Munger: You won't get the returns Buffett and I got by doing what we did

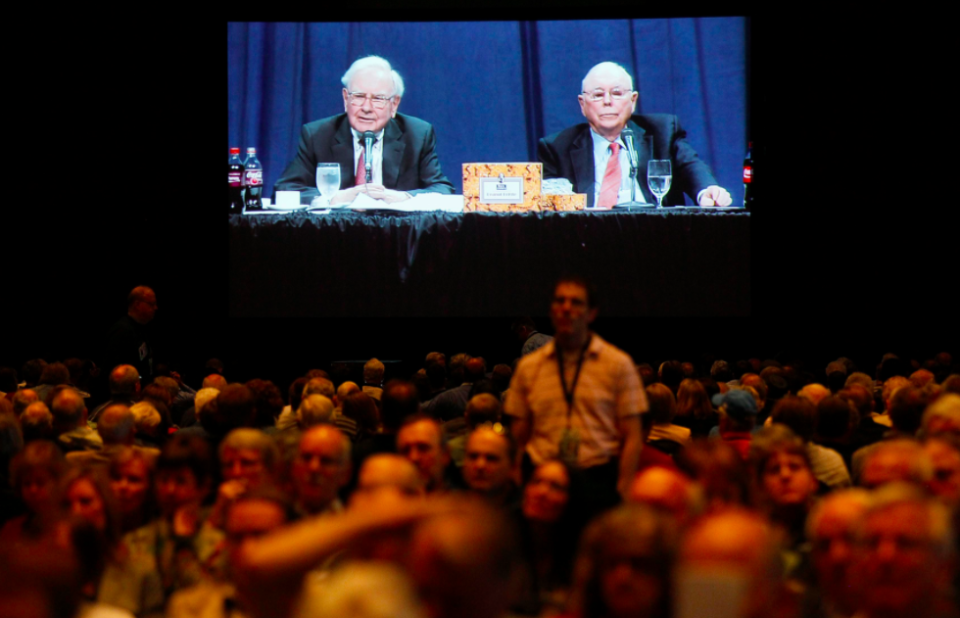

Warren Buffett’s right-hand man, Charlie Munger, the vice chairman of Berkshire Hathaway (BRK-A, BRK-B), said they had an “easier world” than the young investors of today face.

“I don’t think you’re going to get the kind of results we got by just doing what we did,” Munger, 94, said at the Daily Journal’s (DJCO) annual meeting in Los Angeles last week.

He added that’s not to say that what their investment style won’t be useful, it’s just that the “prospects are worse.”

“There’s a rule of fishing that’s a very good rule. And the first rule of fishing is ‘fish where the fish are.’ And the second rule of fishing is ‘don’t forget the first rule,'” Munger said. “Investing is the same thing. And some places have lots of fish and you don’t have to be that good of a fisherman to do pretty well. Other places are so heavily fished that no matter how good a fisherman you are, you aren’t going to do very well.”

He added that there’s “an awful lot of places” in the second category, but young investors shouldn’t be discouraged.

“Life is a long game. There are easy stretches, hard stretches, and good opportunities, and bad opportunities. And, the right way to go about life is to take it as comes and do the best you can, and if you live to an old age, you will get your full share of good opportunities, which will be two in total, maybe the will be your full share, but seize one of the two, and you will be alright,” he said.

‘Delusional’ fees

One area, in particular, that Munger criticized was the fee structure charged by active managers today. Their chances of doing well for clients has shrunk, making it difficult to justify the high fees that they charge.

“It’s so hard to get big advantages when buying securities, particularly when you’re doing it by the billion. And you add the burden of very high fees and think that by working hard and reading up on sell-side research, you’re going to do well. It’s delusional. It’s not good to face the world in a delusional way.”

Munger said that’s why Buffett recently won his famed bet against the hedge funds.

Like Munger, Buffett has been a critic of the hedge fund industry’s fees. Typically, hedge funds are known to charge investors fees known as “2-and-20”, meaning 2% of assets and 20% of profits. Those fees can vary with some being lower and others being as high as 3% and 30%.

Buffett argues that investors, both small and large, would be better off putting money in low-cost index funds, like those offered by Jack Bogle’s Vanguard.

A decade ago, Buffett made a $1 million bet (for charity) that active management professionals (hedge funds), as a group, would underperform the returns achieved by “by rank amateurs who simply sat still.” The bet was to last ten years and Buffett picked a low-cost Vanguard S&P fund as his contender.

Hedge fund manager Ted Seides, the co-manager of Protégé Partners, a funds-of-funds that allocates to hedge funds, took the “Oracle of Omaha” on. For Seides’ part in the bet, Seides picked five funds-of-funds to go up against Buffett’s Vanguard S&P index fund.

“They bet on a bunch of terribly selected bunch of geniuses charging very high fees. Of course, high fees will just kill you,” Munger said.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.