Xcel Energy Inc (XEL) Reports Incremental Earnings Growth in 2023

GAAP Diluted EPS: Increased to $3.21 in 2023 from $3.17 in 2022.

Ongoing Diluted EPS: Rose to $3.35 in 2023, up from $3.17 in the previous year.

Net Income: Reported at $1.77 billion for 2023, slightly up from $1.74 billion in 2022.

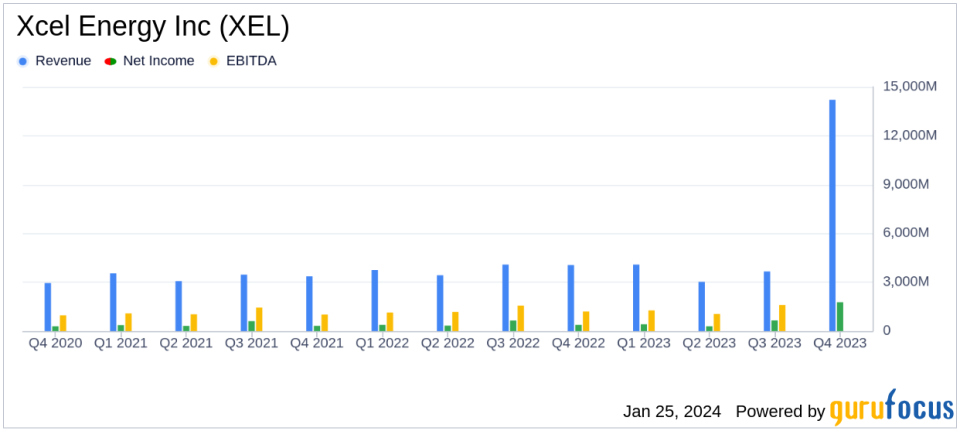

Revenue: Total operating revenues were $14.206 billion in 2023, compared to $15.310 billion in 2022.

2024 EPS Guidance: Reaffirmed in the range of $3.50 to $3.60 per share.

On January 25, 2024, Xcel Energy Inc (NASDAQ:XEL) released its 8-K filing, detailing the financial outcomes for the year ended December 31, 2023. The company, a major utility provider serving 3.8 million electric and 2.1 million natural gas customers across eight states, reported a slight increase in GAAP diluted earnings per share (EPS) from $3.17 in 2022 to $3.21 in 2023. Ongoing diluted EPS, which adjusts for certain non-recurring items, also saw an increase to $3.35 from $3.17 per share in the previous year.

Xcel Energy's performance in 2023 was marked by a strong focus on infrastructure investments and cost management. The company's ongoing earnings reflect favorable regulatory outcomes and lower operating and maintenance (O&M) expenses, which were partially offset by higher depreciation and interest charges. Bob Frenzel, chairman, president, and CEO of Xcel Energy, highlighted the company's commitment to delivering on earnings guidance for the 19th consecutive year, emphasizing the importance of maintaining a competitive cost of capital for the benefit of customers and shareholders.

In 2023, Xcel Energy continued to advance its clean energy initiatives, including the retirement of coal-fired units and the development of significant solar facilities. Despite these advancements, the company managed to keep customer bills below the national average, underscoring its operational efficiency.

Financial Highlights and Challenges

The company's total operating revenues for 2023 stood at $14.206 billion, a decrease from $15.310 billion in 2022. This decline was primarily due to lower electric and natural gas revenues, which were affected by changes in fuel and purchased power expenses. However, the impact on earnings was mitigated by regulatory recovery mechanisms. Xcel Energy's net income saw a marginal increase to $1.77 billion in 2023 from $1.74 billion in the previous year.

O&M expenses decreased by $47 million in 2023, reflecting the company's cost containment efforts and exit from the appliance repair services business. However, these savings were partially offset by higher bad debt expenses and inflationary pressures. Depreciation and amortization expenses increased by $35 million due to system expansion, while interest charges rose by $102 million, largely due to higher debt levels and interest rates.

The company's capital structure and liquidity remain strong, with a solid credit rating and committed credit facilities available to meet liquidity needs. Xcel Energy's capital expenditure forecast through 2028 indicates continued investment in infrastructure to support long-term growth.

Xcel Energy reaffirmed its 2024 EPS guidance, projecting a range of $3.50 to $3.60 per share. The guidance is based on constructive regulatory outcomes, normal weather patterns, and an increase in capital rider revenue, among other factors.

For value investors, Xcel Energy's steady performance, commitment to clean energy, and consistent dividend growth present an attractive investment opportunity in the regulated utilities industry. The company's ability to navigate regulatory environments and manage costs effectively positions it well for continued success.

For more detailed information and analysis on Xcel Energy Inc (NASDAQ:XEL)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Xcel Energy Inc for further details.

This article first appeared on GuruFocus.