What's Driving Varonis Systems Inc's Surprising 14% Stock Rally?

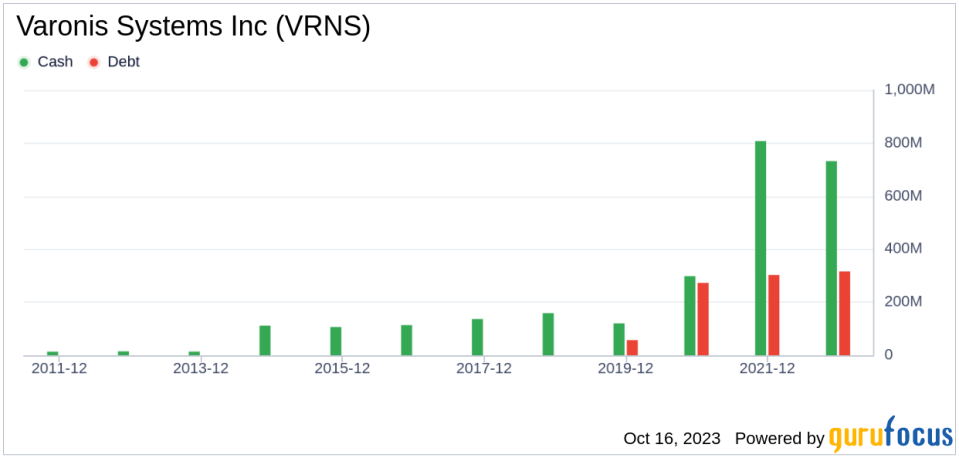

Varonis Systems Inc (NASDAQ:VRNS), a prominent player in the software industry, has been making waves in the stock market. With a current market cap of $3.55 billion and a stock price of $32.42, the company has seen a 14.15% surge in its stock price over the past three months. Despite a slight dip of 1.20% in the past week, the overall performance remains impressive. The GF Value of the stock stands at $54.31, down from its past GF Value of $57.54. This indicates that the stock is significantly undervalued, presenting potential opportunities for investors.

Unveiling Varonis Systems Inc

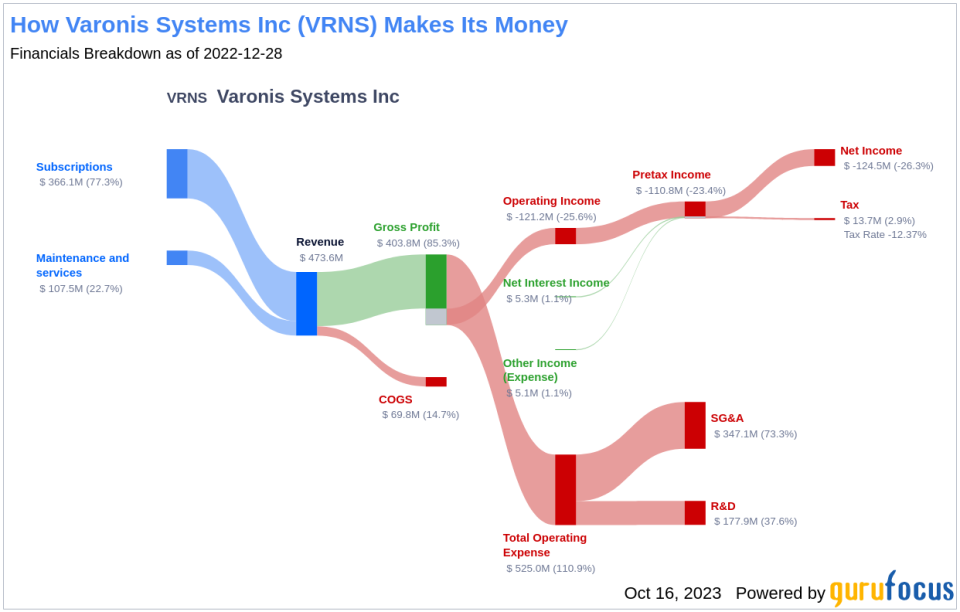

Established in 2004 and publicly listed in 2014, Varonis Systems Inc is a cybersecurity vendor specializing in data privacy and security. The company is currently transitioning its on-premises customers to its cloud products, delivered as software-as-a-service. This strategic shift towards cloud-based products is expected to significantly impact the company's business model and future growth prospects.

Profitability Analysis of Varonis Systems Inc

Varonis Systems Inc's profitability rank stands at 3 out of 10, indicating its profitability relative to other companies. The company's operating margin is -24.23%, better than 24.06% of companies in the industry. Its ROE and ROA stand at -23.17% and -11.19% respectively, while its ROIC is -57.64%. These figures, although negative, are better than a significant percentage of companies in the industry, indicating the company's relative strength in generating cash flow.

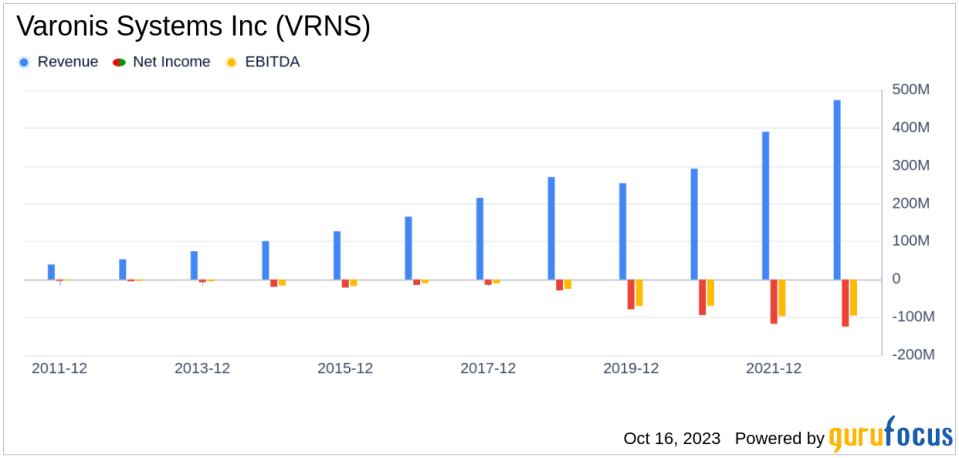

Growth Prospects of Varonis Systems Inc

The company's growth rank is 6 out of 10, indicating its growth relative to other companies. The 3-year and 5-year revenue growth rates per share stand at 15.70% and 9.50% respectively, outperforming a significant percentage of companies in the industry. The future total revenue growth rate estimate is 10.94%, suggesting promising growth prospects. However, the company's 3-year and 5-year EPS without NRI growth rates are -9.40% and -46.70% respectively, indicating a need for improvement. The future EPS without NRI growth rate estimate is 49.81%, suggesting a potential turnaround in profitability.

Major Holders of Varonis Systems Inc Stock

The top three holders of Varonis Systems Inc's stock are Ron Baron (Trades, Portfolio) with 972,009 shares (0.89%), Jim Simons (Trades, Portfolio) with 586,300 shares (0.53%), and Baillie Gifford (Trades, Portfolio) with 26,782 shares (0.02%). Their significant holdings indicate a strong belief in the company's potential and future growth.

Competitors in the Software Industry

Varonis Systems Inc faces stiff competition from other players in the software industry. Nutanix Inc (NASDAQ:NTNX) with a market cap of $9.24 billion, Engagesmart Inc (NYSE:ESMT) with a market cap of $3.45 billion, and Wix.com Ltd (NASDAQ:WIX) with a market cap of $4.78 billion are some of the main competitors.

Conclusion

In conclusion, Varonis Systems Inc has demonstrated impressive stock performance, with a significant surge over the past three months. Despite its negative profitability figures, the company's relative performance and growth prospects indicate potential for future improvement. With its transition to cloud-based products and the backing of major stockholders, Varonis Systems Inc is poised to make significant strides in the software industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.