Fed holds steady on rates, may continue to hold through 2020

The Federal Reserve held interest rates steady on Wednesday and messaged that it could continue to maintain rates where they are through 2020.

After cutting rates in three consecutive meetings this year, the Federal Open Market Committee elected to keep rates at the current target range between 1.5% and 1.75%.

“The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective,” the Fed’s statement said.

The Fed reiterated that it will continue to watch the data to see if global developments and “muted” inflationary pressures affect the U.S. economy. But the statement removed language from the October meeting noting that “uncertainties about this outlook remain,” hinting that the Fed may be optimistic about downside risks (such as the U.S.-China trade war) fading away soon.

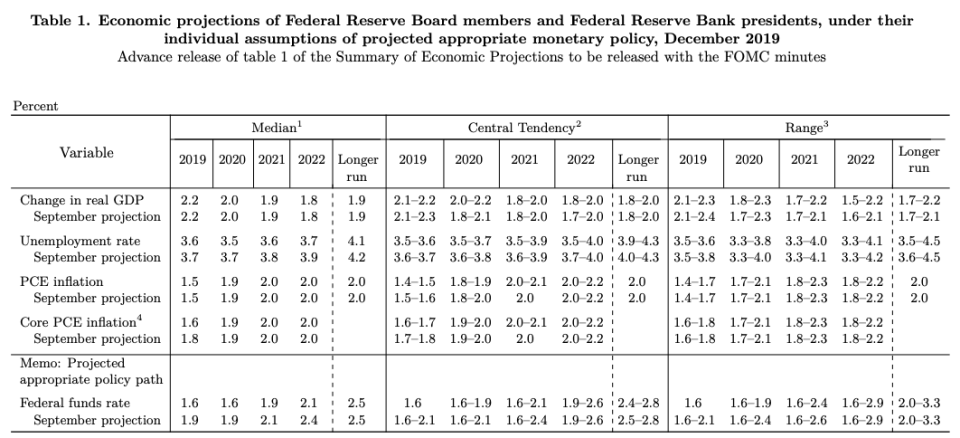

Looking forward, the Fed’s updated release of summary of economic projections signaled the view that the Fed may not move at all in 2020.

New dot plots, which map 17 policymakers’ projections for where interest rates may go in 2020 and beyond, show the median FOMC member predicting rates remaining in the range of 1.50% to 1.75% by the end of next year. Notably, no member of the FOMC sees the case for further accommodation, with only four members predicting one 25 basis point hike.

The median dot projects one rate hike by the end of 2021 and another hike by the end of 2022.

Tight labor market predicted in 2020

The dot plots have not had a stellar record for accurately predicting where interest rates are headed. The Fed’s dot plots from December 2018 forecast two further hikes, taking interest rates within the neighborhood of 2.75% to 3% by the end of 2019. The Fed ended up going in the other direction and cut interest rates three times instead.

The summary of economic projections also includes forecasts for key indicators on unemployment and inflation. As the labor market continues to tighten, the FOMC has again revised down its predictions for unemployment and now predicts 2020 to finish with a 3.5% unemployment rate (down from 3.7% as of the FOMC’s last projection in September).

The Bureau of Labor Statistics reported unemployment in the U.S. at 3.5% for the month of November, a 50-year low.

The Fed has been surprised by how hot the labor market has run, undoing earlier worries that a tight labor market could spur runaway inflation.

In the long-run, the Fed now projects that the natural rate of unemployment for the U.S. economy is 4.1%, a tick down from the 4.2% projection in September.

On inflation, the Fed appears to be unswayed by core personal consumption expenditures (its preferred measure) running below its target in 2019. The Fed still projects inflation rising to a pace of 1.9% by the end of 2020, and hitting its 2% target in 2021 and 2022. Those projections are unchanged from the Fed’s last projection in September.

For overall economic growth, the Fed projects 2.0% GDP growth in 2020, unchanged from its September projection.

‘Far from dull’ 2019

The decision Wednesday caps off a year of remarkable change for Fed policy, which began 2019 with a shrinking balance sheet and a bias toward hiking rates.

The Fed had cut rates in three consecutive meetings this year — in July, September, and October. Fed officials now seem content with their 75 basis points of “mid-cycle adjustment” and have said they would like to hold rates steady to see where the economy heads from here.

Powell said last month that he sees interest rates as “well positioned,” continuing to emphasize that the economy does not appear headed for a recession at the moment.

“At this point in the long expansion, I see the glass as much more than half full,” Powell said Nov. 25.

Powell acknowledged last month that 2019 has been “far from dull” in terms of Fed policy. For Powell, the Fed’s shift from a stance of “patience” to easing rates sparked some debate within the FOMC. In the September FOMC meeting, three voting members of the committee voted against the decision — a record under Powell.

Since then, Powell has been able to rein in consensus on holding rates steady while the Fed watches the impact of monetary accommodation on the economy. No FOMC members appeared to disagree with the Fed’s decision today to hold rates steady.

The next FOMC meeting will take place Jan. 28 and 29.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed in focus as worries mount over a year-end repo market flare-up

Charles Schwab-TD Ameritrade deal would be the latest in a long series of broker mergers

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.