Fed to set 'high bar' for next move on rates, up or down

In its final meeting of 2019, the Federal Reserve is expected to hold rates steady after cutting interest rates in three consecutive meetings. And the Fed may not move again until policymakers see a substantial shift in the economic outlook.

“Policy is currently on hold, with high thresholds for rate moves in either direction, and we do not expect meaningful policy communication at this meeting,” Credit Suisse’s economics team wrote in a note Dec. 11. Goldman Sachs similarly wrote on Dec. 6 that the expectation is for the Fed to set a “high bar” for either hiking or cutting interest rates going forward.

Markets are nearly completely certain of no change in interest rates at the conclusion of the Federal Open Market Committee’s meeting on Dec. 11. As of Monday afternoon, federal funds futures were pricing a 99.3% chance of the Fed holding rates steady at the current range of 1.50% to 1.75%. The Fed had cut rates in each of the last three policy-setting meetings but Fed officials have since signaled that they feel comfortable with leaving rates where they are for the time being.

Fed Chairman Jerome Powell said Nov. 25 that after 75 basis points of cuts, the Fed feels interest rates are “likely to remain appropriate” for the time being.

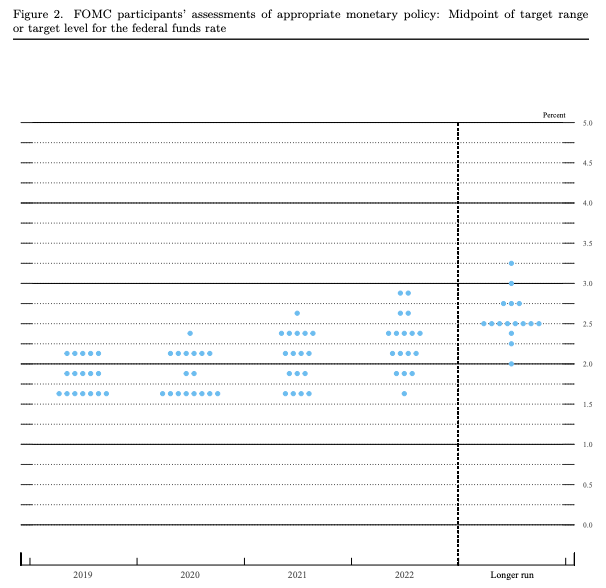

Still, Fed watchers will be closely watching Wednesday’s meeting for a new print of dot plots for clues on where interest rates will go from here.

Up or down?

If the Fed does not cut rates on Wednesday, markets will be laser-focused on the timing of the Fed’s move and whether that move would be a rate hike or a rate cut.

The Fed will release a new summary of economic projections, which include the “dot plots” that map out each member of the FOMC’s predictions on where interest rates will be in each of the next three years.

But with the Fed on pause after cutting rates by 75 basis points this year, Wall Street is all over the place on predicting where the dot plots will project interest rates in the next year.

UBS wrote Dec. 4 that they predict the median dot to show no rate hikes for 2020, but Société Générale wrote Dec. 9 that there’s a chance the median dot in 2020 could be closer to 1.875%, implying a rate hike next year.

But Capital Economics wrote Dec. 6 that in reality, the Fed has a “close to zero” chance of hiking rates during an election cycle, adding that markets are pricing in a 25 basis point cut in 2020. And even Chairman Powell himself said in October’s meeting that “we’re not thinking about raising rates right now.”

Powell will likely downplay the importance of the dot plots, since corralling FOMC participants to a consensus view has proved difficult in a year where the Fed shifted from a stance of gradually raising rates to cutting rates.

UBS wrote that Powell will likely chalk up any dispersion in forecasts to individual views on where interest rates are headed.

“Regardless, the mass of the Committee is either not hiking or hiking only once,” UBS wrote. “Either way, [Powell] will likely argue, the Committee sees itself as remaining extremely accommodative until inflation rises.”

The Fed has persistently undershot its 2% inflation target. The most recent reading of core personal consumption expenditure, the Fed’s preferred reading of inflation, came in at 1.6% for the month of October.

Powell could also point to the dot plots’ poor track record; the December 2018 dot plots projected interest rates between 2.75% and 3.00%, well above where interest rates are now.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Charles Schwab-TD Ameritrade deal would be the latest in a long series of broker mergers

Fed officials split over October cut but now see interest rates as 'well calibrated'

Fed Chair Powell on economic expansion: 'No reason why it can't last'

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.