WR Berkley Corp Leads as Scott Black's Top Portfolio Addition in Q3 2023

Delphi Management's President Scott Black (Trades, Portfolio) Reveals Latest Investment Moves

Scott Black (Trades, Portfolio), the seasoned investment guru and president of Delphi Management, Inc., has unveiled his investment strategy for the third quarter of 2023 through the latest 13F filing. Black, a Johns Hopkins and Harvard Business School alumnus, is known for his disciplined value investing approach, honing in on companies with strong fundamentals and management. His investment philosophy is deeply rooted in the Graham-Dodd school of value investing, ensuring that each investment is made at a low absolute valuation and after thorough management evaluation.

Summary of New Buys

Scott Black (Trades, Portfolio)'s portfolio saw the addition of 7 new stocks in the third quarter. Noteworthy new positions include:

Leidos Holdings Inc (NYSE:LDOS), with 13,944 shares, making up 1.32% of the portfolio and valued at $1.29 million.

American Express Co (NYSE:AXP), comprising 8,523 shares, which is about 1.3% of the portfolio, with a total value of $1.27 million.

Darling Ingredients Inc (NYSE:DAR), with 20,264 shares, accounting for 1.09% of the portfolio and a total value of $1.06 million.

Key Position Increases

Black also bolstered his stakes in 41 stocks. Significant increases include:

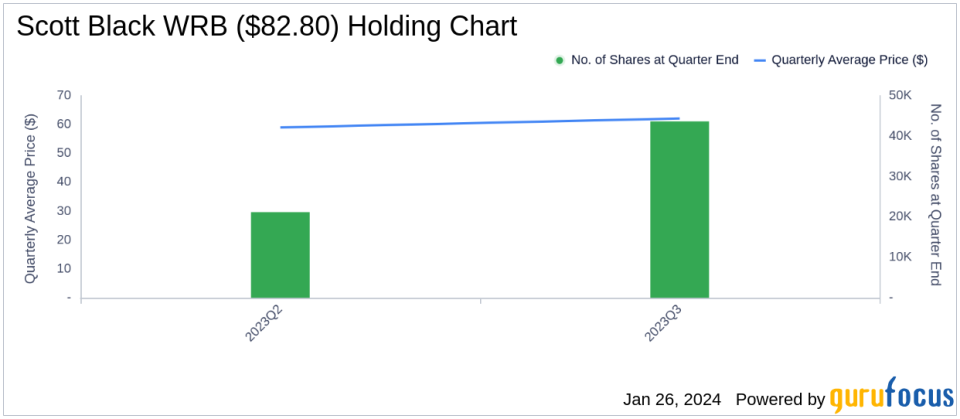

WR Berkley Corp (NYSE:WRB), with an additional 22,436 shares, bringing the total to 43,636 shares. This represents a 105.83% increase in share count, a 1.47% impact on the current portfolio, and a total value of $2.78 million.

Perion Network Ltd (NASDAQ:PERI), with an additional 22,902 shares, bringing the total to 38,923 shares. This marks a 142.95% increase in share count, with a total value of $1.19 million.

Summary of Sold Out Positions

Exiting complete positions, Scott Black (Trades, Portfolio) sold out of 9 holdings in the third quarter of 2023, including:

CACI International Inc (NYSE:CACI), where all 4,065 shares were sold, impacting the portfolio by -1.44%.

Anheuser-Busch InBev SA/NV (NYSE:BUD), with all 22,974 shares liquidated, resulting in a -1.35% portfolio impact.

Key Position Reductions

Black also trimmed positions in 32 stocks. The most significant reductions were:

Apple Inc (NASDAQ:AAPL), reduced by 1,605 shares, leading to a -10.91% decrease in shares and a -0.32% impact on the portfolio. The stock traded at an average price of $183.38 during the quarter and has returned 13.64% over the past 3 months and 0.86% year-to-date.

Sterling Infrastructure Inc (NASDAQ:STRL), reduced by 4,572 shares, resulting in a -19.04% reduction in shares and a -0.26% impact on the portfolio. The stock traded at an average price of $69.98 during the quarter and has returned 2.19% over the past 3 months and -16.83% year-to-date.

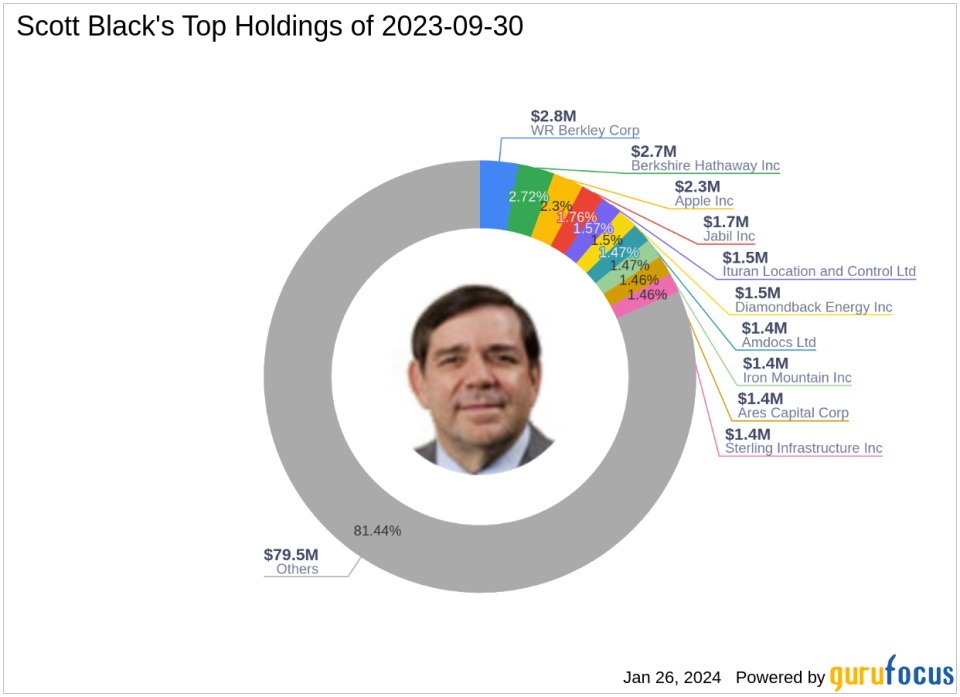

Portfolio Overview

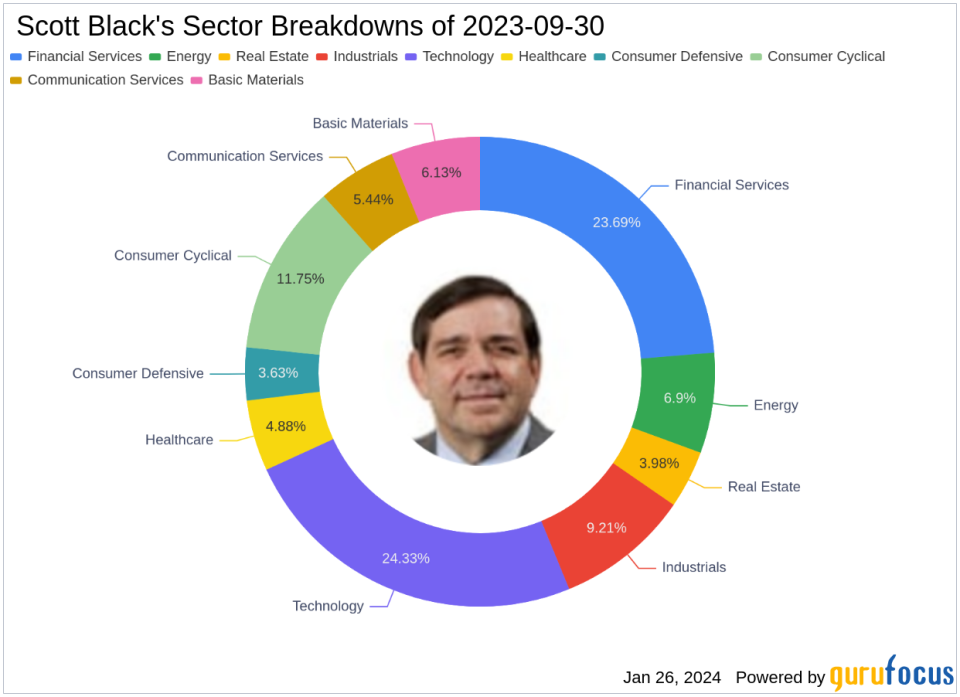

As of the third quarter of 2023, Scott Black (Trades, Portfolio)'s portfolio is composed of 80 stocks, with top holdings including 2.85% in WR Berkley Corp (NYSE:WRB), 2.72% in Berkshire Hathaway Inc (NYSE:BRK.B), 2.3% in Apple Inc (NASDAQ:AAPL), 1.76% in Jabil Inc (NYSE:JBL), and 1.57% in Ituran Location and Control Ltd (NASDAQ:ITRN). The investments span across a diverse range of industries, with significant concentrations in Technology, Financial Services, Consumer Cyclical, Industrials, Energy, Basic Materials, Communication Services, Healthcare, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.