Teen beauty spending plunges 20% from last year to a 9-year low

Teens are spending significantly less on beauty products, according to a new survey from Piper Jaffray.

Female teen beauty spending in fall 2019 fell 20% from the same period last year to just $106 per year, the lowest level in nine and a half years. Piper Jaffray noted that spending levels are 15% below the multi-year survey average of $124 per year.

Piper Jaffray’s 38th semi-annual teen survey analyzed 9,500 responses across 42 states. The average age of participants was 15.8 years old with 54% being male, 45% female and less than 2% identified non-binary.

Among the survey participants, 91% of female teens indicated that they preferred to shop in store for beauty products as opposed to shopping online. Ulta (ULTA) continued its dominance as the favorite beauty destination among female teens with 38% share compared to 34% last year. Sephora came in second place with 26% share, down from 34% last year.

Skincare has been the most significant growth opportunity in the beauty space as of late. According to the NPD Group, skincare grew 13% and contributed to 60% of the U.S. prestige beauty industry’s total gains in 2018. Though Piper Jaffray’s survey found that skincare spending among female teens fell 8% from last year, the $104 per year spent on skincare was in-line with the multi-year survey average.

Johnson & Johnson (JNJ) owned Neutrogena remained the skincare favorite among female teens, while Mario Badescu ranked second.

Among upper-income female teens, brands that gained recognition included personalized skincare brand Curology and Drunk Elephant. Tuesday, Japanese beauty brand Shiseido announced that it would be acquiring Drunk Elephant for $845 million. In a joint press release, the two companies said that the new partnership will strengthen Shiseido’s leadership in the global prestige skincare market. The U.S. prestige beauty industry is booming and reached $18.8 billion in 2018, according to market research firm NPD Group.

With 13% share, Tarte was the most favorite beauty brand among female teens. Too Faced came in second place and Maybelline pushed out Estee Lauder-owned (EL) MAC for the number three spot.

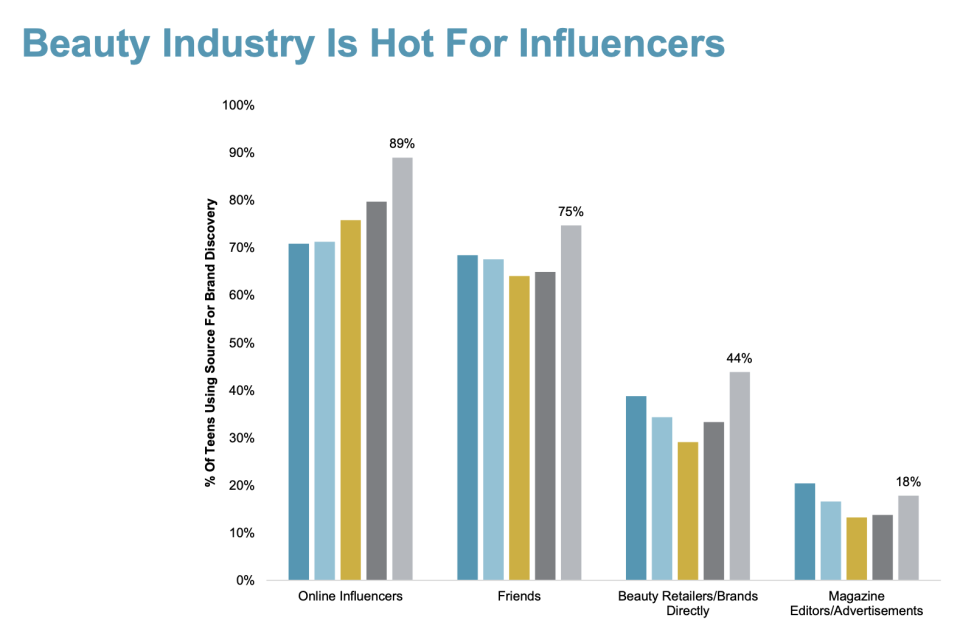

But what were the main factors that influence beauty purchasing among teens?

Piper Jaffray found that about 89% of female teens used online influencers as their main source for beauty brands and trends. Kylie Jenner was ranked number two among the top influencers among teens. Jenner has a partnership with Ulta to sell her beauty products.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Domino's Pizza earnings miss expectations in the third quarter

Nestlé-owned Sweet Earth launches plant-based Awesome Burger

Read the latest stocks and stock market news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.