Stock Market Live Updates: DOW 28,000

Markets hit new record highs amid U.S.-China trade talk optimism.

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

-

4:05 p.m. ET: U.S. markets close at record highs

The Dow crossed 28,000 for the first time ever.

S&P 500 (^GSPC): +23.8 points, or 0.7%

Dow (^DJI): +222.9 points, or 0.8%

Nasdaq (^IXIC): +61.8 points, or 0.7%

Highlight: The Dow tops 28,000 for the first time. "It's an incredible market, there's no anxiety right now," @nyse trader @einsteinowallst says. "These records, I think, are significant. ... For me, these are milestones, these are landmarks." https://t.co/Jb7k9twFHf pic.twitter.com/AIig8Q5WMv

— Yahoo Finance (@YahooFinance) November 15, 2019

-

3:30 p.m. ET: T-Mobile CEO John Legere reportedly not interested in WeWork gig

CNBC reports that T-Mobile CEO John Legere will not be taking over as CEO of WeWork, a position vacated by controversial co-founder Adam Neumann. Earlier this week, WSJ first reported that Legere was in discussions to take the job.

T-Mobile (TMUS) shares jumped by nearly 2.5% on the news.

-

3:25 p.m. ET: Healthcare stocks surge

Democratic presidential candidate Elizabeth Warren unveiled an update to her plan for healthcare, which would involve a “transition” to “Medicare for all.”

Here’s Yahoo Finance’s Rick Newman: “Warren’s transition plan would allow anybody over 50 to pay to join Medicare, with free coverage for all kids under 18 and anybody earning less than 200% of the federal poverty level, which is around $51,000 for a family of four. The Democratic senator from Massachusetts hasn’t estimated the cost of this expanded coverage, but she said previously she’d pay for Medicare for all with new wealth taxes on families with fortunes of $50 million or more and new business taxes. Businesses, in theory, would end up no worse off because their new taxes would be equal to or less than what they’re already spending to provide health care for employees. The key difference with Warren’s new transition plan is she’d leave private insurance in place, which makes it comparable to plans offered by Joe Biden, Pete Buttigieg and other more moderate Democrats running for president. She would also strengthen the Affordable Care Act, which borrows from Biden’s commitment to improve the plan that went into effect when he was Barack Obama’s vice president.“

Rick noted that this would be “less disruptive and more palatable to voters” than what Warren had initially proposed.

The big healthcare names surged in the wake of the news. Humana (HUM), UnitedHealth (UNH), Anthem (ANTM), and Centene (CNC) were among stocks that surged more than 5%.

-

2:14 p.m. ET: Supreme Court to hear Google bid to end Oracle copyright suit

From Reuters: “Google has appealed a lower court ruling reviving the suit in which Oracle has sought at least $8 billion in damages. A jury cleared Google in 2016, but the U.S. Court of Appeals for the Federal Circuit in Washington overturned that decision in 2018, finding that Google's inclusion of Oracle's software code in Android did not constitute a fair use under U.S. copyright law.”

-

1:31 p.m. ET: ‘Hindenburg Omen’ and ‘Titanic Syndrome’ indicators triggered in the Nasdaq

For the chartists out there, two bearish technical indicators have been triggered. Here’s Yahoo Finance’s Brian Sozzi: “The Hindenburg Omen’s guidelines say the market has to be in an uptrend, it must show a large number of stocks hitting 52-week highs and 52-week lows and display negatively diverging breadth momentum. As for the Titanic Syndrome, the rule of thumb is that the market must have reached a new high in the past seven sessions and then suddenly more stocks hit 52-week lows than 52-week highs.“

-

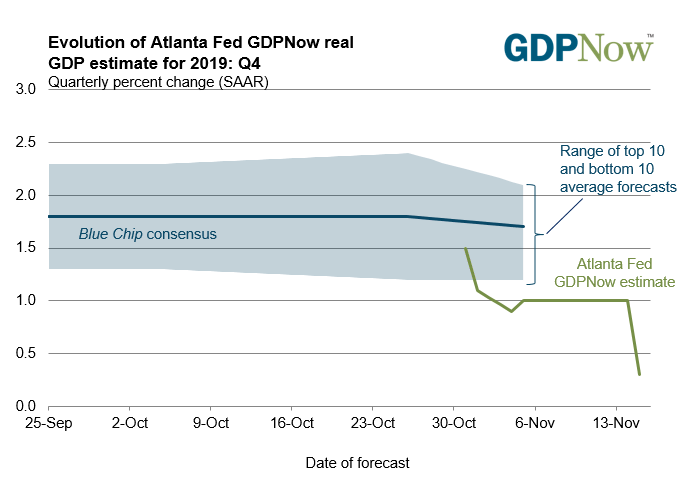

1:04 p.m. ET: Atlanta Fed’s model gives gloomy GDP forecast

According to the latest update from the Atlanta Fed’s GDPNow model, GDP growth plunged to just 0.3% in the current quarter. From the Atlanta Fed: “After this morning's retail trade releases from the U.S. Census Bureau, and this morning's industrial production report from the Federal Reserve Board of Governors, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 2.1%vand -2.3%, respectively, to 1.7% and -4.4%, respectively.“

-

12:23 p.m. ET: Markets are near their highs in midday trading

The S&P, Dow and Nasdaq all set new intraday highs on Friday. Here’s where they are now:

S&P 500 (^GSPC): +18.5 points, or 0.6%

Dow (^DJI): +152.53 points, or 0.6%

Nasdaq (^IXIC): +54.1 points, or 0.6%

-

11:34 a.m. ET: Trump has his eye on the rally

Stock Market up big. New and Historic Record. Job, jobs, jobs!

— Donald J. Trump (@realDonaldTrump) November 15, 2019

-

10:00 a.m. ET: Markets have bigger things to worry about than impeachment

AGF policy strategist Greg Valliere tells Yahoo Finance’s The First Trade, “The more pressing issue for the markets right now is trade, and every day the narrative changes."

Highlight: "I think people who underestimate [Trump] do so at their own peril," @agf U.S. Policy Strategist Greg Valliere says about impeachment hearings, adding: "The more pressing issue for the markets right now is trade, and every day the narrative changes." pic.twitter.com/RzzMqTSIMk

— Yahoo Finance (@YahooFinance) November 15, 2019

Follow day two of the Trump impeachment hearings on Yahoo News.

-

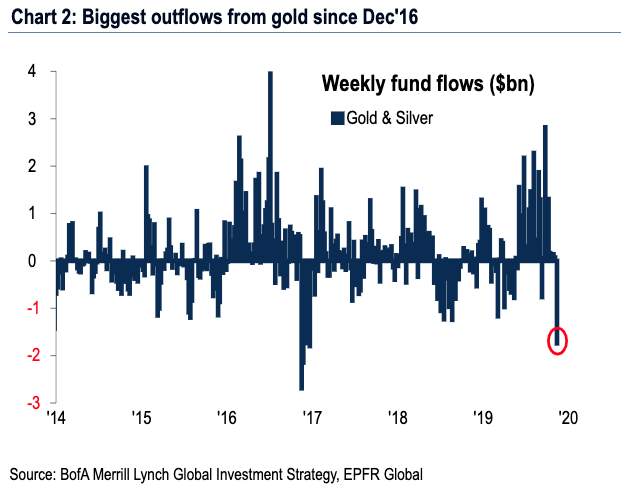

9:52 a.m. ET: Investors flee gold

From Bank of America Merrill Lynch: “Weekly flows: $9.7bn into equities, $4.2bn into bonds, $1.7bn from gold (biggest outflow since Dec'16 - Chart 2)”

-

9:31 a.m. ET: Wall Street opens higher

Markets are modestly higher at the moment.

S&P 500 (^GSPC): +11.2 points, or 0.3%

Dow (^DJI): +61.5 points, or 0.2%

Nasdaq (^IXIC): +17.9 points, or 0.2%

-

9:30 a.m. ET: Nvidia is ‘exceptionally positioned,’ analysts says

On Thursday afternoon, semiconductor company Nvidia (NVDA) reported quarterly revenue and earnings that beat expectations.

Bank of America Merrill Lynch analyst Vivek Arya appeared on The First Trade to discuss the outlook for the company.

Highlight: "We are starting to see new technologies emerge," @bankofamerica semis analyst Vivek Arya says about $NVDA. "You're seeing adoption by enterprises and you're seeing adoption by a lot of super computing companies, so we think Nvidia's exceptionally positioned." pic.twitter.com/P6llQLuThx

— Yahoo Finance (@YahooFinance) November 15, 2019

-

9:15 a.m. ET: Industrial production falls more than expected

Industrial production activity fell 0.8% in October, which was much worse than the 0.4% decline expected.

“With almost the entire drop back in industrial production last month due to the strike at GM and a fall in utilities output, we expect a big rebound in November,” Capital Economics’ Michael Pearce. “With autos and utilities output set to rebound, industrial production will rise over the remainder of the year. However, the continued subdued global backdrop and the still weak domestic activity surveys suggest that underlying manufacturing output growth will remain close to zero over the coming months.“

-

8:30 a.m. ET: Retail sales climb, Empire manufacturing index falls

Retail sales climbed 0.3% month-over-month in October, which was higher than the 0.2% expected by economists. Excluding autos and gas, core retail sales gained just 0.1%, which was far less than the 0.3% expected.

“There were so many spending categories down in October, it is difficult to see how overall spending rose 0.3%,” MUFG economist Chris Rupkey observed. “It looks like consumers shopped on the Internet or filled their cars with gasoline all month long and did nothing else. Spending on furniture, electronics, building materials, clothing, sporting goods, restaurants and bars, all fell... Ouch.

“Net, net, American shoppers returned to the stores and malls in October, but the coast isn't clear yet for consumer spending in the fourth quarter of the year. It's looking more and more that this quarter is going to turn out to be another soft patch for the consumer much like it was in the final quarter of last year and the first quarter of 2019 when purchases were also weak.”

The Empire State Manufacturing index fell to 2.9 in November from 4.0 a month ago. Economists were looking for this activity index to climb to 6.0. From the NY Fed’s report: “New orders increased slightly, and shipments grew modestly. Delivery times were somewhat shorter and inventories declined. Employment continued to expand, and the average workweek was slightly longer. Input price increases continued to slow, while selling prices increased modestly. Optimism about the six-month outlook remained subdued, while capital spending plans picked up markedly.”

-

7:30 a.m. ET: JCPenney’s numbers could’ve been worse

Beleagured department store giant JCPenney (JCP) lost less money than expected. In Q3, the company booked an adjusted net loss of $0.30 per share, which wasn’t as bad as the $0.56 loss expected. Same-store sales, however, plunged 9.3% during the period, which was worse than the 8.3% drop expected.

Shares are up more than 10% in pre-market trading.

-

6:07 a.m. ET: Q3 earnings season update: 94% of the S&P have reported, and they’re beating expectations

From Credit Suisse equity strategist Jonathan Golub: “94.0% of the S&P 500's market cap has reported 3Q results. Earnings are beating by 4.4%, with 69% of companies exceeding their bottom-line estimates. This compares to 5.4% and 71% over the past 3 years. 3Q expectations are for revenues, earnings, and EPS growth of 2.1%, -1.2%, and 0.8%, respectively. EPS is on pace for +1.0%, assuming a typical beat rate for the remainder of the season.“

-

5:00 a.m. ET: “We’re coming down to the short strokes,” Kudlow said.

White House economic adviser Larry Kudlow suggested that a trade deal with China was close, saying that the administration was speaking to its Chinese counterparts “every single day now,” and that “we’re coming down to the short strokes.”

Dow futures (YM=F) are up 84 points or 0.3%.

-

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news