Stocks rally after the French election

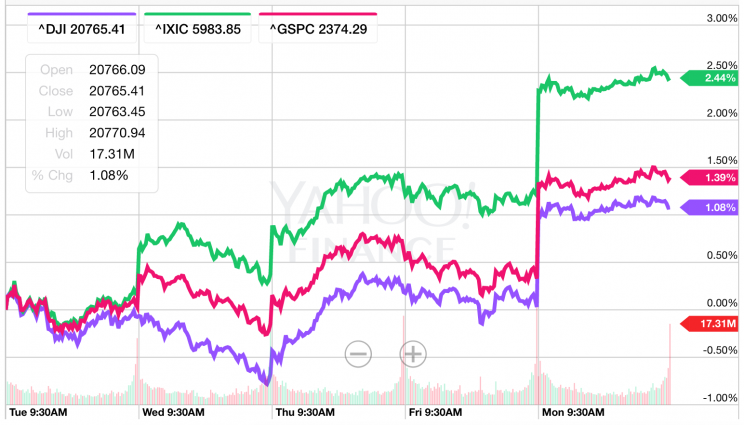

Stocks rallied on Monday after the first round of France’s presidential elections on Sunday was cheered by markets.

Results in France’s election on Sunday saw centrist Emmanuel Macron and far-right nationalist Marine Le Pen emerge as the top two candidates for a run-off in two weeks’ time. Early polling shows that Macron is expected to win by a wide margin, with one poll showing the 39-year-old is expected to get 62% of the vote, according to Bloomberg.

Le Pen, who has been compared to U.S. president Donald Trump, was seen as a risk to markets for, among other reasons, vowing to hold a referendum on France leaving the EU were she to win election as president.

When all was said and done on Monday, the Dow was up 216 points, the S&P 500 added 25, while the tech-heavy Nasdaq closed at a new record, gaining 73.3 points to 5,983.82. Each of the indexes gained more than 1%.

The U.S. markets took their lead from stocks in Europe, where the CAC in Paris closed higher by 4%, the Dax is Germany gained 3.3%, the FTSE in London rose 2%, and the Euro Stoxx 50 was up 3.9% on Monday.

The euro was also significantly stronger on Monday, with the currency gaining more than 1.2% against the dollar to trade as high as 1.086. The euro was up better than 2% against the Japanese yen, and higher by 1.3% against the pound. Gold was down about 1%, while WTI crude oil fell about 0.8% to trade near $49.23 per barrel.

Update 2:26 p.m. ET

Details are trickling out about Trump’s tax overhaul, and it’s starting to look like this reform will not be revenue-neutral and the emphasis will be on getting tax rates lower by whatever means available.

From The Wall Street Journal:

President Donald Trump has ordered White House aides to accelerate efforts to draft a tax plan slashing the corporate rate to 15% and prioritizing cuts in tax rates over an attempt to not increase the deficit, according to a person familiar with the directive.

During a meeting inside the Oval Office last week, Mr. Trump told staff he wants a massive tax cut to sell to the American people, the person said. It was less important to him if the plan loses revenue. Mr. Trump told his team to “get it done,” in time to release a plan by Wednesday.

This report appeared to give a slight bump to markets, which were sitting near their best levels of the day in afternoon trading.

Update 2:05 p.m. ET

Quick one on the Trump administration.

CNBC’s Kayla Tausche tweeted Monday afternoon that Treasury Secretary Steven Mnuchin said that a tax plan — which President Trump said last week would be unveiled Wednesday — “will pay for itself with economic growth.”

In other words, a tax plan need not be revenue neutral and might, in fact, create deficits according to the Congressional Budget Office. Making a tax reform bill revenue neutral is what had been underwriting the House Republican plan scheme for a border-adjustment tax.

With a desire to keep the plan revenue neutral looking set for exclusion from a tax reform plan, investors appear closer to getting some version of “all the good stuff but none of the bad stuff” from the administration that was anticipated in some corners after the election.

And as Breitbart’s John Carney noted on Twitter, this apparent shift from the administration is bullish.

If the Trump administration is willing to stomach adding to the deficit to get tax reform through, the next question will be whether the same political appetite exists when it comes to infrastructure. All throughout the campaign and after Trump’s election, many noted that the president has never seemed aligned with the hard-line deficit hawks in the Republican party.

We’ll see if this is the beginning of a bigger fracture between the White House and the Republican establishment.

Update 12:36 p.m. ET

Donald Trump’s latest accomplishment: unifying Europe.

David Zervos at Jefferies writes Monday that across all of his client meetings in Europe the one thing that unified investors was a view that Trump’s economic policies would be bad. Full stop.

Contrary to many U.S.-based investors and strategists who view Trump’s potential policies as a mix of good (tax reform and infrastructure spending) and bad (immigration restrictions and tariffs), Europeans were all bad all the time.

“Even just looking through the lens of expected real returns to capital, most European clients were quick to dismiss ALL Trump policies as economically disastrous,” Zervos writes on Monday.

“And as the consistency of these meetings started to gel, something very unusual dawned on me: Europeans were actually finding some common ground for the first time in eight years. Instead of the north complaining about the profligacy of the south and the south complaining about the parsimony of the north (which had typically been the case in all my European meetings since joining Jefferies in 2010), they were all complaining about a new demon to the west.”

Fast forward to the reaction not only by voters in France on Sunday but by markets on Monday, and Zervos says the move towards the political center in Europe is continuing apace.

“In any case, I have no real change in my views on Europe’s moving towards a more centrist political structure,” Zervos writes.

“The Dutch election and the French election (thus far) confirm this theme. As such, I am just going to reprint my original note from late February, as that still pretty much sums up my current European view.”

And to quickly touch on the day’s Trump news, a reminder that Wednesday of this week has been teased by the president as the day tax reform “really formally begins.” And as for the stock market, Business Insider’s Bob Bryan notes that the administration still sees it as a good report card for progress made by the administration, with Trump saying, “You live by the sword, you die by the sword, to a certain extent.”

Update 11:54 a.m. ET

Stocks are popping to start the week, the Nasdaq is at a record high, but if we go back to the beginning of March for the Dow and the S&P 500, we’re still flat.

David Rosenberg, a strategist at Gluskin Sheff and someone who has regularly been outlining the potential issues facing markets, has six quick points in his morning note on Monday on problems with the market right now.

—1) We haven’t made a new high in the Dow or S&P 500 since March 1st.

—2) The S&P 500 made a failed attempt to reclaim its 50-day trend-line late last week.

—3) The 10 largest stocks have accounted for about 40% of the overall advance in the market year-to-date.

—4) A trailing price-to-earnings multiple of over 20x and a forward P/E of 18x attests to an overvalued market.

—5) Only 20% of the S&P 500 is currently trading above their 10-day moving averages, confirming a near-term corrective backdrop in play.

—6) The fact that the 10-year U.S. Treasury note yield sits at 2.2% instead of 3% may be the greatest non-confirmation data point there is for the growth bulls.

So, it’s a mix of some technical and some fundamental obstacles facing the market, in Rosenberg’s view.

Given Monday’s headline-related pop and the impact this rally could have on some of the technicals for the market — for example, Monday’s rally could push the S&P 500 back above its 50-day moving average — this is why many market pros will advocate for always having a mix of technicals and fundamentals.

Update 11:23 a.m. ET

With the French elections dominating the headlines on Monday, let us not forget that this is a busy week for earning, particularly for some of the biggest tech leaders in the market.

On Thursday, U.S. investors will get reports from Amazon (AMZN), Google parent Alphabet (GOOG, GOOGL), and Microsoft (MSFT). Elsewhere in earnings this week, reports are expected from McDonald’s (MCD), AT&T (T), Chipotle (CMG), Twitter (TWTR), Starbucks (SBUX), and Ford (F).

So far, earnings season has been living up to the hype, though the sample is a bit limited. Here’s John Stoltzfus, chief investment strategist at Oppenheimer:

With just under 20% of S&P 500 companies thus far having reported, 75.8% have beaten consensus earnings forecasts while 62.1% have beaten consensus revenue forecasts according to Thomson Reuters I/B/E/S. Though it is still too early in the reporting season to jump to conclusions, Q1 earnings so far are up over 11% inclusive, of course, of an improvement in earnings from the oil sector which had been a significant drag on earnings for the benchmark in prior quarters.

An outright win by Le Pen looks less likely

The market reaction to Sunday’s election reflects the broad view that Le Pen’s inability to win the most votes in the five-candidate election on Sunday makes an outright win by Le Pen in a run-off even less likely than it had been ahead of the first-round vote.

“The bottom line is that while nothing should be taken for granted, it would seem that the second round election in May will see Macron as the Presidential winner,” write analysts at Jefferies.

The firm does note, however, that while Macron’s victory in two weeks appears most likely, this election does not reveal a French political establishment that is at ease.

“While the pollsters will feel relieved that the vote went according to the plan, there were a number of subtle surprises behind the result,” the firm writes.

“Firstly, both establishment parties were eliminated in the first round for the first time. Secondly, if Macron wins he will not only be France’s youngest ever president but he has also seen his support swell dramatically despite having never stood for election before. Thirdly, while all attention was on the far-rights share of the vote, it should be noted that Jean-Luc Mélenchon, the hard-left candidate came a close third with around 19% of the vote. The election was a very polarized affair as the high voter turnout indicated.”

“If Le Pen had won the most votes in the first round, this would have raised the possibility that the runoff would result in an anti-EU president,” analysts at a Nomura wrote, according to Bloomberg.

“But given outcome, Nomura thinks a Le Pen presidency can be safely relegated to a risk scenario.”

And while a Le Pen victory has long been teased as an event like that of President Donald Trump’s surprising election win and last year’s Brexit vote — when many polls had forecast the votes to go the other way — analysts at Bespoke Investment Group outlined in a note Monday why these comparisons are off base.

“First: it is not at all like Trump and Brexit,” Bespoke writes.

“Second-round polling shows a yawning gap between Le Pen and Macron, with roughly 60% of those surveyed breaking his way. Contrast that with low single digit polling errors in a few US states and very little difference between final vote tallies and national polls for each of those events and we find direct comparisons between the two and the French elections to be flat-out innumerate.”

Additionally, polls in the French election have been accurate, Bespoke notes, and there’s no reason to think that this will change in the future.

“The rejoinder ‘the polls aren’t useful’ is not only wrong generally but also completely inaccurate in the current French election cycle,” the firm writes.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: