholly Owned |

2002 | Pampered Chef | Direct marketer of kitchen tools | Wholly Owned |

2012 | Oriental Trading Company | Party supplies, school supplies and toys and novelties | Wholly Owned |

2015 | Berkshire Hathaway Automotive (BHA) | Automotive | Wholly Owned |

2015 | Detlev Louis Motorrad (Louis) | Motorcycle accessories based in Germany | Wholly Owned |

2017 | Pilot Travel Centers | Fuel and Convenience Stores | 80% |

2019 | Kroger (NYSE:KR) | Grocer | 7.14% |

2019 | Amazon (NASDAQ:AMZN) | Online Retailer | 0.11% |

2022 | Floor and Decor Holdings (NYSE:FND) | Flooring | 4.51% |

The following profiles are by no means an exhaustive list that Buffett or Berkshire Hathaway has bought and sold throughout the years.

Retail sob stories

Hoschild-Kohn

In 1966, Munger and Buffett were quite enthusiastic about retail. Along with one other investor, they formed a retail holding company called Diversified Retail Companies and set out on their retail journey with the Graham-style purchase of Hoschild-Kohn, a downtrodden Baltimore department store, for $6 million dollars. The venture eventually flopped because management and DRC's partners could not agree on the addition of two new stores in Pennsylvania and Maryland. Buffett compromised his values by allowing the New York store, but squashed plans for the Maryland one. He also noticed there was intense competition and a need to keep up with the Joneses. When one retailer added a business enhancement, all the surrounding retailers were pressured to do so as well. DRC sold its stake in Hoschild-Kohn to Supermarkets General Corp in 1970 for approximately $5 million plus notes worth $6 million, so DRC profited from its investment despite the venture mishap. Hoschild-Kohn's Baltimore downtown store closed in 1977 and the chain closed in 1984. Diversified Retail Holdings was merged into Berkshire Hathaway in 1978.

Vornado

In a 1977 Wall Street Journal article, Buffett admitted he had lost $6 million dollars on Vornado, a company that originally started out in 1936 as a decorating company, but was transformed in 1959 into a discount retail chain when discounter, Two Guys from Harrison Inc., acquired Sutton Corp., a manufacturer of fans, air conditioners and heaters. The new company continued to operate its discount retailing business under the name Two Guys and expanded the Vornado appliance business by outsourcing the manufacturing process. The discount chain became a predecessor of big-box retailers like K-Mart and Walmart (NYSE:WMT). In its heyday, the chain operated as many as 60 stores, mainly on the East Coast. In 1967, Vornado acquired the West Coast supermarket chain, Food Giant Markets, for $50 million in stock. Sales instantly doubled, but the company had management integration problems and started accumulating debt. Profits began declining and by 1972, Vornado had sold off the Food Giant Chain. Vornado was taken over by Interstate Properties, a private shopping-center development partnership, in 1980. Two Guys was liquidated in 1981 and ceased operations in 1982. The real estate operations continued. The company became a REIT in 1993 and now operates as Vornado Realty Trust (NYSE:VNO).

Buffett admitted that he had fell for the value trap proposition of Vornado and that the discount retail industry was overstored. The chain's series of poor management decisions and overexpansion also contributed to its demise.

Walmart

Buffett may have forgotten his overstored comment when he started investing in this big-box retailer in 2005. I can only speculate why he bought the stock. Walmart still has market dominance in the retail space and Buffett has called Walmart one of the great stories of American business, but the stock performed poorly during the time Buffett owned it and by 2017, he had sold 90% of his shares. Although Walmart's sales volume still dwarfs those of other major competitors, its market share is shrinking, with Amazon gaining ground on the store retailing giant, which is struggling to keep up with e-commerce aspects of the business. As noted above, Berkshire Hathaway began buying Amazon in 2019, but he has admitted he wished he had bought it earlier.

Tesco

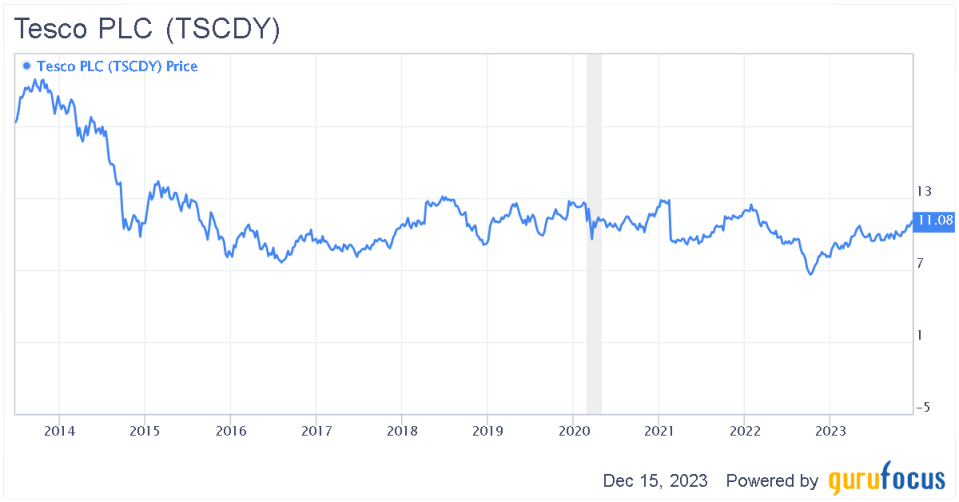

Buffett admitted he made a huge mistake when investing in British grocer Tesco PLC (LSE:TSCO) (TSCDY). Buffett first started investing in the company in 2006 and then amped up his shares to over 5% of the company in 2012 after the share price dropped by 16% over a profit warning issued by company CEO Philip Clarke. The company continued to struggle with competition from discount retailers and became involved in an accounting scandal in 2014, in which Clarke was ousted along with seven other executives. Buffett sold out of his Tesco stock by October of the same year and admitted he did not sell the stock quickly enough after it went south. He lost $444 million in the process.

TSCDY Data by GuruFocus

The above chart reflects Tesco's share price since the Berkshire purchase in 2014.

Costco

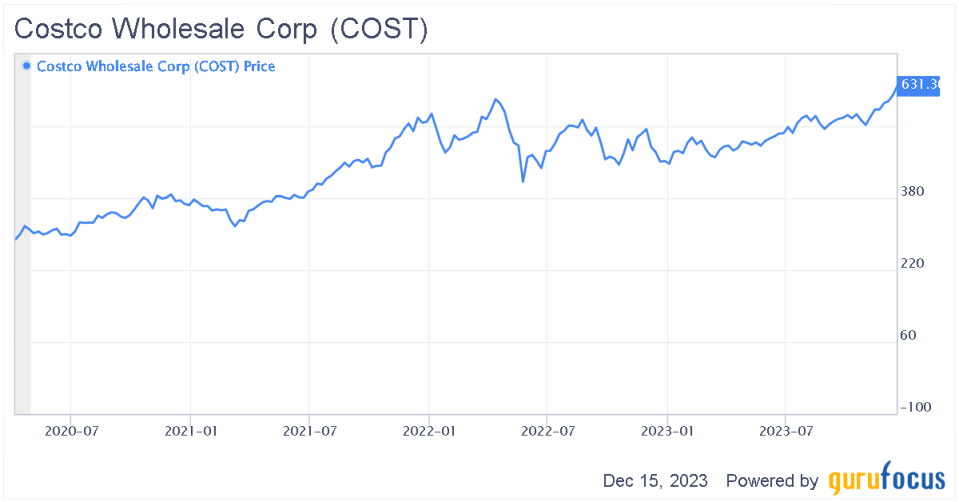

Charlie Munger (Trades, Portfolio) was known to be an avid fan of Costco Wholesale Corp. (NASDAQ:COST) and served on the company's board of directors since 1997. Buffett is less of a fan, but still praises the company, which is a dominant market player in the big-box retail discounting space. Berkshire first started investing in the stock in 1999 and held the stock for over 20 years, selling out in the third quarter of 2020. Again, no reason was given for the sale, but it may have been because Buffett suspected the stock was overvalued. Although Berkshire's Costco stake value grew from $32 million in 1999 to $1.3 billion in 2020, I'm still putting this in the sob story section because Costco's share price has risen by 60% after the sale. In hindsight, Buffett may have made a mistake by selling out.

COST Data by GuruFocus

The above chart reflects Costco's share price since Berkshire sold out in 2020.

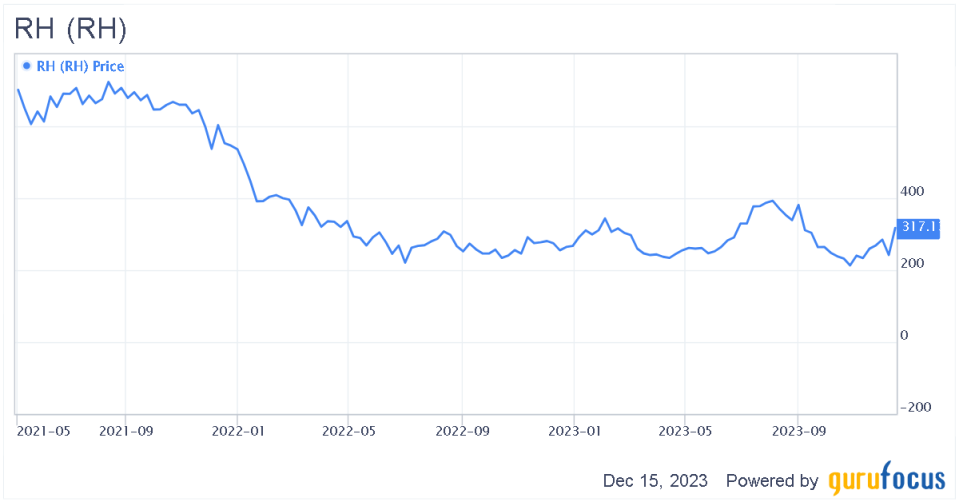

RH (NYSE:RH)

Buffett bought 1.2 million shares worth $206.3 million of the luxury furniture retailer commonly known as Restoration Hardware in 2019. Buffett has long been attracted to furniture stores since he purchased Nebraska Furniture Mart in 1983, which he often talks fondly about. Consumers prefer purchasing furniture at brick-and-mortar locations as the product is bulky and most people want to try out the product by sitting on sofas or lying on beds before they buy them. This allows management to observe the consumer in action and keep tabs on consumer feedback. As a luxury retailer, RH was particularly attractive since high-end items generally equate to higher gross margins.

Buffett sold his position in the company in the first quarter of the year for $575 million and made a considerable profit. He did not give a reason for the sale, but I suspect it may be due to mean reversion. Shares of the company have dropped nearly 65% since they peaked during the pandemic.

RH Data by GuruFocus

The above chart reflects RH's share price since the height of the pandemic.

Pilot Travel Centers

Berkshire Hathaway currently owns 80% of Pilot Travel Centers, a private company that operates truck stops throughout the U.S. and Canada. Berkshire began investing in the company in 2017 and now includes the investment in financial reporting as PTC on consolidated statements. PTC contributed 20.8% to Berkshire's revenues in the third quarter of 2023. Buffett is enthusiastic about the company and wants to buy the remaining 20%. The sob story comes in because Buffett is currently squabbling with company owner, Jimmy Haslam, over accounting methods. Haslam sued Berkshire in October claiming that Berkshire's changed accounting methods have artificially reduced the company's Ebit, lowering the valuation of the company. Berkshire counter-sued the Haslam family in November, alleging that Haslam secretly paid top-level executives to inflate short-term profits. The current turmoil may be just a blip in an otherwise successful venture. Whether or not this becomes a long-term or short-term sob story is yet to be determined.

PTC's portion of Berkshire revenue is 20.8%.

Retail darlings

See's Candy

Buffett's love affair with See's Candy started in 1972 when he bought the business for $25 million through Berkshire's Blue Chips Stamps affiliate. See's was the first investment in which Buffett paid a premium for business quality. Munger had a big influence over his decision. Prior to that time, he rigidly had adhered to Benjamin Graham's cigar butt strategy. See's had numerous characteristics that Buffett looks for in a business: product quality; exceptional management, its simple, easy-to-understand business model and, most importantly, pricing power. The company has consistently contributed to cash flow, profits and high return on capital. Its incredible pricing power has allowed the company to generate increased dollar sales revenues and cash flow in times when unit sales have waned. Cash flow is frequently used to fund operations of other Berkshire businesses.

NFM

Buffett was attracted to Nebraska Furniture Mart by the tenacity and integrity of its then 89-year-old founder, Rose Blumkin, who operated her store at expense ratios that were unmatched by competitors. Buffett bought the store in 1983 for 41 times post-tax earnings, which wasn't cheap. However, Buffett's 1983 shareholder letter implied the store generated sales of $500 per square foot annually and that its sales volume was more than the combined amount of all its Omaha competitors. The company has rebranded itself as NFM and now has stores in Texas, Kansas, Iowa and a clearance store in Omaha in addition to the original store.

The company also owns a 45-year-old, family-run Homemakers store in Iowa. Homemakers was founded in 1974 by an Iowa couple and purchased by NFM in 2000. In addition to its brick-and-mortar locations, the company has a robust web presence for both its NFM and Homemakers stores. NFM boomed during the Covid epidemic, as did the entire industry, as home-bound consumers with extra stimulus income invested in their living environments.

Borshiems

Borsheims is a 150-year-old Omaha-based jewelry store offering a wide selection of fine jewelry, watches, engagement rings and home decor. Throughout history, it has grown in square feet and product assortment, but still only operates a single Omaha store. It also has an online presence. The company has developed a reputation for buying in volume and passing on the savings to its customers. It is known for its extraordinary product value and its Signature Service. Buffett has been a long-time fan of the company. The store has also become a destination for Berkshire Hathaway shareholders, who enjoy special discounts and events during the annual meeting. Borsheims also sells exclusive Berkshire Hathaway memorabilia.

Buffett's 1989 purchase of the company was partially motivated by the company's outstanding manager at the time, Ike Friedman, who he referred to as Borsheim's managing genius and a great showman, who displayed shrewd business acumen as outlined in his 1989 shareholder letter. Today, Borsheims has been woman-run for nearly 20 years and does $40 million in sales.

R.C. Willey

Buffett's relationship with R.C. Willey is documented in the book, How to Build a Business Warren Buffett Would Buy: The R.C. Willey Story by Jeff Benedict. Buffett wrote the forward and the first chapter of the book. R.C. Willey was a Utah-based family-owned business when Buffett bought the company in 1995 for $175 million in stock. The retail chain began in 1932 as a door-to-door sales business of appliances. The first store was opened in 1950 in Syracuse, Utah. The business grew to six stores by the 1990s, was the Utah market leader in furniture and was making $257 million in sales when Buffett bought it. Bill Child, the CEO, was interested in selling and was introduced to Buffett by Irv Blumkin, the CEO of Nebraska Furniture Mart. Buffett was attracted to the company's large moat signified by market dominance and its honest and committed customer-centric management with no debt and good capital allocation. The business was also known for adherence to the founding families' strict religious principles that included a refusal to keep Sunday business hours. (This later became a thorn in Buffett's side during a discussion between Buffett and Child about expansion into Nevada.) Child placed more importance on the company's legacy than the sales price and sold to Buffett even though the offer was over $20 million less than others he had received. Buffett has called R.C. Willey, A jewel of a company. Child referred to his Buffett transaction as the climax of my business career. R.C. Willey currently has 10 stores and 4 distribution centers in Utah, Idaho, California and Nevada. The company currently makes over $500 million in sales and its stores are still closed on Sundays.

DQ

The first Dairy Queen store was opened in 1940 by Sherb Noble in Illinois and offered soft-serve ice cream based on a recipe created by the McCollough family in 1938. Dairy Queen acquired the Orange Julius chain in 1987. Berkshire Hathaway acquired Dairy Queen in 1998 for $585 million. Dairy Queen's competitive advantages lie in its brand equity and innovative creamy concoctions like Blizzards and Dilly Bars. It was also the first restaurant to offer its unique blend of soft-serve ice cream. DQ has a franchise business model that requires low capital allocation and allows the business to generate tremendous cash flow and leverage franchise owners' local knowledge and expertise while maintaining quality and consistency across its locations. Franchise owners are responsible for their stores' capital expenditures and pay DQ for initial franchise fees, training fees, 4% royalty fees on sales and promotional program fees. An analyst from Piper Jaffray Inc. called it a high-margin, very profitable business in which Berkshire [goes] down to the post office once a month and [picks] up a gunny sack full of [royalty] checks. At the time of the Berkshire acquisition, less than 1% of the store locations were company operated and the company had 23 consecutive years of earnings. In 1987, Dairy Queen bought Orange Julius, which is also a franchise business. Buffett has praised Dairy Queen for its performance and potential, calling it a wonderful company and a great American brand. He loves products and he, along with his great-grandchildren, are regulars at the Omaha store.

Since the acquisition, Dairy Queen has grown its sales and profits and has expanded its menu to include burgers, chicken strips, salads and sandwiches. The company officially changed its name to DQ in 2000 and opened the first DQ Grill & Chill in 2001 in Tennessee. The chain has more than 6,000 stores nationwide. Dairy Queen has also increased its global presence, operating in more than 20 countries, with a strong focus on China, where it has over 1,000 stores. Its current CEO is Troy Bader and the company made roughly $457 billion in annual sales in 2022.

Jordan's Furniture

Massachusetts-based Jordan Furniture has a story that parallels those above, however, the siblings, Eliot and Barry Tatelman, who ran the company at the time of the Berkshire acquisition were somewhat more flamboyant than their counterparts at NFM and R.C. Willey. The brothers took over the family-run business from their father in the 1970s, stopped their traditional newspaper advertising and began advertising aggressively on radio and TV, starring in most of the spots and spoofing movies and celebrities. They coined the term, Shoppertainment in the early 1990s that described their unique promotion strategy of combining their wacky ads and celebrity status with amusement park-like attractions like a flight-simulator movie ride, zip lines and multimedia Mardi Gras shows to provide memorable customer experiences. The brothers became pop culture icons throughout New England, known for their humor and charisma. The business grew from a single location to four stores generating $250 million by the time the business was sold to Berkshire Hathaway in 1999.

In 2002, it added an IMAX theater to the Natick, Massachusetts store and, in 2004, it added another one in the Reading, Massachusetts store. Both these theaters had to be shut down during the pandemic. Barry left the company in 2006 to pursue an entertainment career.

The Shoppertainment strategy requires huge capital outlay by the company, which is typically not a characteristic Buffett likes, but the large moat it has developed has likely overcome any objection Buffett had toward its expenditures. The attractions may also contribute to increased sales as customers are persuaded to extend their store visits. After the acquisition, Buffett stated, Jordan's Furniture is truly one of the most phenomenal and unique companies that I have ever seen. Jordan's Furniture's strengths focus on a combination of friendly service, no-nonsense merchandising and strong brand exemplified by its unique marketing strategy. Jordan's currently has eight stores across New England.

Benbridge Jewelers

Benbridge Jewelers is another family-run business that has over a 100-year-old history. The company, based in Seattle, is currently lead by Lisa Bridge. At the time Buffett purchased Benbridge in 2000 for an undisclosed amount, it had a reputation for its cautious approach to expansion to keep from overstretching its financial resources and for promoting from within, which resulted in one of the lowest employee turnover rates for the industry. The Berkshire transaction was initiated by Ed Bridge, Lisa's father and co-CEO at the time, who wished to extend the business' legacy and was concerned over inheritance tax issues. Before Buffet's acquisition, the Bridge family had grown the store from one location purchased from founder Sam Silverman in 1927 to 63 stores nationally with consistent revenue growth for the prior 15 years. Buffett made the purchase based on a strong recommendation from Barnett Helzberg, who had transformed Helzberg Diamonds from a struggling jewelry chain in the 1960s to a 143-store chain by moving downtown stores to shopping malls when Buffett bought the chain in 1995.

Benbridge offers premier brands and has a knowledgeable staff of certified gemologists and certified watchmakers who have enhanced the customer experience. Compared to Borsheims, Benbridge is positioned as a luxury retailer that bases value on personal service versus low prices, thus it serves a different market of consumers and is a good complement to Berkshire's other jewelry retailers. It currently operates 80 stores.

Berkshire Hathaway Automotive

Berkshire Hathaway Automotive is one of the largest dealership groups in the U.S., with over 80 dealerships representing 27 automakers across 10 states. The business represented 68% of combined retail revenues in the first three quarters of 2023. Berkshire Hathaway acquired the 62-year-old dealership chain, formerly known as Van Tuyl Group, in 2014 for an undisclosed amount. At the time of the acquisition, Van Tuyl Group was the third-largest dealership nationally doing over $8 billion in revenue, and had 78 independent dealerships with over 100 franchises that reaped all the franchise benefits documented above. At the time of the purchase, Buffett was quoted as saying, This is just the beginning for Berkshire Hathaway Automotive. The Van Tuyl Group displayed many of the characteristics of the other sweetheart businesses in the Berkshire portfolio: a well-established dominant player with a long history, excellent management, great capital allocation with its franchise business model and great competitive advantages due to size, scale and a diversified portfolio of both new and used vehicles spanning a range of economy to luxury brands, service and warranty plans. According to Automotive News, Berkshire Hathaway Automotive ranked fifth among the top 150 dealership groups in the U.S. in 2020.

Whether or not BHA becomes a long-term success story or a long-term sob story is yet to be determined. Although the business is Berkshire's largest retail holding, investors have expressed concerns over the long-term prospects of the company due to its predominantly physical dealerships in the face of online shopping; however, BHA is in the process of building out its omnichannel approach.

Takeaways

Whether or not a retail business becomes either an investment success or failure is determined by a combination of factors that are inherent in quality businesses. Price, scale, service or network effect individually will not be sufficient to compete in this turbulent industry, as illustrated by the many examples of large companies like Sears and Macy's (NYSE:M) that are struggling currently. As quoted by Buffett:

"Retailing is a tough business. During my investment career, I have watched [many] retailers enjoy terrific growth and superb returns on equity for a period, and then suddenly nosedive, often all the way into bankruptcy. This shooting-star phenomenon is far more common in retailing than it is in manufacturing or service businesses. In part, this is because a retailer must stay smart, day after day. Your competitor is always copying and then topping whatever you do. Shoppers are meanwhile beckoned in every conceivable way to try a stream of new merchants. In retailing, to coast is to fail."

Successful retailers will need to evolve quickly to consumers changing shopping habits by adopting new technologies and omnichannel presences. The success stories featured here all have similar characteristics: long operating histories of consistent performance, market dominance or a niche marketing superiority, simplicity, efficient operations, high gross margins and good management signified by low debt-to-equity ratio, high return on equity and a conservative approach to growth and expansion. Buffett has said, Buying a retailer without good management is like buying the Eiffel Tower without an elevator. Prospective retail investors may want to evaluate pricing power by examining comparative store sales or unit sales instead of just year-over-year revenue growth (Please note that this is my opinion as a non-credentialed investor and does not constitute investment advice.) As stated above, See's has been able to increase gross sales even when volumes are down. A one-pound box of See's Candy has increased in price from less than $2 in 1972 when Buffett purchased the company to nearly $30 currently. See's products exceed the prices of competitor Russell Stover by almost 30% and are viewed as superior. Pricing premiums that translate to high gross margins are also why Buffett likes jewelry businesses. Jewelry is a centuries-old business that isn't going anywhere, so it's a safe bet. He is dearly fond of furniture stores and credited his experience with them in helping him determine Apple's net worth. Of NFM, he was quoted as saying I can learn very easily how consumers react to different things there. According to the 2022 annual report, Berkshire's home furnishing businesses represented 20% of retail revenues and are known for their ability to control costs and to produce high business volume by offering significant value to their customers.

Although Buffet still dips his toe into the retail realm from time to time, he concedes that he has made many mistakes and that it is generally not an industry he does not like to be involved in. With his advanced age and the recent death of his beloved sidekick, we know Buffett has been diverting most of his acquisition decisions to those who will be next at the helm, but it will be interesting to see what retail escapades Berkshire has in the future.

This article first appeared on GuruFocus.